Samsung Electronics, SK Hynix 2023 Executive Appointments

Reflecting Semiconductor Uncertainty and Crisis Concerns

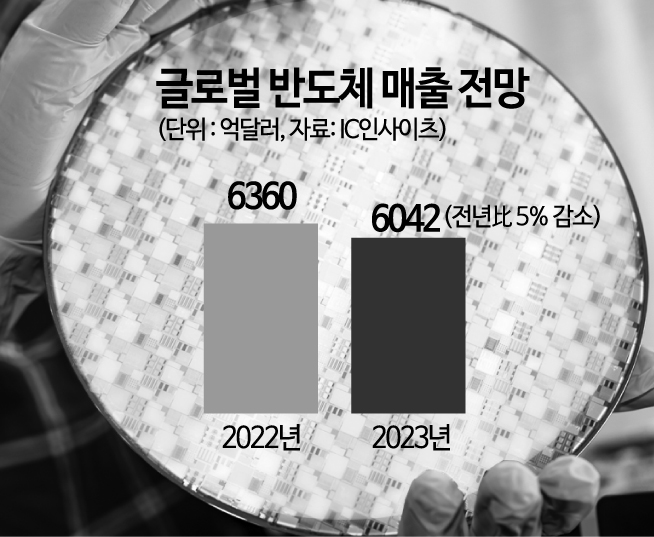

Global Semiconductor Sales Expected to Decline 5% Next Year Compared to This Year

[Asia Economy Reporter Han Yeju] The 2023 executive appointments at Samsung Electronics and SK Hynix largely reflect a sense of crisis regarding the semiconductor uncertainties expected next year. As forecasts gain traction that global semiconductor sales will contract for the first time in four years, both companies have devised strategies to strengthen development and manufacturing capabilities through organizational restructuring and personnel changes to prepare for the future.

According to market research firm IC Insights on the 6th, global semiconductor sales next year are projected to reach $604.2 billion (810.8364 trillion KRW). This represents a 5% decline compared to this year's sales forecast of $636 billion. The global economic downturn and inflation that began earlier this year have dampened consumer sentiment, causing semiconductor supply to exceed demand. This marks the first global semiconductor sales contraction since 2019.

The memory semiconductor market outlook is even bleaker. The World Semiconductor Trade Statistics (WSTS), a global market research organization, expects memory semiconductor sales to decline by 12.6% this year and fall by approximately 17.0% next year.

Concerns over deteriorating performance for Samsung Electronics and SK Hynix, whose main revenue source is memory semiconductors, are intensifying. In fact, the financial investment sector estimates that next year’s semiconductor sales for Samsung Electronics and SK Hynix will be around 89 trillion KRW and 36 trillion KRW, respectively. Both companies are expected to see sales decrease by about 10 trillion KRW compared to this year. It is only natural that their focus is on effectively responding to the semiconductor downturn.

Preparing for a challenging year ahead, Samsung Electronics selected two of the seven promoted presidents from the Device Solutions (DS) division. The key figures are Nam Seok-woo, Executive Vice President and Head of Global Manufacturing & Infrastructure, and Song Jae-hyuk, Executive Vice President and Head of the Semiconductor Research Center.

Samsung Electronics plans to concentrate its efforts on the construction and operation of the Pyeongtaek 3 and 4 plants currently under construction, as well as the second foundry plant in Taylor, Texas, led by President Nam Seok-woo. The company is focusing on strengthening semiconductor production capacity. Improving manufacturing process capabilities, such as achieving high yield rates, is a core task. Leveraging President Nam’s competitiveness across both memory and system semiconductors, Samsung is expected to enhance manufacturing infrastructure directly linked to implementing advanced semiconductor processes. President Song Jae-hyuk is anticipated to focus on securing differentiated technologies and building roadmaps to gain a competitive edge in the market. Beyond developing advanced technologies at the existing Semiconductor Research Center, President Song has led R&D efforts to realize breakthrough technologies in both memory and system semiconductors. He will spearhead the development of cutting-edge processes across all semiconductor products, driving the enhancement of semiconductor technological competitiveness.

SK Hynix is establishing a new 'Global Strategy' team under the newly formed 'Future Strategy' organization to respond swiftly to semiconductor uncertainties and geopolitical issues. SK Hynix Vice Chairman Park Jung-ho has stepped down from his concurrent role as CEO of SK Square to focus on discovering future growth engines in the semiconductor business. The possibility of pursuing new semiconductor mergers and acquisitions (M&A) following Solidigm and Key Foundry is increasing. Executives such as CEO Kwak No-jung and President Noh Jong-won are relinquishing roles in safety development manufacturing and business divisions, respectively, to create conditions where they can demonstrate their expertise. In particular, President Noh Jong-won is expected to focus on generating synergies in the NAND business by shuttling between South Korea and the U.S. Solidigm. As Chief Business Officer (CBO) at Solidigm, he is likely to concentrate on formulating company-wide strategic plans similar to his previous role leading the business division at SK Hynix. Above all, SK Hynix will devote full efforts to enhancing the competitiveness of 'P5530,' the first joint enterprise SSD (NAND flash memory-based data storage device) developed with Solidigm.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.