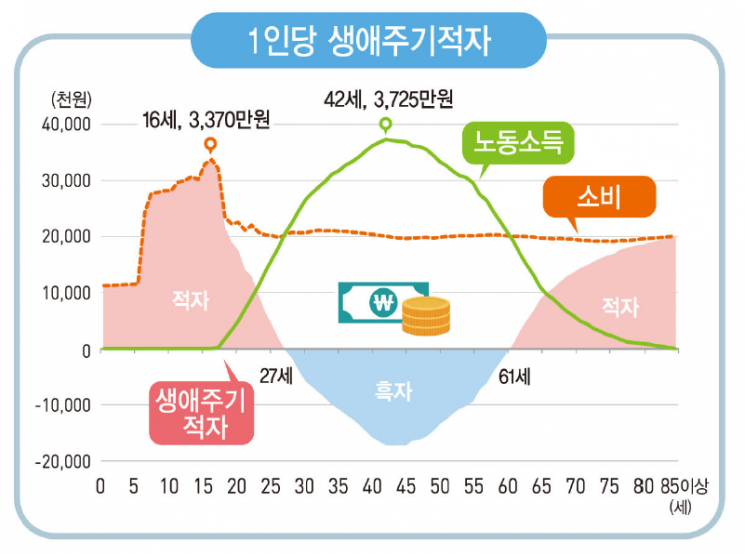

[Asia Economy Sejong=Reporter Son Seon-hee] The average labor income per capita of our citizens was found to be highest at age 42, amounting to 37.25 million KRW. After entering surplus at age 27, it peaked at age 42, and then shifted back to deficit from age 61.

According to the '2020 National Transfer Accounts' released by Statistics Korea on the 29th, in 2020, the total consumption of the population was 1,081.8 trillion KRW, labor income was 984.3 trillion KRW, resulting in a lifecycle deficit of 97.5 trillion KRW. The economic lifecycle shows whether an individual can satisfy consumption through current labor, consisting of consumption, labor income, and the difference between them, the lifecycle deficit.

The working-age population (15-64 years) showed a surplus of 167.2 trillion KRW, but the relatively low or no income groups, children (0-14 years) and elderly (65 years and older), recorded deficits of 141.8 trillion KRW and 122.9 trillion KRW respectively.

The per capita lifecycle deficit was largest at age 16, amounting to 33.7 million KRW. From age 27, labor income exceeded consumption, entering surplus, peaking at 17.26 million KRW at age 43. From age 61, it shifted back to deficit.

Looking at historical trends, the age of entering surplus has generally been steady at 27-28 years, but the age of re-entering deficit has tended to be delayed. In 2010, the age of deficit transition was 56, gradually increasing to 61 in 2020. This is interpreted as meaning that the working period throughout the lifecycle has lengthened due to increased average life expectancy.

The age with the highest per capita consumption was 16, at 33.7 million KRW. For children, education consumption was significant, and for the elderly, health consumption had a large impact.

The deficit portions occurring in children and the elderly are covered through transfers and asset redistribution. Transfers are divided into public income by the government and private transfers such as family support.

The government collects taxes and social contributions from the working-age population and distributes approximately 160.6 trillion KRW to children (77.9 trillion KRW) and the elderly (82.7 trillion KRW) in the form of education and health services, child allowances, basic pensions, and pensions.

In the case of private transfers, 89.9 trillion KRW was net outflow from the working-age population for family support, with net inflows of 63.9 trillion KRW and 22.9 trillion KRW to children and the elderly, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)