[Asia Economy Reporter Park Byung-hee] Bloomberg reported on the 28th (local time) that the inversion of global bond short- and long-term interest rates has made the risk of the world economy falling into a recession more apparent.

Bloomberg aggregates the interest rate trends of bonds traded in financial markets worldwide and indexes them under the name 'Bloomberg Global Aggregate.' There are various bond indices with the name Bloomberg Global Aggregate, which comprehensively cover the interest rate trends of bonds traded globally.

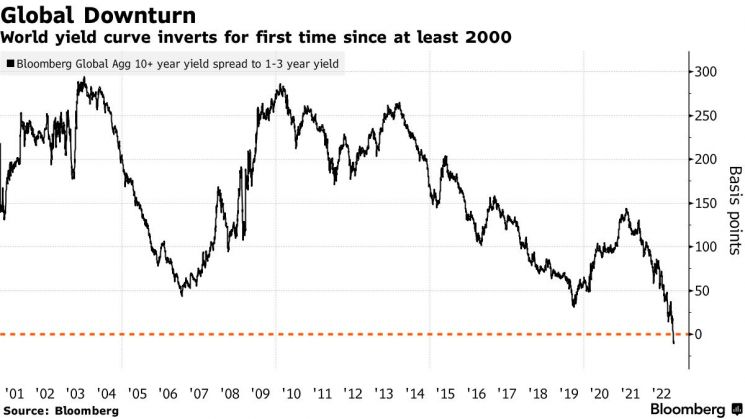

Bloomberg reported that an analysis of the 10-year bond yields and short-term bond yields with maturities of 1 to 3 years included in the Bloomberg Global Aggregate indices confirmed that recently short-term interest rates have been higher than long-term interest rates. Furthermore, Bloomberg added that the inversion of global bond short- and long-term interest rates is the first occurrence since at least 2000.

Typically, long-term interest rates are higher than short-term rates, and an inversion of short- and long-term rates is interpreted as a precursor to an economic recession.

If inflation rises too much, central banks begin raising benchmark interest rates to prevent the economy from overheating. If central banks raise rates excessively and tighten market liquidity, it can lead to an economic recession. When recession fears increase, short-term interest rates, which are more sensitive to monetary policy, rise faster than long-term rates, narrowing the gap between short- and long-term rates, and in cases of extreme recession fears, an inversion phenomenon occurs.

In the United States, the inversion of short- and long-term interest rates has been ongoing since July, with the 2-year Treasury yield higher than the 10-year Treasury yield. The inversion has deepened, and recently the yield gap has widened to the largest level in about 40 years. According to the Federal Reserve Bank of St. Louis, as of this date, the 2-year U.S. Treasury yield is 0.77 percentage points higher than the 10-year Treasury yield.

In reality, concerns are growing that the global major economies will fall into recession due to the Ukraine war and the tightening policies of central banks worldwide.

According to the minutes of the Federal Open Market Committee (FOMC) released by the U.S. Federal Reserve on the 23rd, Fed economists judged that the economy is close to the baseline probability of entering a recession next year. This has been interpreted as Fed economists viewing the probability of a recession next year at 50%.

The Bank of England (BOE), the central bank of the United Kingdom, already warned last summer that the UK economy had entered a recession and that the recession could last up to about two years.

Deutsche Bank, Germany's largest bank, also diagnosed that the German economy may already be in a recession.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.