10 Times Longer Lifespan and 4 Times Efficiency Compared to Conventional Fluorescent Light Sources

Over 10 Years of Commercialization Efforts by UDC and Others

Korean Companies Like Samsung Also Chasing... High Demand Expected from Apple and Others

Samsung Display unveiled its QD display at a private booth inside the Encore Hotel in the United States on January 4, local time, one day before the opening of the International Consumer Electronics Show (CES) 2022. The photo shows a QD display embedded with quantum dots. (Image source=Yonhap News)

Samsung Display unveiled its QD display at a private booth inside the Encore Hotel in the United States on January 4, local time, one day before the opening of the International Consumer Electronics Show (CES) 2022. The photo shows a QD display embedded with quantum dots. (Image source=Yonhap News)

[Asia Economy Reporter Moon Chaeseok] As the OLED (organic light-emitting diode) emitting material market, a key display material, is expected to continue its growth trend, industry attention is focused on Samsung Display's competition to secure 'blue phosphorescent' materials. The world's No. 1 OLED material company, UDC (Universal Display Corporation) in the U.S., has declared that it will commercialize blue phosphorescent materials in 2024. With expectations that these materials could be installed in Apple's 'Pro' series announced the same year, attention is on how quickly Samsung can catch up.

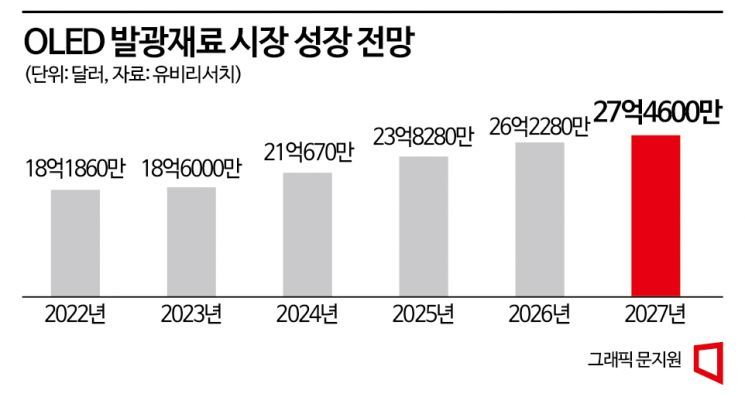

On the 5th, market research firm UBI Research projected that the OLED emitting material market will grow from the current $1.8186 billion (approximately 2.4 trillion KRW) to $2.746 billion (approximately 3.6 trillion KRW) by 2027, five years from now. This corresponds to an average annual growth rate of 8.6%. Although the short lifespan of OLEDs could be an issue, it is expected to maintain its status as a 'mainstream material.'

Notably, the survey predicts that by 2027, 'Red-Green-Blue (RGB)' OLEDs will dominate with a 69.1% market share when viewed by OLED deposition methods. OLED emission proceeds via phosphorescent and fluorescent methods, but unlike red and green, blue phosphorescent materials have a short lifespan, so blue light is emitted only by the fluorescent method. While the fluorescent method yields about 25% internal emission efficiency, the phosphorescent method is theoretically known to reach up to 100%. Regarding lifespan, phosphorescent materials are said to last about ten times longer than fluorescent materials.

Since the form factors of IT devices such as TVs, mobiles, and tablet PCs from major set (finished product) companies like Apple, Samsung, and LG, which use OLED materials, change frequently and rapidly, the 'self-emission' level and lifespan of display panels must be supported accordingly. Therefore, attention to 'blue phosphorescent' technology is inevitably high. Since the early 2010s, companies including UDC, Japan's Idemitsu Kosan, and Germany's BASF have attempted to develop this technology aiming for commercialization in the mid-2010s, but even after about ten years, commercialization news has not emerged, indicating the technology's difficulty.

Apple, a major set company, has specified '2024' as the concrete timing to apply blue phosphorescent OLED to its premium products, drawing attention to the speed of technology development among display companies. Global market research firm Display Supply Chain Consultants (DSCC) expects Apple to incorporate this material into the 'Pro' series in 2024. As a parts supplier, companies have no choice but to put all their efforts into accelerating commercialization to secure Apple's orders. Since UDC firmly stated "commercialization in 2024" earlier this year, there are expectations of 'Apple-UDC' blue phosphorescent orders.

Samsung Display uses an RGB OLED with blue as a self-emitting light source and applies red and green on top in a QD-display system, and is actively developing blue phosphorescent technology. However, since phosphorescent technology can also be used in small and medium-sized displays like mobiles and tablet PCs, LG Display, which uses 'white (W)' elements as light sources, is also reportedly continuing its RGB research and development.

Samsung Display announced in September that it acquired the thermally activated delayed fluorescence (TADF) patent technology developed by German materials company Cynora to enhance its blue material development capabilities. An industry insider said, "The most important aspect in display materials is lifespan. Phosphorescent emission can dramatically extend lifespan, and especially Samsung Display, which uses blue light sources, is expected to be proactive in developing blue phosphorescent materials," adding, "It is difficult to predict exactly when commercialization will occur."

LG Display applies RGB OLED materials to small and medium-sized OLED panels for smartphones, automotive use, and more. Competition in materials with the U.S. and China is intense. An industry insider said, "LG Display is also accelerating research and development of phosphorescent materials such as TADF."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)