Financial Supervisory Service Issues Administrative Guidance on Simple Payment Fee Disclosure Guidelines

Disclosure Within One Month After Each Half-Year Period Ends

[Asia Economy Reporter Song Hwajeong] Electronic financial service providers such as Naver Financial and Kakao Pay will be required to disclose payment fees semiannually starting February next year.

According to financial authorities on the 30th, the Financial Supervisory Service recently announced an administrative guidance draft titled "Guidelines for Separate Management and Disclosure of Fees by Electronic Financial Service Providers" and is collecting opinions until the 13th of next month. These guidelines were established to enhance transparency in fee imposition by setting standards for the separate management and disclosure of fees charged by electronic financial service providers for payment services.

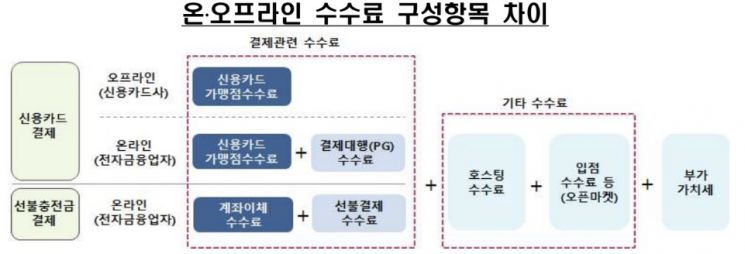

The guidelines stipulate that fees must be separated and managed into payment fees and other fees based on reasonable criteria. Payment fees refer to fees directly related to payment services, including fees paid to payment originators such as credit card companies and upper-tier companies, as well as fees directly collected by electronic financial service providers under the names of costs related to payment operations (general administrative expenses, system development and maintenance costs, marketing expenses, risk management costs, etc.) and margins. Other fees refer to fees excluding payment fees from the total fees, including hosting fees paid to third-party hosting companies or fees directly collected by electronic financial service providers under the names of online homepage construction and management, fees collected for online sub-mall entry or promotions, and so forth.

The companies subject to disclosure are those whose average monthly simple payment transaction amount (excluding regional currency handling) in the previous fiscal year is 100 billion KRW or more. These companies must prepare disclosure materials based on fees received from contracting parties and disclose them on their websites. Additionally, for the first disclosure, the accuracy and appropriateness of the disclosure materials must be verified by an accounting firm.

The disclosure deadline is within one month after the end of each half-year period. Disclosures for the February to July half-year must be posted in August, and disclosures for the August to January half-year must be posted in February of the following year. Accordingly, companies subject to disclosure will make their first disclosure in February next year for fees from the August last year to January this year half-year period.

The payment fee rate disclosure forms are divided into card payment fee rates and prepaid electronic payment instrument fee rates, which are further categorized into micro, small 1, small 2, small 3, and general categories for disclosure. The classification of merchants follows the credit card merchant classification standards under the Specialized Credit Finance Business Act, and merchant sales data is based on National Tax Service sales data provided by the Credit Finance Association. When calculating prepaid electronic payment instrument fee rates, costs related to simple remittance are excluded.

These guidelines will take effect from the 30th of next month and will be applied for two years. A Financial Supervisory Service official stated, "The guidelines were prepared based on discussions in the task force (TF) for disclosing payment fees of big tech companies, and the first disclosure will be made starting February next year." Since May, the Financial Supervisory Service has operated a TF to discuss the final disclosure plan for big tech companies' payment fees. The TF included representatives from 12 companies, including the Fintech Industry Association, Korea Internet Corporations Association, Naver Financial, Kakao Pay, and Viva Republica (Toss).

There have been concerns in the market that simple payment fees charged by big tech and other electronic financial service providers are higher than those of card companies, placing a burden on small business owners. While card payment fees are regulated under the Specialized Credit Finance Business Act, simple payment fees are autonomously set through agreements between companies, raising the need for fee disclosure. Accordingly, the Yoon Seok-yeol administration included the establishment of a simple payment fee disclosure system as a national agenda.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.