[Asia Economy Reporter Changhwan Lee] It has been revealed that insurance companies' sales of repurchase agreements (RPs) have surged sharply over the past 2 to 3 months. This is analyzed as an unusual increase in RP sales due to the growing amount of money that must be paid out to customers immediately, caused by the maturity of savings-type insurance and the cancellation of retirement pensions. It is pointed out that some insurance companies with a large proportion of retirement pensions need to pay more attention to liquidity management.

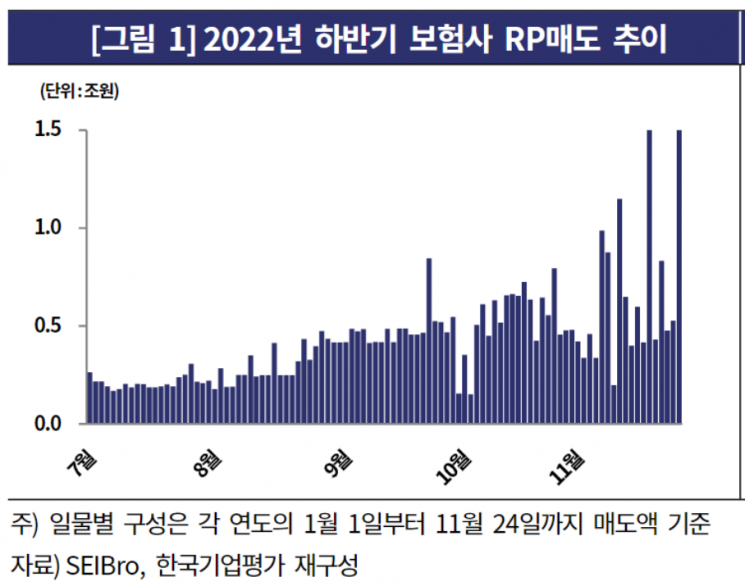

According to Korea Ratings on the 29th, the amount of RP sales by domestic insurance companies reached 9.4 trillion won in September, 10.4 trillion won in October, and 12.7 trillion won as of the 24th of November. From January to August, the average monthly RP sales amount was about 6.8 trillion won, but it has been increasing significantly toward the end of the year. Compared to last year's average monthly sales amount of 5.6 trillion won, it has more than doubled.

RP is a bond sold by financial institutions on the condition that it will be repurchased later with added interest, representing a typical short-term funding method. It is issued using government bonds or corporate bonds held by financial institutions as collateral, and the transaction period is short, ranging from 1 day to about 3 months.

Insurance companies have many highly liquid assets such as government bonds and special bonds that can be immediately traded in the market among their operating assets, enabling liquidity to be secured through bond sales. However, due to ongoing instability in the domestic bond market caused by incidents like Legoland and Heungkuk Life Insurance, and the government's request to financial institutions to refrain from bond sales to prevent the spread of instability, insurance companies are unusually utilizing RP sales backed by bonds they hold as collateral.

RP sales are being led by life insurance companies. This year, the maturity of savings-type insurance policies has concentrated, significantly increasing the insurance payouts to customers. Additionally, cancellations of savings-type insurance and retirement pensions have increased due to weakened interest rate competitiveness, creating an immediate need for funds. Insurance companies that need to strengthen capital in accordance with the new insurance accounting standards (IFRS17) to be introduced next year are also participating in RP sales.

Concerns about funds related to retirement pension maturities, expected to concentrate at the end and beginning of the year, are also growing. Most of the retirement pension reserves held by insurance companies are principal and interest guaranteed types, which can easily be transferred to other financial institutions depending on interest rates. From the perspective of insurance companies, which have weaker interest rate competitiveness compared to banks, fund outflows are inevitable. The industry expects that at least several trillion won of retirement pension reserves could exit the insurance sector by the end of the year.

Accordingly, it is pointed out that insurance companies with a high proportion of retirement pensions need to strengthen liquidity management. Fubon Hyundai Life and IBK Pension Insurance are companies with retirement pension liabilities accounting for more than 30%. These companies are considered to have a high proportion of retirement pension operations relative to their size, making them burdened with responding to sudden outflows of retirement pensions.

Song Mijeong, a senior researcher at Korea Ratings, said, "At the end and beginning of the year, when retirement pensions mature, the demand for funds by insurance companies will increase further," adding, "As the tightening phase of the funding market is expected to continue for the time being, the burden of liquidity management for insurance companies will increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)