TIGER China 135.6 Billion KRW

Raises Net Purchase Volume to 3rd Place

[Asia Economy Reporter Minji Lee] Interest in the China Electric Vehicle ETF, which once established itself as the ‘national ETF (Exchange-Traded Fund),’ is growing again. This is analyzed as reflecting expectations that consumption could increase if the Chinese government shifts from its COVID-19 lockdown policy to a with-COVID approach.

According to the Korea Exchange on the 1st, individual investors purchased 135.6 billion KRW worth of the ‘TIGER China Electric Vehicle SOLACTIVE ETF’ last month, ranking it third in net buying volume. Excluding leveraged ETF products that seek more than double the returns, this is the largest purchase volume among ETFs.

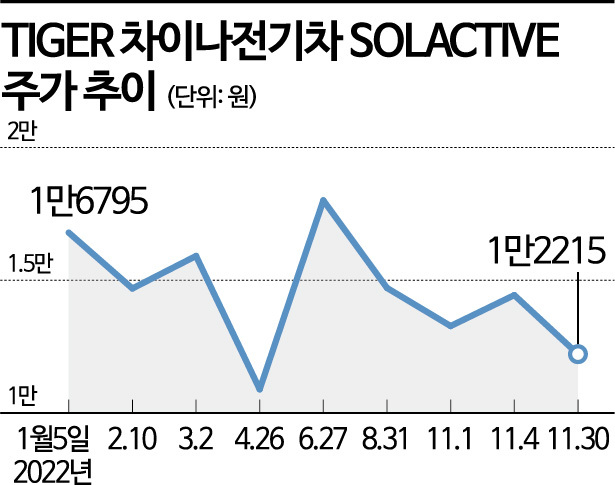

Foreign investors also bought 92.2 billion KRW worth during the same period. This ETF invests in China’s electric vehicle and secondary battery industries, with major holdings including Shenzhen Inovance Technology (11.48%), Eve Energy (8.93%), and BYD (7.60%). In June of this year, as China showed signs of lifting COVID-19 lockdowns, the index rose, and this overseas ETF was the first to exceed 4 trillion KRW in net assets. However, since then, its price has dropped about 30% compared to June, and its net asset size has shrunk to 2.9 trillion KRW.

The buying momentum among individuals was stimulated by expectations of the Chinese government lifting COVID-19 lockdowns. Since strict quarantine measures had suppressed consumption within China, it is judged that a gradual recovery in consumption will occur once regulations are lifted. Oh Minseok, head of the Global ETF Division at Mirae Asset Global Investments, said, “The major factor behind this year’s stock price fluctuations was not a significant change in fundamentals within the Chinese electric vehicle market, but rather the impact of investment sentiment being dampened by the COVID-19 lockdown policy. Recently, as expectations for lifting lockdowns have increased, buying sentiment appears to have revived.”

It is also positive that the Chinese electric vehicle market has steadily grown even amid COVID-19 lockdown conditions. China is the world’s largest electric vehicle market, and from January to October, the cumulative electric vehicle penetration rate reached 26.3%, surpassing the 2025 target of 20% announced in the ‘Automotive Technology Roadmap 2.0’ ahead of schedule. While cumulative internal combustion engine vehicle sales decreased by 21%, electric vehicle sales increased by 119%. Lee Jisoo, a researcher at Korea Investment & Securities, analyzed, “Despite concerns about weak consumption, the electric vehicle market is expected to continue growing in the fourth quarter, supported by positive policy trends such as the extension of vehicle purchase tax reductions. It is also expanding its global market share, focusing on Thailand among emerging countries, as well as the European electric vehicle market.”

Oh also said, “In the long term, the electric vehicle market remains an important theme, and eco-friendly policies and renewable energy expansion policies will have a positive impact on stock prices.”

However, the implementation of the U.S. Inflation Reduction Act (IRA) and news of China’s electric vehicle subsidy reductions next year are aspects to watch closely. Although Chinese companies are turning their attention to Europe instead of the U.S., so the damage from the IRA implementation has not yet become apparent, if electric vehicle subsidies in China decrease, price competition is expected to intensify, increasing pressure on companies’ profitability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.