[Asia Economy Sejong=Reporter Kim Hyewon] The average household debt in South Korea reached 91.7 million KRW, marking an increase of over 4% compared to a year ago. Due to rising real estate and jeonse prices, the average household assets increased by 9% to 547.72 million KRW.

The government assessed that although household debt continues to rise, the pace of net asset growth is faster, leading to an improvement in household financial soundness. However, it noted that there may be a perceived discrepancy due to recent interest rate hikes and declines in real estate prices.

The Statistics Korea, Bank of Korea, and Financial Supervisory Service announced the results of the '2022 Household Finance and Welfare Survey' conducted on about 20,000 sample households nationwide on the 1st.

Average Household Debt 91.7 Million KRW... Debt Growth Rate Higher Among Those Under 29 and Self-Employed

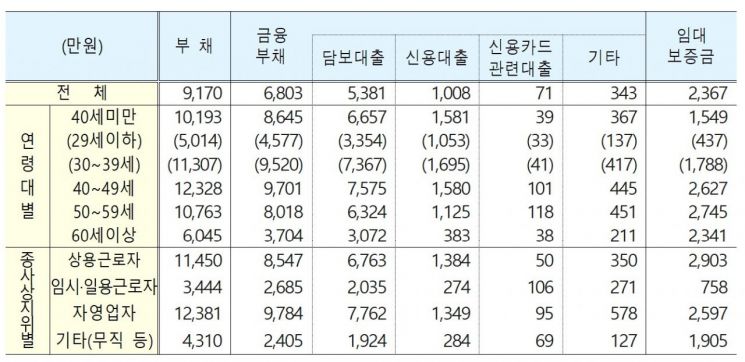

As of the end of March this year, the average household debt was 91.7 million KRW. This is a 4.4% increase from 88.01 million KRW a year earlier, which is lower than the previous year's growth rate of 6.6%.

Financial debt stood at 68.03 million KRW, and rental deposits at 23.67 million KRW, increasing by 4.4% and 3.6% respectively compared to the previous year.

Financial debt includes secured loans of 53.81 million KRW, unsecured loans of 10.08 million KRW, and credit card-related loans of 0.71 million KRW. Secured loans increased by 5.0%, unsecured loans by 4.4%, and credit card loans by 11.6% compared to the previous year.

The proportion of households with debt was 63.3%, down 0.3 percentage points from the previous year. The median debt of indebted households was 74.63 million KRW, up 9.9%, and the median financial debt of households with financial debt was 69.9 million KRW, up 14.6%.

By debt amount brackets, the highest proportion of indebted households was 16.5% in the 110 million to less than 200 million KRW range. Households with debt exceeding 300 million KRW accounted for 12.4%.

Looking at average debt by income quintile, debt increased by 6.5% in the third quintile and 4.9% in the fifth quintile, while it decreased by 2.2% in the first quintile. Debt share increased by 0.4 percentage points in the third quintile (16.7%) and 0.3 percentage points in the fifth quintile (45.0%) compared to the previous year.

By household head age group, debt among those aged 29 and under (economically active population aged 15 and above) surged by 41.2%. Lim Kyung-eun, director of the Welfare Statistics Division at Statistics Korea, said in a briefing that "some households under 29 obtained financial debt to purchase homes with jeonse deposits," adding, "This characteristic is reflected in the high growth rate."

Debt growth rates for those in their 50s (107.63 million KRW) and those aged 60 and above (60.45 million KRW) were 6.8% and 6.0%, respectively, both higher than the overall average of 4.2%. The age group with the highest debt was those in their 40s, with 123.28 million KRW.

By occupational status of the household head, debt among self-employed households increased by 4.4% compared to the previous year, while temporary and daily workers' households decreased by 2.1%. The average debt of self-employed households was the highest at 123.81 million KRW, with rental deposits accounting for 21% of this.

The Ministry of Economy and Finance explained that the asset growth rate (9%) significantly outpaced the debt growth rate (4.2%), resulting in an improved debt-to-asset ratio, which fell by 0.8 percentage points from the previous year to 16.7%.

57.3% of Households Hold Financial Debt... Average 132.82 Million KRW for Those in Their 40s

It was found that 57.3% of all households hold financial debt. The average financial debt among these households was 118.79 million KRW. Their average income was 73.57 million KRW, and assets were 602.51 million KRW.

Financial debt holdings were highest among households in their 40s at 132.32 million KRW and lowest among those aged 60 and above at 101.45 million KRW. While 73% of households in their 40s held financial debt, only 36.5% of those aged 60 and above did.

The perceived repayment burden among households with financial debt slightly decreased compared to last year. Among households with financial debt, 64.4% responded that "principal and interest repayment is burdensome," a 1.2 percentage point decrease from last year's response rate.

Among households with financial debt, 4.7% said "repayment of household debt will be impossible." The proportion who said "they can repay within the loan term" was 77.7%, up 2.1 percentage points from the previous year.

As of the end of March this year, the debt-to-asset ratio was 16.7%, down 0.8 percentage points from a year earlier. The debt-to-asset ratio was highest among households aged 39 and under (28.1%), self-employed households (18.7%), households in the fourth income quintile (18.3%), and households in the first net asset quintile (73.9%).

The ratio of financial debt to savings decreased by 0.9 percentage points to 79.6%. This ratio was also highest among households aged 39 and under (155.6%), self-employed households (107.2%), households in the fourth income quintile (92.3%), households in the first net asset quintile (274.7%), and jeonse households (90.0%).

In a press reference, the Ministry of Economy and Finance explained, "While rising asset prices have improved households' debt repayment capacity and thus financial soundness, the current economic sentiment perceived by households may differ from survey results due to recent interest rate hikes and continued declines in real estate prices."

It added, "We will continue to stably manage the slowing growth rate of household loans since the second half of last year and efforts to alleviate financial burdens on vulnerable groups. The government is taking the current income and distribution situation, as well as our economy, very seriously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.