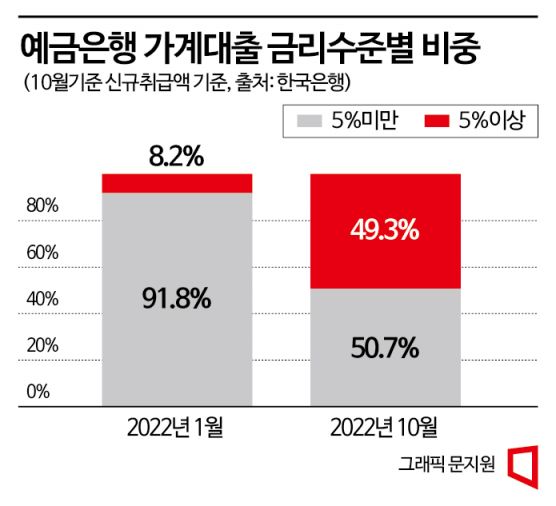

49.3% of New Loans at Deposit Banks Carry Interest Rates of 5% or Higher

Only 8.2% of Loan Amounts Had Rates Above 5% in January This Year

Household Interest Rate Burden Rises Sharply

[Asia Economy Reporter Shim Nayoung] "They say it's no longer the era of 'Yeongkkeuljok' (borrowers who pull loans to the bone), but the era of 'Yeongteoljok' (borrowers who are drained to the bone). Seeing the interest rates really woke me up," said office worker Lee Jinah (34). Last month, she took out a 30 million KRW unsecured loan from an internet bank and was shocked to see the 6.7% interest rate. "The interest I have to pay exceeds 2 million KRW per year," she said, adding, "I took the loan urgently, but I only think about repaying it as soon as possible."

It was revealed that half of the new loans from domestic deposit banks were subject to interest rates above 5%. Specifically, 49.3% of new loan amounts were charged interest rates exceeding 5%. This is the highest proportion in 10 years and 6 months since April 2012 (50.7%). This indicates a sharp increase in household interest burdens.

According to the Bank of Korea Economic Statistics System on the 2nd, 34.6% of loans issued by domestic deposit banks in October fell into the '5% or higher but less than 6%' interest rate category. Loans with '6% or higher but less than 7%' accounted for 5.4%. Compared to January of this year, when the proportions were only 2.7% and 1.6% respectively, this shows the rapid rise in interest rates.

A representative from a commercial bank explained, "The proportion of loans with '6% or higher' interest rates likely increased more in November than in October," adding, "Last month, the COFIX rose to an all-time high, pushing up variable mortgage loan rates, causing the upper limit of interest rates at the five major banks to reach 7%, and the upper limit for unsecured loan rates also settled at 7%."

Returning to the levels of 10 years and 6 months ago is not limited to commercial bank interest rates. The Bank of Korea's base rate also returned to that time. In April 2012, the base rate was 3.25%, similar to the current rate of 3.0% as of October. This also demonstrates that market interest rates move similarly to the base rate.

The somewhat fortunate aspect is that the total household loan amount is decreasing. This means that due to high interest rates, repayments of existing loans exceed new loan amounts. As of November, the total household loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) stood at 693.0346 trillion KRW, a decrease of 14.6549 trillion KRW compared to January this year (707.6895 trillion KRW).

Meanwhile, fixed deposits with interest rates above 4% have become the trend. The interest rate for fixed deposits at deposit banks (based on new contracts in October) showed that 58% fell into the '4% or higher' category. This is the highest proportion in 13 years and 9 months since January 2009 (59.2%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.