DRAM Prices Steady but Down 40% Year-on-Year

Price Decline Expected Until Q2 2025

Price Factors Include Inventory Clearance, 2024 Outlook Also Considered

[Asia Economy Reporter Kim Pyeonghwa] As the down cycle in the memory semiconductor market fully sets in this year, product prices are falling continuously due to factors such as increased inventory. This trend is expected to continue until the second quarter of next year.

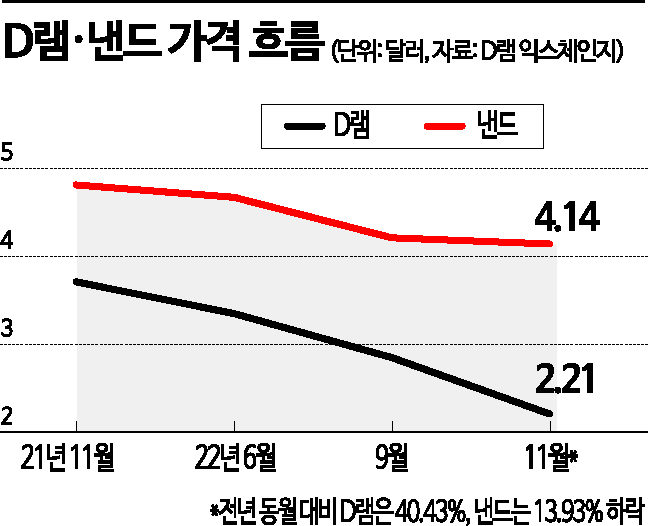

According to the semiconductor industry on the 1st, prices of major memory semiconductor products, DRAM and NAND flash, are plummeting amid an unprecedented downturn in the market. As of the end of last month, the fixed transaction prices for PC-oriented DRAM (DDR4 8Gb 1Gx8) and memory card/USB-oriented NAND (128Gb 16Gx8), announced by market research firm DRAMeXchange, are $2.21 and $4.14 respectively. Although the price decline for both products stopped compared to the previous month, they have sharply dropped by 40.43% and 13.93% respectively compared to the same month last year.

The market anticipates further price declines. Market research firm TrendForce expects the DRAM market to continue experiencing demand decreases in the first quarter of next year, similar to this year. Even with production adjustments by suppliers, front-end consumption is also expected to decrease, potentially causing the average selling price (ASP) of DRAM to fall by more than 10% compared to the fourth quarter of this year. There is also a forecast that the price decline for DDR5-based products, the latest DRAM standard, could be greater than that for DDR4 products.

The prevailing view is that the price decline trend will continue at least until the second quarter of next year. It is analyzed that memory prices may only turn upward with market improvement in the second half of next year. Shinhan Investment Corp. predicts that price declines will continue until the second quarter of next year due to increased inventory by memory manufacturers. However, Hyundai Motor Securities forecasts that the decline will not continue at this year’s level. Noh Geun-chang, head of the Hyundai Motor Securities Research Center, said, "The sharp decline in memory prices is expected to end by the end of this year," adding, "The price decline in the first half of 2023 will be gradual."

In the memory semiconductor market, which experiences cyclical fluctuations, a concern is the low inventory turnover ratio of major players compared to past cycles. The inventory turnover ratio is an indicator that shows how quickly a company’s inventory is converted into sales. Due to significant inventory, as of the third quarter, Samsung Electronics’ inventory turnover ratio is 3.8 times, and SK Hynix’s is 2.4 times, both of which have decreased. Since inventory levels are a major factor determining price fluctuations, negative forecasts are emerging in the securities industry. Researcher Hwang Min-seong of Samsung Securities evaluated Samsung Electronics and SK Hynix, saying, "Memory inventory depletion is likely to extend into 2024, and there is a high risk regarding a rebound in the second half of next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)