FKI Survey on '2023 Domestic Investment Plans'

[Asia Economy Reporters Sunmi Park and Chaeseok Moon] Due to uncertain economic conditions, nearly half of South Korea's major conglomerates have yet to establish their investment plans for next year. Among the companies that have formulated investment plans, more responded that they would 'reduce' rather than 'expand' investments, indicating that the early-year mood of investment expansion quickly shifted to cash accumulation.

On the 5th, the Federation of Korean Industries (FKI) commissioned the polling agency Monoresearch to survey the top 500 companies by sales regarding their '2023 Domestic Investment Plans' (with 100 companies responding). The results showed that 48.0% of respondents either had no investment plans for next year (10.0%) or had not yet made plans (38.0%). Only 52.0% of companies had established investment plans.

Among the companies with investment plans, 67.3% indicated they would invest at levels similar to this year. However, responses expecting investment reductions (19.2%) outnumbered those anticipating expansions (13.5%). In the 2022 domestic investment plan survey, those planning to increase investments accounted for 38.5%, nearly three times higher than the 11.5% who planned to reduce them. The recent triple high phenomenon of inflation, interest rates, and exchange rates has worsened the business environment, leading companies to lean toward reducing investments.

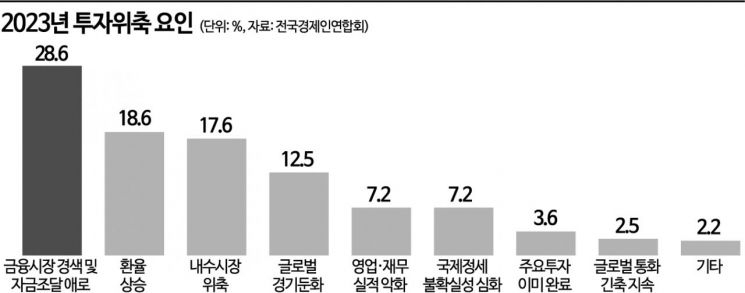

Companies cited financial market tightening and difficulties in raising funds (28.6%) as the biggest reasons making it difficult to increase investment scale next year. The rise in the won-dollar exchange rate (18.6%) and contraction of the domestic market (17.6%) followed. In reality, companies are struggling to secure investment funds due to the sharp rise in market interest rates following the base interest rate hikes. As of the end of last month, the corporate paper (CP) interest rate stood at 5.51%, the highest level since the 2009 financial crisis (5.66%).

SK Hynix’s declaration to 'cut next year’s investment scale by half' is a representative example of investment plan reduction. With the memory semiconductor market?their main product?deteriorating and third-quarter operating profit down 60.3% year-on-year, the company is adopting a conservative management stance. The scale of investment reduction is expected to be similar to that during the global financial crisis. Hyundai Motor Company has also decided to lower its management expectations. While planning to invest over 75 trillion won by 2025 to accelerate business restructuring toward future mobility, it has decided to reduce this year’s investment from the initially planned 9.2 trillion won to 8.9 trillion won, a 300 billion won cut. Many expect a similar approach to continue next year. LG has also signaled conservative management, with LG Electronics stating it will minimize unnecessary investments and maintain financial soundness through efforts to improve investment efficiency.

Companies are focusing more on 'cash accumulation' than investment expansion. Hyundai Motor secured 19.5844 trillion won in cash and cash equivalents in the third quarter, an increase of about 53% compared to the previous year. Cash equivalents refer to assets that can be converted into cash within three months. Samsung Electronics’ cash and cash equivalents stood at 44.5154 trillion won as of the third quarter, up about 14% from the end of last year. LG Electronics’ cash and cash equivalents increased by about 25% to 7.5676 trillion won from 6.0515 trillion won at the end of last year.

Choo Kwang-ho, head of the FKI Economic Department, stated, "In a situation where market liquidity is shrinking due to recent interest rate hikes, if the economic downturn intensifies, companies will face deteriorating profitability and significant difficulties in raising investment funds." He suggested, "It is necessary to control the pace of interest rate hikes and proactively prepare financial market stabilization measures in advance to prevent tightening of the capital market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)