Differences in Trade Deficit Compared to 14 Years Ago

[Asia Economy Reporter Park Sun-mi] Amid the forecast of the first annual trade deficit in 14 years, unlike in 2008 when the main cause of the trade deficit was a decline in exports due to the global economic recession, this year the sharp increase in imports caused by energy inflation is cited as the biggest factor behind the trade deficit.

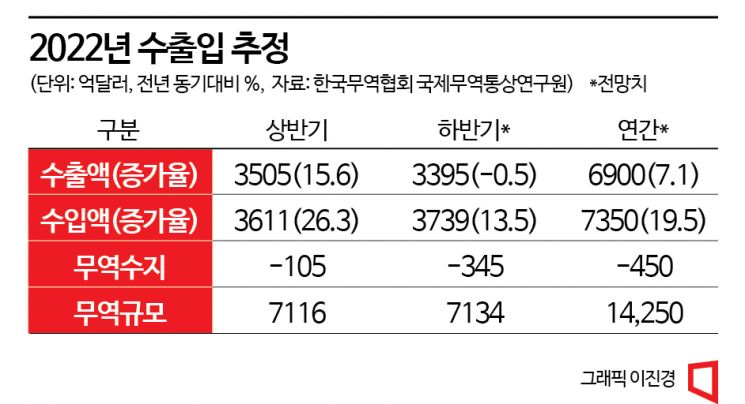

On the 2nd, the Korea International Trade Association's Institute for International Trade and Commerce predicted a trade deficit of $45 billion this year. Exports are expected to reach $690 billion, up 7.1%, while imports are projected to increase by 19.5% to $735 billion, resulting in a $45 billion trade deficit. Despite achieving record-high export performance despite the global economic slowdown, the increase in energy imports such as crude oil, natural gas, and coal is expected to turn the trade balance into a deficit for the first time in 14 years.

Energy inflation is cited as the biggest background for this year's trade deficit. Due to the impact of the Russia-Ukraine conflict, energy prices have risen, and imports of the three major energy sources?crude oil (67.9%), natural gas (109.6%), and coal (122.3%)?increased by 84.3% compared to the same period last year from January to October. The share of these three major energy sources in total imports rose by 7.6 percentage points from 17.4% last year to 25% in the first ten months of this year, the highest since 2012 (27.7%). The decrease in the trade balance for these three major energy items compared to the same period last year was $70.2 billion, exceeding the total trade balance decrease of $62.3 billion (trade balance decrease impact rate 112.6%).

In contrast, in 2008, when a trade deficit of $13.27 billion was recorded, a decline in exports due to energy inflation and the global financial crisis-induced economic recession occurred simultaneously. The rise in raw material prices was partially passed on to export prices, resulting in a high export growth rate in the first half of 2008, but exports sharply declined in the second half as global economic recession dampened overall demand for goods. When exports sharply declined after November 2008 due to the spread of the global recession, companies cited reduced overseas import demand (61.2%), exchange rate fluctuations (16.7%), and rising raw material prices (10%) as reasons for the export decrease.

The export items and regions have also changed compared to 2008. In 2008, the item with the largest export increase was petroleum products raw materials and fuels (49.8%), followed by food and direct consumer goods (13.7%), and heavy chemical industrial products such as machinery, precision instruments, and ships (10.7%). Exports of semiconductors, computers, and automobiles decreased. As of January to October this year, among the 13 major key items, petroleum products showed the highest export growth rate (75.6%). However, the following items were automobiles (13.6%), steel (10.9%), semiconductors (8.3%), and displays (5.1%). Notably, the rapid growth of new industry exports such as electric vehicles from January to October led to qualitative growth in Korean exports, which is a difference from 2008.

Another difference is the significantly expanded export growth to the United States compared to 2008. From January to October this year, exports to the U.S. (16.1%), ASEAN (22.4%), Australia (104%), and the Middle East (16.9%) increased, but exports to China (0.7%) slowed significantly due to the impact of COVID-19 lockdowns. In contrast, in 2008, the Middle East (35.1%) and Latin America (29%) grew around 30%, and China (11.5%) also recorded double-digit growth rates. At that time, the U.S. growth rate was only 1.3%.

Next year, due to the prolonged Russia-Ukraine war and economic downturns in major countries caused by monetary tightening, exports are expected to decrease by about 4% to $662.4 billion, and imports are expected to decline by 8% to $676.2 billion due to domestic economic slowdown and falling oil prices. The deficit is projected to reach $13.8 billion. In particular, a decrease in semiconductor exports next year is likely to directly impact domestic trade. The Korea International Trade Association expects semiconductor exports among the 13 major key items to decrease by more than 15%, showing the largest export decline.

At a press conference commemorating the 59th Trade Day, KITA Chairman Koo Ja-yeol said about next year's trade environment, "We will face a difficult environment where exports and imports will shrink more than this year." He explained, "The aftermath of COVID-19 and the Russia-Ukraine war continues, and with monetary tightening, the global economy is expected to rapidly enter a downward phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.