FKI Surveys 2023 Investment Plans of Top 500 Companies

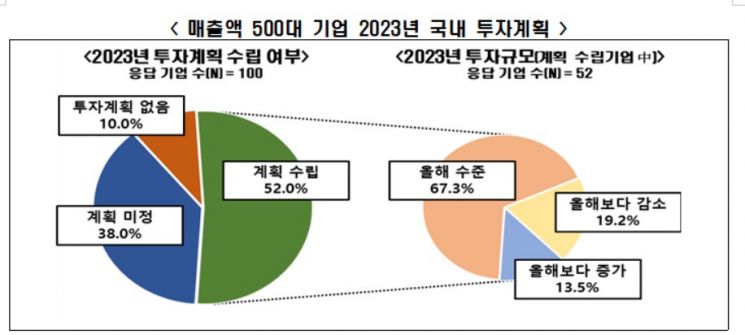

[Asia Economy Reporter Park Sun-mi] Due to uncertain economic conditions, nearly half of South Korea's major conglomerates have yet to establish their investment plans for the coming year. Among the companies that have formulated investment plans, more responded that they would 'reduce' rather than 'expand' their investments. On the 5th, the Federation of Korean Industries (FKI) commissioned the polling agency Monoresearch to survey the top 500 companies by sales on their '2023 Domestic Investment Plans' (with 100 companies responding). The results showed that 48.0% of respondents either have no investment plans for next year (10.0%) or have not yet formulated any plans (38.0%). Only 52.0% of companies had established investment plans.

Among the companies that have set investment plans, 67.3% responded that they would invest at levels similar to this year. However, the proportion expecting to reduce investment (19.2%) was higher than those expecting to expand it (13.5%). The biggest reason companies cited for difficulty in increasing investment scale next year was financial market tightening and difficulties in raising funds (28.6%). This was followed by the rise in the won-dollar exchange rate (18.6%) and contraction of the domestic market (17.6%).

In reality, companies are facing challenges in securing investment funds due to the sharp rise in market interest rates following the base rate hikes. As of the end of last month, the corporate paper (CP) interest rate stood at 5.51%, the highest level since the 2009 financial crisis (5.66%). Companies that responded they would expand investment next year cited key reasons such as ▲securing future vision (52.4%), ▲intensified competition within the industry (19.0%), and ▲strengthening competitiveness through proactive investment during a recession (14.3%). Regarding the timing of investment revitalization, 64.0% expected it to occur after the second half of 2023. The proportion selecting 'no foreseeable time' was also high at 26.0%. Only 5.0% of companies anticipated investment revitalization in the first half of 2023.

Meanwhile, companies viewed global economic slowdown (29.1%) and continued rise in exchange rates (21.3%) as the biggest risks hindering investment activities in 2023. High inflation (15.3%), ongoing global tightening and interest rate hikes (15.3%), and excessive private debt and financial market deterioration (9.7%) were also mentioned as investment risks. As measures to revitalize investment, respondents emphasized ▲controlling the pace of base rate hikes (24.6%), ▲activating the capital raising market (22.0%), ▲easing corporate regulations (14.7%), and ▲corporate tax cuts and strengthening tax support (13.7%) as important.

Choo Kwang-ho, head of the Economic Department at FKI, stated, "If the economic downturn intensifies amid shrinking market liquidity due to recent interest rate hikes, companies will face deteriorating profitability and significant difficulties in raising investment funds." He added, "It is necessary to control the pace of interest rate hikes and proactively prepare financial market stabilization measures in advance to prevent capital market tightening."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.