[Asia Economy New York=Special Correspondent Joselgina] International oil prices have fallen to their lowest level since the end of last year due to growing fears of a global economic recession.

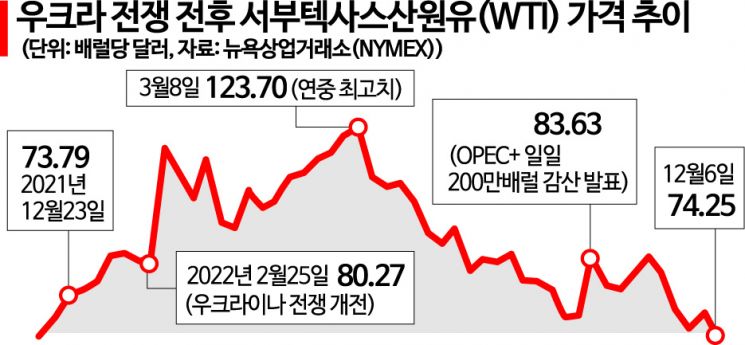

On the 6th (local time), West Texas Intermediate (WTI) crude oil for January delivery on the New York Mercantile Exchange (NYMEX) closed at $74.25 per barrel, down 3.5% ($2.68) from the previous session. This is the lowest level since December 23 of last year. WTI has shown a decline for three consecutive trading days recently, with a total drop of 8.58% during this period.

On the same day, February Brent crude on the London ICE Futures Exchange also plunged 4% ($3.33) to $79.35 per barrel. This is also the lowest level since January 3 of this year.

This downward trend in oil prices is attributed to increased global economic uncertainty and a bleak economic outlook for 2023. Recently, stronger-than-expected indicators in the United States have raised concerns that the Federal Reserve's tightening policy may be prolonged, increasing downward pressure on oil prices alongside recession fears. Prolonged Fed tightening is considered a factor that could lower medium- to short-term growth prospects and trigger a decline in crude oil demand.

On this day, Wall Street heavyweights such as Jamie Dimon, CEO of JP Morgan Chase, the largest bank in the U.S., and David Solomon, CEO of Goldman Sachs, issued unanimous warnings about a potential recession.

Senior Market Strategist Eli Tesfaye of RJO Futures said, "Market sentiment is negative," and predicted, "If this continues, we could see WTI fall to $60 per barrel." The U.S. Energy Information Administration (EIA) also lowered its price forecasts for WTI and Brent crude in its monthly report released that day.

Major foreign media outlets also noted that this decline continues amid the implementation of price caps and some embargo measures on Russian crude oil by Western countries including the European Union (EU). The market is said to be paying more attention to demand concerns due to recession fears than to the impact of the EU-led price cap.

Additionally, the slow pace of China's easing of COVID-19 lockdowns is also acting as downward pressure on oil prices.

There is also analysis that future oil price movements depend on the timing of China's relaxation of COVID-19 prevention measures. Stephen Ines, Managing Partner at SPI Asset Management, said, "China's economic recovery could drive oil prices up," adding, "The sooner it happens, the higher prices will rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)