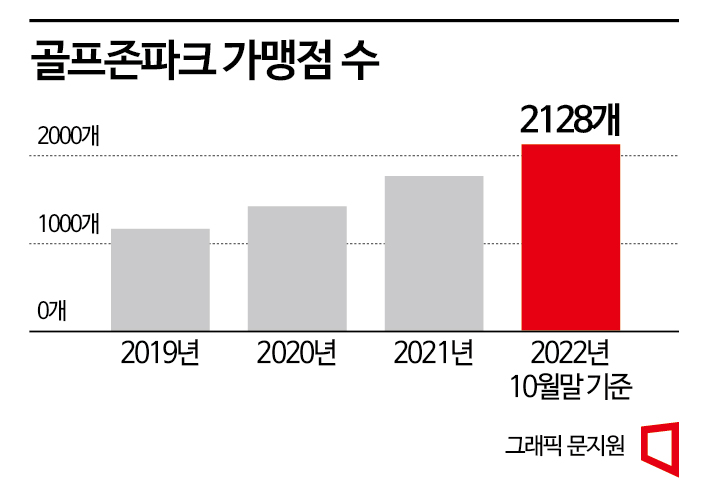

Golfzon Park Reaches 2,128 Locations by Late October with 360 New Sites This Year

Golf Population Growth and Establishment of Sgol Culture... 1 in 10 Koreans Play Golf

Bright Outlook Due to Climate Change and Overseas Market Growth... Demand Expected to Increase

[Asia Economy Reporter Choi Taewon] Contrary to concerns about an economic recession and predictions that the golf industry would experience a 'peak out,' the screen golf industry is booming. The absolute number of golf players has increased, and the screen golf culture has become established, helping the industry overcome the crisis. The growth potential remains open as well. Due to climate change, the periods for outdoor activities are becoming longer as spring and autumn shorten, and overseas markets are steadily growing.

According to Golfzon on the 6th, as of the end of October this year, there are 2,128 Golfzon Park franchise stores. This year alone, the number increased by 360 stores, showing a growth rate of over 20%. The number of franchise stores, which was 1,167 in 2019, has continuously increased to 1,423 in 2020 when COVID-19 broke out, and 1,768 in 2021. As users increased, the number of screen golf game rounds also surpassed 60 million in 2019, 65 million in 2020, and exceeded 70 million in 2021. The cumulative number of Golfzon integrated members is reported to have exceeded 4 million.

Along with the increase in the number of franchise stores, sales and operating profits are also rising. Golfzon's sales increased from 298.5 billion KRW in 2020 to 440.3 billion KRW in 2021, and 476.2 billion KRW (cumulative for the first three quarters) in 2022. Operating profits during the same period surged from 51.6 billion KRW to 107.7 billion KRW, and then to 141.2 billion KRW.

Latecomer KakaoVX is also showing a clear upward trend. KakaoVX's screen golf brand 'Friends Screen' has about 2,600 stores, a 25% increase from the previous year, and its sales rapidly grew from 55.3 billion KRW in 2020 to 112.7 billion KRW last year.

Experts cite the increase in golf population, the sharp rise in green fees and caddie fees, and the establishment of screen golf culture as the reasons behind the smooth sailing of the screen golf industry. The golf industry is one of the biggest beneficiaries of the COVID-19 pandemic. According to the 'Leisure White Paper 2022' published by the Korea Leisure Industry Research Institute, the domestic golf population, which was 4.7 million in 2019, surged by 20% to about 5.64 million last year. This means that one out of every ten people in the country enjoys golf.

The reflective benefits that screen golf, as a substitute, enjoyed due to the sharp rise in green fees and caddie fees are also analyzed as a positive factor. According to the Korea Leisure Industry Research Institute, the total market size of the golf course industry (golf course sales and caddie fees) surged by 18.3% to 7.0066 trillion KRW in 2020 compared to the previous year. Since the COVID-19 pandemic, green fee increases alone have reached 30%. The same applies to caddie fees. The caddie fee, which was 130,000 KRW last year, rose to 140,000?150,000 KRW this year. Golfers' spending on caddie fees last year was 1.5934 trillion KRW, a 35.5% increase from 2019.

On the other hand, screen golf is accessible as it can be enjoyed at around 15,000 to 25,000 KRW per person. The stable establishment of screen golf culture is also seen as contributing to the boom in the screen golf industry. It is analyzed that the culture of visiting screen golf centers after drinking, which became popular just before the COVID-19 pandemic, lowered psychological barriers to access.

Seo Cheonbeom, director of the Korea Leisure Industry Research Institute, explained, "Screen golf has settled as a culture among office workers, and as the COVID-19 pandemic passed, the golf population surged, green fees increased, and booking became difficult. As a result, a mood formed among golfers to enjoy golf cheaply and conveniently, leading to increased demand for screen golf."

The industry consensus is that the outlook for the screen golf industry is bright. This is because the period during which outdoor activities are difficult is lengthening due to climate change, and overseas markets are steadily growing. An industry insider said, "Summer and winter are getting longer, and spring and autumn are squeezed into about a month. There are also air quality issues such as fine dust, so demand for indoor screen golf is expected to increase," adding, "There is absolutely no sense that the screen golf market is shrinking."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.