Bank of Korea Reviews Inflation Situation

"5% Increase Rate in Line with Expectations

Considering Base Effects and Energy Prices

Upward Trend to Continue Until Early Next Year"

Funding Tightness and Real Estate Slump Pose Challenges

Overall Economy's Interest Rate Sensitivity Increases

The core inflation rate (excluding agricultural products and petroleum) that shows the underlying trend of prices remained at 4.8% in November, the same as the previous month, maintaining the highest level since February 2009 (5.2%).

The core inflation rate (excluding agricultural products and petroleum) that shows the underlying trend of prices remained at 4.8% in November, the same as the previous month, maintaining the highest level since February 2009 (5.2%).

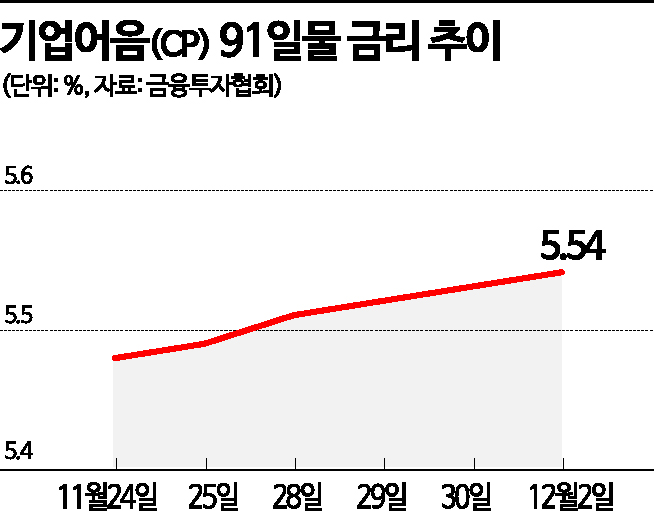

In the short-term money market, corporate funding difficulties continue, causing CP (Commercial Paper) interest rates to soar.

In the short-term money market, corporate funding difficulties continue, causing CP (Commercial Paper) interest rates to soar.

[Asia Economy Reporters Seo So-jeong and Moon Je-won] Although last month's consumer price inflation rate slowed significantly to 5.0%, the high inflation situation persists, and the Bank of Korea's (BOK) monetary tightening stance is expected to continue for the time being. However, due to the impact of the global economic recession, next year's economic growth rate is expected to remain in the 1% range, falling below the potential growth rate (2%). Additionally, the domestic capital market tightening triggered by the Legoland incident and the frozen real estate market conditions are expected to become major variables in monetary policy management.

On the morning of the 2nd, the BOK held a "Price Situation Review Meeting" at the main building conference room in Seoul, chaired by Deputy Governor Lee Hwan-seok, to review recent price trends and future outlooks. The BOK evaluated last month's 5% consumer price inflation rate as being in line with expectations but forecasted that the high inflation rate around 5% would continue until early next year.

Deputy Governor Lee said, "The November consumer price inflation rate slowed significantly due to base effects from last year's sharp rise in agricultural and petroleum prices, which aligns with last week's forecast." The BOK explained that core inflation saw an expansion in the rise of prices mainly in industrial products excluding petroleum, alongside a continued high increase in personal service prices. Earlier, BOK Governor Lee Chang-yong also mentioned at a press conference following the Monetary Policy Board meeting on the 24th of last month that "the November consumer price inflation rate could be significantly lower than October's 5.7%." While the inflation rate may temporarily slow due to the November base effect, it is expected to rise again in January and February next year, making a temporary decline more likely.

Considering base effects and international energy prices, the BOK expects consumer prices to maintain a rise around 5% until early next year. Deputy Governor Lee explained, "There is significant uncertainty regarding the future inflation path related to trends in crude oil and other commodity prices. Downside risks include the possibility of a deeper economic slowdown, while upside risks include the potential for increased energy price hikes." Although last month's consumer price inflation rate of 5.0% was the lowest since April (4.8%), it still far exceeds the BOK's inflation stabilization target of 2%, increasing the likelihood that monetary policy will continue to focus on inflation for the time being.

However, difficulties in the bond market triggered by the Legoland default incident and the domestic real estate downturn are major variables in future monetary policy decisions. The current base interest rate of 3.25% is at or slightly above the neutral rate, and considering the continuation of high inflation, the monetary tightening stance should persist. However, the increased interest rate sensitivity across the financial markets, including short-term market tightening, poses a burden on further rate hikes. The potential for the financial and real economy impacts of future policy rate increases to fully materialize is also a factor to consider.

In particular, Governor Lee indicated that the rapid deterioration of the real estate market will be taken into account in future monetary policy operations. In an interview with foreign media on the 30th of last month, he stated, "I hope to complete rate hikes around 3.5% annually," adding, "The Monetary Policy Board will review the pace of monetary tightening and strive for a soft landing." He mentioned that opinions among Monetary Policy Board members on the final rate ranged from 3.25% to 3.75%, but considering recent financial stability and real estate market deterioration, the direction was suggested to converge toward a final rate of 3.5%. Accordingly, the market widely expects the BOK to raise the base rate once more (by 0.25 percentage points) in the first quarter of next year and then conclude the rate hike cycle.

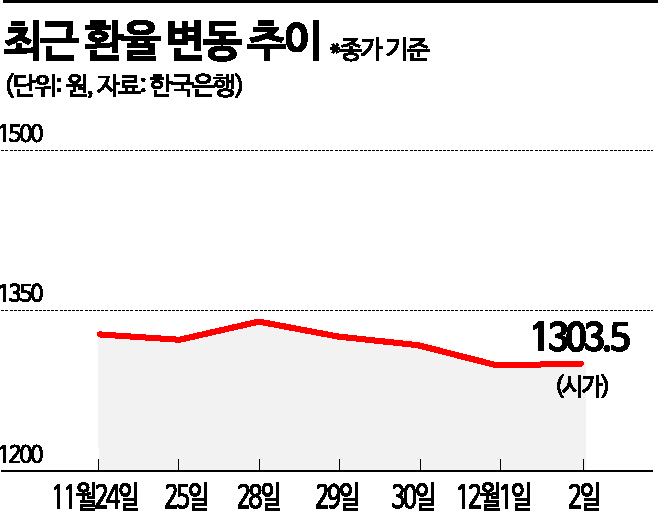

Kim Jeong-sik, Emeritus Professor of Economics at Yonsei University, said, "Domestically, the loan-to-value (LTV) ratio is high, so financial stability risks are not significant, but the high interest rate environment could cause a hard landing in the real estate market, so the BOK must be cautious about further rate hikes." He added, "With recent government liquidity supply measures gradually warming the previously tight capital market and growing expectations that the U.S. Federal Reserve will slow its tightening pace, the won-dollar exchange rate has stabilized, increasing the likelihood that the BOK will focus on domestic conditions in managing monetary policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.