[Asia Economy Reporter Myunghwan Lee] Amid the recent surge in stock prices of companies announcing bonus stock issues, advice has emerged that bonus stock events are not an unconditional positive factor. This is because the actual value of a company does not change even if a bonus stock issue is implemented. There is also an analysis that the stock price may appear cheap due to the illusion effect of the ex-rights date in bonus stock issues.

A bonus stock issue means that a company distributes additional shares to shareholders without receiving payment for the shares. Unlike a paid-in capital increase where newly issued shares are purchased by shareholders or third parties for consideration, a bonus stock issue is regarded as a short-term positive factor for the stock price. This is because the trading volume increases as the number of circulating shares rises, and it is perceived as a signal that the company's financial structure is solid.

However, in the domestic stock market, some stocks have surged immediately after announcing bonus stock issues, leading investors to perceive them as a kind of ‘bonus stock theme stocks.’ In fact, during this process, individual investors tend to make large net purchases of stocks announcing bonus stock issues. For example, individual investors showed the strongest buying power by purchasing 452 million KRW worth of shares of Studio Santa Claus, a KOSDAQ-listed company that announced a 1-for-5 bonus stock issue, on the announcement day, the 22nd. This stock closed at the upper price limit on the day of the bonus stock announcement.

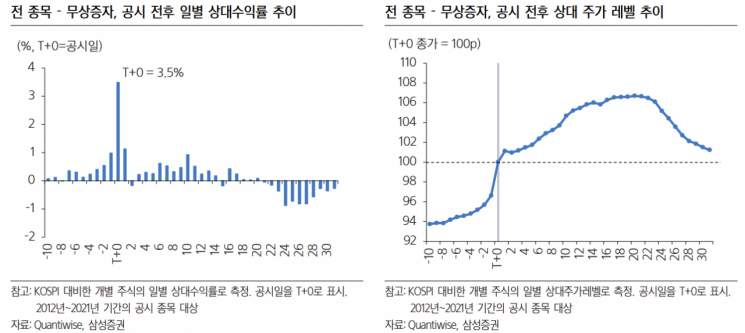

The ‘blind’ net buying of bonus stock issue stocks by individual investors has continued in the past as well. According to an analysis by the Korea Capital Market Institute on the cumulative net purchase ratio of investors for bonus stock issue stocks since 2015, individual investors have shown a consistent tendency to net buy immediately after the bonus stock announcement. Especially, buying pressure was stronger on the announcement day and the ex-rights date. Senior Research Fellow Kilnam Nam of the Korea Capital Market Institute explained, "Institutional investors showed the opposite trading behavior to individual investors by continuously net selling," adding, "The difference in trading behavior by investor type has consistently appeared regardless of the period, but the directionality has strengthened since 2020."

The strong buying tendency of individuals in bonus stock issue stocks is also due to the illusion effect of the ex-rights date. Since the overall corporate value of the company does not change with a bonus stock issue, the value per share decreases proportionally to the increased number of shares. Therefore, an ex-rights date is designated to reflect the decrease in per-share value on that date, creating an illusion that the stock price drops on the ex-rights date. In fact, PicoGram, which announced a 1-for-5 bonus stock issue, immediately hit the upper price limit on the ex-rights date on the 21st and recorded the upper price limit for three consecutive trading days thereafter. PicoGram was also the largest net purchase target by individual investors alone, who bought 1.639 billion KRW worth of shares in two days after the bonus stock announcement.

Researcher Dongyoung Kim of Samsung Securities diagnosed, "Many individual investors may not understand the concept of adjusted stock price or that the stock price decline due to the increase in the number of shares on the ex-rights date is inevitable," adding, "There can be an illusion where the temporarily low stock price caused by the ex-rights date is seen as a temporary drop and triggers buying."

The securities industry advised caution in investment as the actual value of a company does not increase due to a bonus stock issue. Researcher Kim said, "To easily explain a bonus stock issue, it is like initially issuing three meal tickets to share the entire rice in one rice cooker, then issuing six tickets later," adding, "Recently, money games causing sharp stock price fluctuations using bonus stock issues have increased in the stock market, so investors should be careful not to participate in such speculative trading and suffer losses."

Since bonus stock issues are sometimes abused to attract individual investors, there are also suggestions for institutional improvements. Senior Research Fellow Nam said, "The recent overheating of bonus stock issues can be said to be closer to abuse aimed at attracting individual investors rather than rational management decisions," adding, "Currently, listed companies disclose only the basic requirements of bonus stock issues through major event reports, but it is necessary to add the purpose of the bonus stock issue to the major event report."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)