Interest Rates on Corporate Loans at 4 Major Banks Surpass Household Loan Rates

Corporate Loans Swell Like a Snowball

Emergency as Rates Are Higher Than Household Loans

Credit Ratings Fall Due to Economic Downturn, Corporate Bond Rates Surge

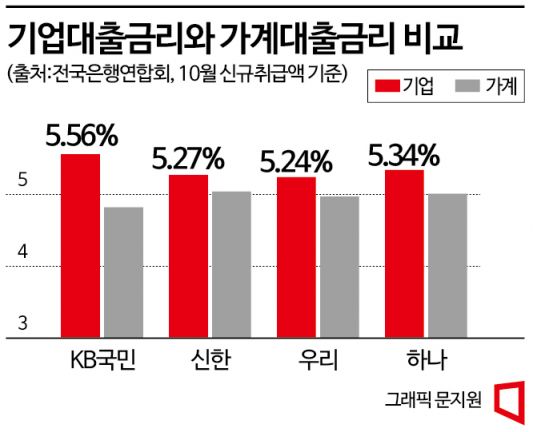

[Asia Economy Reporter Shim Nayoung] Amid the economic downturn and the sharp rise in corporate bond interest rates, the scale of corporate loans by commercial banks has significantly increased, with the corporate loan interest rates of the four major banks (KB Kookmin, Shinhan, Hana, Woori) all surpassing household loan interest rates. Considering the current situation where corporate operating profits are declining and the creditworthiness of self-employed individuals is deteriorating, it is expected that their interest burden will increase further.

According to the disclosure by the Korea Federation of Banks on the 29th, based on new loan amounts in October, the corporate loan interest rates of the four major banks were 0.23 to 0.75 percentage points higher than household loan interest rates (excluding policy-based low-income financial products). Over the past four months, during which the Bank of Korea consecutively raised interest rates, corporate loan interest rates rose much more steeply than household loan interest rates.

Corporate Loan Interest Rates Rising Faster Than Household Loans

Comparing the corporate loan interest rates of the four major banks in October to those in July this year, all increased by more than 1 percentage point. KB Kookmin rose by 1.48 percentage points (4.08% → 5.56%), Shinhan by 1.26 percentage points (4.01% → 5.27%), Woori by 1.17 percentage points (4.07% → 5.24%), and Hana by 1.14 percentage points (4.20% → 5.34%).

In contrast, the increase in household loan interest rates was relatively smaller. Hana increased by 0.9 percentage points (4.11% → 5.01%), Woori by 0.82 percentage points (4.15% → 4.97%), Shinhan by 0.63 percentage points (4.41% → 5.04%), and KB Kookmin by 0.48 percentage points (4.34% → 4.82%).

There are three main reasons why corporate loan interest rates surged. First, regulatory pressure to lower interest rates only affected household loans. In particular, after banks disclosed their loan-deposit interest rate spreads, fearing the stigma of profiteering from interest rates, banks repeatedly lowered the additional interest rates on household loans, but this did not apply to corporate loans. As a result, corporate loans were relatively fully exposed to the risk of rising interest rates.

The sharp rise in bond market interest rates in October also had an impact. Among household loans, mortgage loans, which account for the largest portion, reflect the COFIX (Cost of Funds Index) that changes monthly, but corporate loans mostly move according to bank bond interest rates. Following the Legoland incident, the bond market became unstable, with 6-month bank bond rates reaching the 4% range and 1-year rates hitting the 5% range, the highest in about 13 years, pushing up corporate loan interest rates.

Companies and Self-Employed with Lower Credit Ratings Flocking to Bank Loans

There is also analysis that bank loans to small and medium-sized enterprises (SMEs) and self-employed individuals with low credit ratings have increased. A commercial bank official said, "Including companies related to real estate project financing (PF), companies that cannot issue corporate bonds due to very high bond interest rates have flocked to bank loans," adding, "Companies that find it difficult to issue corporate bonds often have inadequate creditworthiness or collateral, and these companies have caused the overall corporate loan interest rates to rise."

Loans to self-employed individuals, which are also classified as corporate loans, have been affected by the decline in their creditworthiness due to the economic downturn, according to the banking sector. According to a survey by the Korea Credit Guarantee Fund, which provides guarantees for small business loans, the 'Small Business Credit Risk Trend Index' for the third quarter of this year was 45.0 points, up 8.2 points from 36.8 points in the second quarter, and is expected to rise to 55.6 points in the fourth quarter. The closer the index is to 100 from a baseline of 0, the higher the probability of loan delinquency or default.

Despite this situation, corporate loans continue to balloon. As of the end of October this year, corporate loans by the four major banks amounted to approximately KRW 578.3 trillion, an increase of about KRW 56.2 trillion compared to the end of December last year (approximately KRW 522.1 trillion).

While interest rates are rising almost daily, the business conditions of companies are worsening, which is problematic. Looking at the third-quarter earnings of KOSPI-listed companies this year, excluding Korea Electric Power Corporation, which posted the largest operating loss in history, operating profit (KRW 46.8975 trillion) decreased by 25.61%, and net profit (KRW 33.5575 trillion) fell by 31.22%. Kim Jisan, head of the Kiwoom Securities Research Center, explained, "The semiconductor, steel, and chemical sectors, which had been the pillars of our economy, experienced significant profit declines," adding, "Exports have also turned to negative growth, and profit declines were especially pronounced in industries sensitive to economic conditions."

The financial sector predicts that while loan interest rates are rising, worsening earnings will lead to an increase in so-called 'zombie companies'?firms that cannot even cover interest payments with operating profits. A commercial bank official said, "With the real estate market so depressed that household loans are retreating, banks will continue to increase corporate loans next year," but added, "However, the risk that corporate loan repayment capacity will deteriorate due to rising interest rates remains a variable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)