[Asia Economy Reporters Eunju Lee and Seungseop Song] The secondary financial sector has settled on transferring a significant portion of delinquent loans from self-employed borrowers to the New Start Fund under the Korea Asset Management Corporation (KAMCO). This appears to be influenced by considerable pressure from authorities to bolster the underperforming New Start Fund. Launched in October, the New Start Fund has so far fallen short of initial expectations.

According to financial industry sources on the 29th, the secondary financial sector has recently begun procedures to sell a substantial portion of non-performing loans that meet the conditions of the New Start Fund under KAMCO. Sources from the secondary financial sector indicated that savings banks and mutual finance institutions are currently in discussions with KAMCO to transfer delinquent loans. Financial officials stated, “Although the exact purchase price table has not yet been finalized, discussions are ongoing,” adding, “However, since participation is based on voluntary agreements determined by each bank (or association), some institutions have chosen not to participate.”

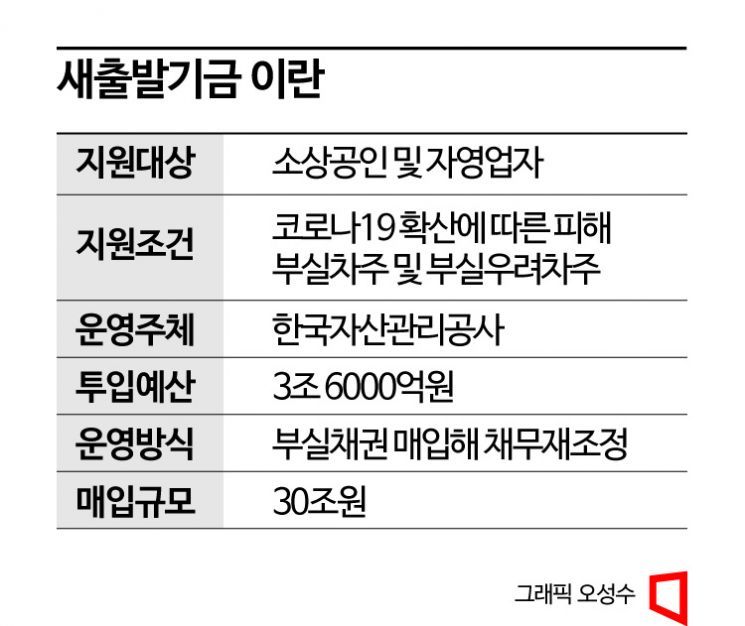

The New Start Fund is a debt adjustment program implemented to alleviate the financial burden of self-employed borrowers who have suffered due to COVID-19-related business restrictions and are struggling to repay loans. These borrowers are defined as those with long-term delinquencies of three months or more on one or more loans. Under the program, banks can choose how to restructure the debts of delinquent borrowers. Banks may sell non-performing loans to the New Start Fund so that KAMCO handles the restructuring, or they may retain the loans and restructure the debts themselves. Borrower consent is not a mandatory condition in this process. Banks can activate the New Start Fund program based on their own judgment even for loans where the borrower has not consented.

From the perspective of the secondary financial sector, having to initiate debt restructuring even for borrowers who do not agree to the New Start Fund program is unwelcome, as it likely means selling loans at a steep discount. A representative from a savings bank explained, “Non-performing loans without the borrower’s voluntary application are likely to be classified as ‘junk bonds’ with very low market value,” adding, “This is because such loans are seen as having little chance of the borrower’s sincere repayment.” For savings banks, it is more beneficial to sell these loans to distressed debt investment institutions like Union Asset Management (UAMCO) or Hana F&I rather than transferring them to KAMCO.

Nevertheless, many institutions in the secondary financial sector have decided to transfer loans to the New Start Fund, seemingly due to significant pressure from authorities. Recently, the New Start Fund has struggled to gain traction contrary to expectations. A representative from a savings bank said, “There was a perception that if we held delinquent loans, we would try to recover and collect them ourselves,” adding, “There was a demand to quickly transfer delinquent loans to KAMCO instead.” A mutual finance sector official also stated, “Although it is disadvantageous for our sector, since this is a government policy initiative, we have no choice but to cooperate even if it is not profitable.”

Officials from financial authorities denied such pressure, calling it “groundless,” and said, “The purchase price is also not an area where the government can intervene; it is determined through business negotiations among KAMCO, accounting firms, and banks within the market domain.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)