Government Announces Second Support Measure Following 50 Trillion Won Liquidity Injection

Market: "Year-End Book Closing... Time Needed for Short-Term Market Stabilization"

Bank of Korea: "CP Rate Rise Slows... Policy Effect"

[Asia Economy Reporters Ji Yeon-jin and Moon Je-won] Corporate Paper (CP) interest rates continue to soar. Although the government began supplying liquidity exceeding 50 trillion won last month, the short-term funding market remains unsettled. The government is making every effort to resolve the 'money stagnation' by introducing additional measures to supply liquidity to the market, but volatility is expected to increase further during the year-end 'book closing' period, raising the possibility of further rate hikes.

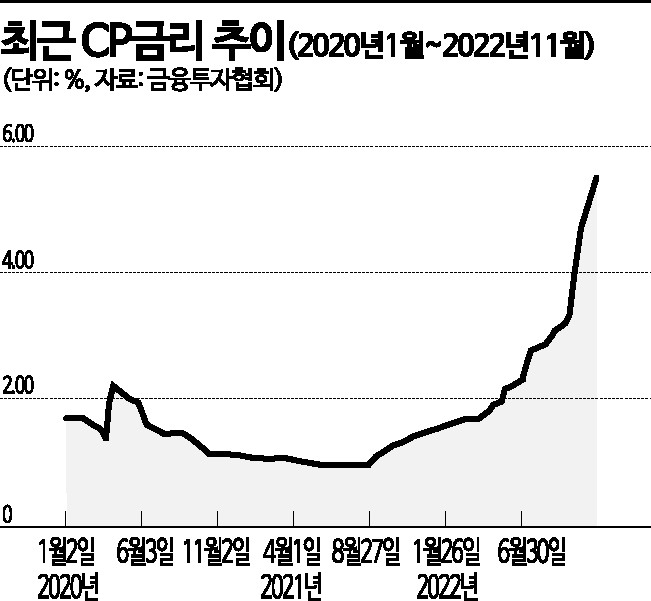

According to the Korea Financial Investment Association on the 29th, the CP rate (91 days) recorded 5.51%, up 0.01 percentage points from the previous trading day. This marks the 46th consecutive trading day of daily increases since September 21. The CP rate had fallen below 1% in August last year due to liquidity released during the COVID-19 recovery process but has since followed an upward trend. The current rate is 3.3 times higher than the same period last year. CP is a representative means for companies to raise short-term funds, meaning companies are now paying more than three times the cost compared to a year ago to secure financing.

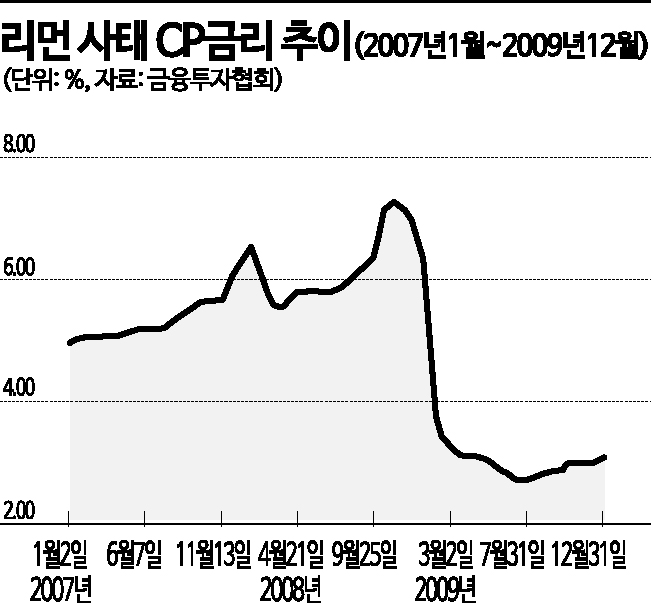

The CP rate reaching such a high level is the first time since January 12, 2009 (5.66%). The CP rate had previously surged to 7.26% on November 4, 2008, following the bankruptcy of the U.S. investment bank Lehman Brothers.

Last month, due to the government's first liquidity support, demand concentrated on stable government bonds in the bond market, causing CP prices to fall. Additionally, companies facing funding difficulties flocked to the short-term funding market, which analysts say has contributed to the recent rise in CP rates.

Moreover, growing concerns about an economic recession have further fueled instability in the bond market. The 3-year government bond yield rose by 0.025 percentage points to 3.669% annually compared to the previous day. In contrast, the 10-year bond yield fell by 0.017 percentage points to 3.606% annually. The inversion, where the 3-year yield is 0.063 percentage points higher than the 10-year yield, has continued for six consecutive trading days since the 21st. Historically, an inverted yield curve often appears just before a recession and is generally considered a leading indicator of economic downturns.

Heo Jeong-in, a researcher at Daol Investment & Securities, said, "This time, due to persistent supply chain disruptions, geopolitical risks, and unanchored inflation expectations amid high inflation, a significant interest rate hike is necessary. We must also consider the possibility of a larger-than-intended economic slowdown."

The market expects that year-end will be a difficult period for fundraising due to the book closing issue, and the real estate market downturn is expected to continue. It is anticipated that the government's additional liquidity measures will take time to spread warmth to the short-term funding market. Kim Myung-sil, a researcher at Hi Investment & Securities, said, "There is a possibility of increased volatility due to the real estate market downturn and changes in year-end cash flow. While policy support may help avoid the worst-case scenario immediately, it will take time to confirm visible results in the short-term funding market."

On the other hand, the Bank of Korea noted that after announcing additional liquidity supply measures, the rate of increase in CP rates has somewhat slowed, suggesting a gradual stabilization. A Bank of Korea official explained, "The 0.01 percentage point rise in CP rates is the first since the end of September," adding, "This can be interpreted as the measures having some effect." The official further stated, "Going forward, CP rates may rise slightly or remain flat. Since CD rates have already shown almost no change, the CP-CD rate spread is also expected to narrow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.