Korea Federation of SMEs Announces 'December SME Business Outlook Index Survey'

[Asia Economy Reporter Kwak Min-jae] The business outlook for small and medium-sized enterprises (SMEs) has been declining for two consecutive months.

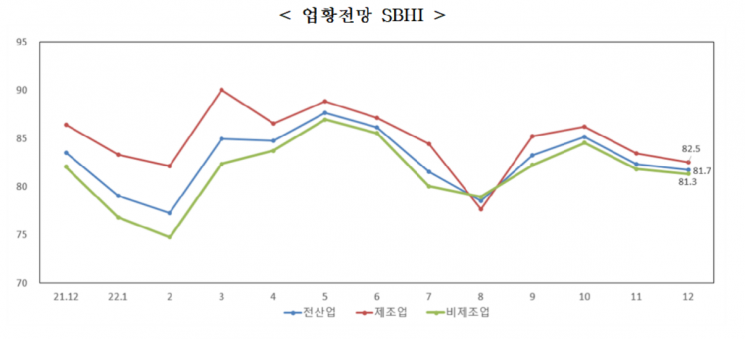

On the 29th, the Korea Federation of SMEs announced the results of the December SME Business Outlook Survey, revealing that the Business Outlook Index (SBHI) dropped by 0.6 points from the previous month to 81.7. The survey was conducted from November 15 to 22, targeting 3,150 SMEs.

The Business Outlook Index had recorded an upward trend for two consecutive months since September (83.2), but has shown a downward trend for the past two months. The decline (0.6 points) was slightly less than the previous month’s drop (2.8 points).

The December business outlook for manufacturing was 82.5, down 0.9 points from the previous month, while non-manufacturing was 81.3, down 0.5 points. Construction stood at 78.6, down 0.7 points, and services at 81.8, down 0.5 points compared to the previous month.

Among the 22 manufacturing sectors, seven sectors including metal products, furniture, apparel, apparel accessories, and fur products saw an increase compared to the previous month, whereas 15 sectors such as other machinery and equipment, paper and paper products, and medical substances and pharmaceuticals experienced a decline.

In the service sector, four out of ten industries, centered on educational services and accommodation and food services, showed an increase, while six industries including real estate and rental services, arts, sports, and leisure-related services declined.

Domestic demand (83.6→82.0), exports (86.1→80.4), operating profit (80.0→78.4), and financial conditions (80.5→78.8) outlooks all fell compared to the previous month, while employment (93.3→93.2), which follows a counter-trend, slightly decreased compared to the previous month.

The main difficulties faced by SMEs in November were dominated by sluggish domestic demand (57.7%), followed by rising raw material prices (48.3%), increased labor costs (45.4%), excessive competition among companies (36.5%), and high interest rates (28.0%).

Responses indicating exchange rate instability (21.7→20.6) and difficulty in procuring raw materials (8.6→8.5) decreased compared to the previous month, whereas sluggish domestic demand (56.5→57.7), excessive competition among companies (34.6→36.5), and high interest rates (27.5→28.0) increased amid growing concerns over economic slowdown.

The average operating rate of small and medium manufacturing firms in October 2022 was 72.1%, up 0.4 percentage points from the previous month and 0.6 percentage points from the same month last year.

An official from the Korea Federation of SMEs stated, “With the recent trend of interest rate hikes, high inflation, and global economic downturn, the weakening of the business sentiment among SMEs is expected to continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.