Concerns Over Accelerating Slowdown in Growth Rate

[Asia Economy Reporter Seo So-jeong] In the third quarter of this year, the Korean economy grew by 0.3% quarter-on-quarter, supported by a recovery in private consumption and an expansion in facility investment centered on semiconductors, making it likely to achieve the Bank of Korea's growth forecast of 2.6% for this year. While the third-quarter growth rate avoided contraction, making it possible to reach this year's growth forecast, concerns are growing that the growth slowdown will accelerate due to the prolonged Ukraine crisis and a decline in exports amid the global economic downturn.

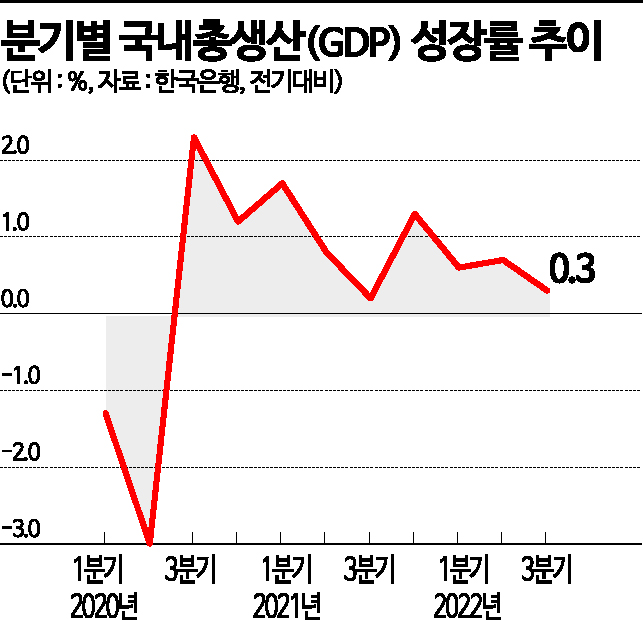

On the 1st, the Bank of Korea announced that the real gross domestic product (GDP) growth rate for the third quarter of this year (provisional, quarter-on-quarter) was 0.3%. This figure is the same as the preliminary figure (0.3%) released on October 27. Quarterly growth rates showed negative figures in the first (-1.3%) and second (-3.0%) quarters of 2020, when COVID-19 spread, but have maintained growth for nine consecutive quarters from the third quarter of 2020 through the third quarter of this year.

Looking at the third-quarter growth rate by sector, exports, private consumption, and government consumption all increased. Private consumption rose by 1.7%, mainly driven by semi-durable goods such as entertainment and hobby products, and services such as food and accommodation. Government consumption increased by 0.1%, mainly due to spending on goods. Facility investment grew by 7.9%, the highest since the first quarter of 2012 (9.7%), as both machinery such as semiconductor equipment and transportation equipment increased. Construction investment decreased by 0.2% due to a decline in civil engineering construction.

Choi Jung-tae, Director of the Bank of Korea's National Accounts Department, explained the surge in facility investment: "Growth was centered on facility investment related to semiconductor equipment and transportation equipment such as ships, but there is a base effect, and concerns about semiconductor supply and demand remain, so it is premature to consider this a trend growth."

Exports increased by 1.1%, escaping the contraction trend of the second quarter (-3.1%), mainly due to transportation equipment and service exports, despite a decline in semiconductors. However, imports rose by 6.0%, mainly due to crude oil and natural gas, about six times the increase in exports. As imports increased more than exports, net exports pulled down the growth rate by 1.8 percentage points.

Compared to the preliminary figures, private consumption (-0.2 percentage points) and construction investment (-0.6 percentage points) were revised downward, while facility investment (+2.9 percentage points), exports (+0.1 percentage points), and imports (+0.1 percentage points) were revised upward. Regarding the contribution to GDP growth, net exports fell from -1.0 percentage points in the previous quarter to -1.8 percentage points, while domestic demand rose from 1.7 percentage points to 2.0 percentage points. This means that although consumption increased due to the return to normal life, the sharp decline in exports pulled down the growth rate.

By industry, manufacturing continued to decline as in the previous quarter, while services showed growth. Manufacturing decreased by 0.8%, centered on computers, electronic and optical equipment, and chemicals and chemical products. Construction increased by 1.3%, mainly due to building construction. Services grew by 0.8%, driven by wholesale and retail trade, accommodation and food services, information and communication, and cultural and other services.

Real gross national income (GNI) in the third quarter decreased by 0.7% quarter-on-quarter. Although real net primary income from abroad increased from 4.4 trillion won to 7.3 trillion won, real trade losses worsened from 28 trillion won to 35.7 trillion won due to deteriorating terms of trade, causing the real GDP growth rate (0.3%) to be outpaced. The total savings rate fell by 1.5 percentage points to 32.7% compared to the previous quarter, as the final consumption expenditure growth rate (2.2%) was higher than the growth rate of gross national disposable income (0.0%).

Thanks to private consumption, the third-quarter growth rate exceeded expectations, making it likely to achieve this year's growth target. Director Choi said, "Arithmetically, even if there is a slight negative growth in the fourth quarter, it seems possible to achieve an annual growth rate of 2.6%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.