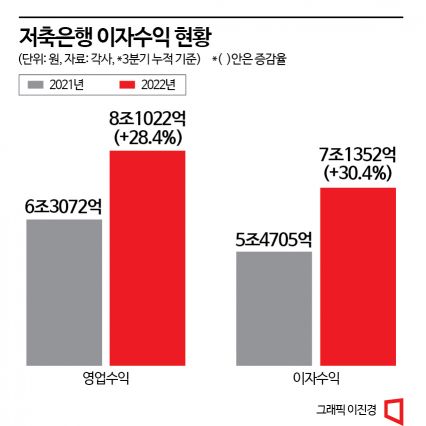

Cumulative Interest Income of 7.1352 Trillion KRW in Q3... Increased by 1.6647 Trillion KRW (30.4%) in One Year

SBI, First in Industry to Surpass 1 Trillion KRW in Interest Income... Industry Says "Performed Well but Worried About Risks Next Year"

[Asia Economy Reporter Song Seung-seop] Savings banks have surpassed 7 trillion won in cumulative interest income for the third quarter of this year. This was due to the surge in loan interest rates following the rise in the base interest rate, resulting in massive interest earnings. However, the industry is cautious about the increasing risks that may arise from next year despite the expanded interest income.

According to the savings bank industry on the 2nd, the cumulative interest income of 79 companies for the third quarter of this year was recorded at 7.1352 trillion won. Compared to 5.4705 trillion won last year, this is an increase of 1.6647 trillion won (30.4%). During the same period, cumulative operating income jumped from 6.3072 trillion won to 8.1022 trillion won. Savings bank operating income mainly consists of interest, fees, and others. Among these, interest income accounts for 88%.

HB Savings Bank's interest income, which was around 51.2 billion won, surged by 53.4% in one year to 78.6 billion won. In the case of Sangsangin Savings Bank, it increased by 52.4% from 133.8 billion won to 211.7 billion won, and Kiwoom YES Savings Bank and Kiwoom Savings Bank also recorded growth rates of 50.0% and 48.9%, respectively.

In particular, affiliate savings banks under major financial groups played a key role. The interest income growth rates of Shinhan, Hana, and Woori Financial savings banks all exceeded 40%. Shinhan Savings Bank achieved 160.1 billion won, and Hana Savings Bank reached 121.1 billion won in interest income. NH Savings Bank's interest income, which was around 73.2 billion won, increased by 37.5%, surpassing 100 billion won.

In terms of scale, the top five savings banks by asset size (SBI, OK, Welcome, Pepper, Korea Investment) earned the most interest income. SBI Savings Bank's interest income increased by 22.0% to 1.0057 trillion won. It is the first time in the industry that a savings bank has surpassed 1 trillion won in interest income. OK Savings Bank followed with 962.8 billion won (+20.3%), Welcome with 450.1 billion won (17.2%), Pepper with 428.7 billion won, and Korea Investment with 355.4 billion won (32.6%).

Interest Income Increased Significantly but "Concerns Over Risks Next Year"

Savings banks have been generating profits by actively engaging in loan operations in a 0-1% base interest rate environment from the start of COVID-19 in 2020 until the end of last year. Especially, as real estate prices soared, loans were extended even to high-credit borrowers looking to buy homes. Real estate project financing (PF) loans, identified as a risk factor for savings banks recently, also increased sharply during this period.

The background of this year's massive interest income for savings banks is the rise in loan interest rates following the increase in the base interest rate. When the base interest rate rises, the increase is immediately applied to new loans and variable interest rates of financial companies. However, low-cost deposits, which make up a large portion of deposit funds, are less affected by the rise in the base interest rate. This is why financial companies' profit expansion widens as the base interest rate rises. Particularly, while growth in the household loan sector, which had previously expanded significantly, slowed down, the corporate loan sector grew rapidly.

However, some companies recorded negative growth in interest income depending on their size and region. Cheongju Savings Bank's interest income decreased by 14.6% from 16.4 billion won to 14.0 billion won, and Dae-A Savings Bank also recorded a decline of 5.8%.

Despite the encouraging expansion of interest income, savings banks are concerned about risks. The business environment in the first half of next year is expected to be challenging. A savings bank official explained, "The industry is performing better than expected this year, but the interest rates have risen too much, so we are worried about next year," adding, "The biggest concern is that borrowers, both households and companies, who have taken out loans, are shaken by the higher interest rate environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)