[Asia Economy Reporter Song Hwajeong] Due to an increase in corporate loans and a rise in exchange rates, risk-weighted assets have significantly increased, resulting in a decline in the total capital ratio of domestic banks under the Basel III framework (BIS) in the third quarter compared to the previous quarter.

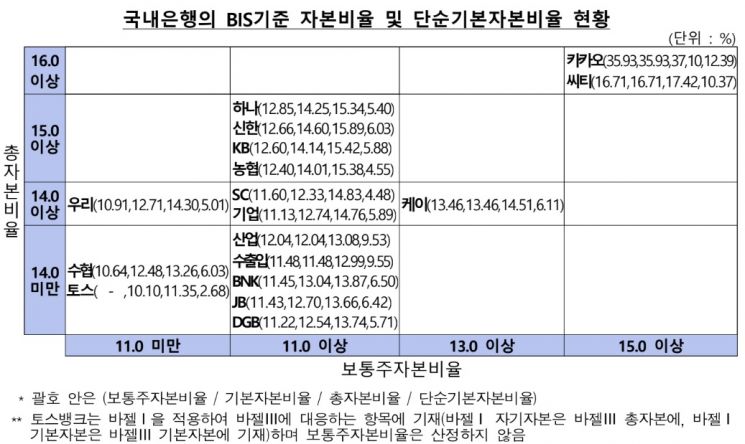

According to the "Status of Bank Holding Companies and Banks' BIS Capital Ratios as of the End of September" released by the Financial Supervisory Service (FSS) on the 6th, the common equity tier 1 capital ratio, tier 1 capital ratio, total capital ratio, and simple tier 1 capital ratio of domestic banks as of the end of September were recorded at 12.26%, 13.51%, 14.84%, and 6.09%, respectively.

The common equity tier 1 capital ratio, tier 1 capital ratio, and total capital ratio each fell by 0.45 percentage points, 0.44 percentage points, and 0.46 percentage points compared to the end of June. The simple tier 1 capital ratio dropped by 0.15 percentage points as the growth rate of total risk exposure exceeded the growth rate of tier 1 capital.

This is because, despite realizing net profits and capital increases, the increase in capital was limited due to bond valuation losses caused by rising interest rates, while risk-weighted assets significantly increased due to corporate loan growth and exchange rate rises, causing the asset growth rate (4.5%) to surpass the capital growth rate (1.4%).

Although the ratios declined compared to the previous quarter, all domestic banks' capital ratios remained above regulatory requirements. Four banks (BNK, JB, Citi, and Suhyup), which saw a decrease in risk-weighted assets or a relatively large increase in common equity capital, experienced an increase in their common equity tier 1 capital ratio compared to the previous quarter.

Twelve banks (Shinhan, Hana, KB, DGB, Nonghyup, Woori, SC, Industrial, Corporate, Export-Import, K, and Kakao), where the growth rate of risk-weighted assets exceeded the growth rate of common equity capital, saw a decline in their common equity tier 1 capital ratio.

The FSS analyzed, "The decline in domestic banks' capital ratios at the end of September was due to the continued rise in interest rates and a sharp increase in risk-weighted assets caused by exchange rate appreciation during the third quarter. However, domestic banks' capital ratios have so far remained at a healthy level, exceeding regulatory requirements."

An FSS official stated, "Despite domestic and external economic shocks, we plan to encourage banks to strengthen their loss-absorbing capacity so that they can maintain soundness and faithfully perform their core function of financial intermediation. To this end, we will enhance monitoring of banks' capital ratios and encourage banks with weak capital adequacy to improve their capital soundness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)