Retained Earnings, R&D, and Employment All Moving Overseas

After Introducing 'Source-Based Taxation' on Domestic Income Only

Overseas Retained Earnings Repatriation Rate... Japan 95.4%, US 77% Increase

[Asia Economy Reporter Moon Chaeseok]

#If the UK headquarters sends all 500 billion KRW earned by its Irish subsidiary back to the home country, it can pay 62.5 billion KRW in taxes to Ireland and keep 437.5 billion KRW in after-tax profits. However, the Korean headquarters must pay 62.5 billion KRW in Korean taxes as well, resulting in only 375 billion KRW being brought back. This is due to the long-standing 'residence-based' taxation system, which requires paying taxes in the Korean mainland equivalent to the amount earned in Ireland.

Due to the residence-based system, it has been found that domestic companies have approximately 120 trillion KRW in retained earnings hidden overseas. There are calls to promptly change the current 'residence-based' taxation system, which taxes multinational corporations' foreign-sourced income, to a 'source-based' system that only taxes domestic income, in order to encourage the repatriation of funds, research and development (R&D), and employment back into Korea.

On the 29th, the Korea Economic Research Institute under the Federation of Korean Industries argued this in a report titled "Six Reasons to Switch to Source-Based Taxation." The report emphasized the need to accelerate the implementation of the source-based taxation on dividend income of multinational corporations included in this year's tax law amendment announced by the government.

Under the 'residence-based' system, which is currently adopted only by six OECD member countries including Korea, taxes must be paid not only on foreign-sourced income but also on domestic income, with only partial foreign tax credits allowed. Conversely, most OECD countries such as the United States and Japan adopt the source-based system, which exempts business and dividend income earned abroad from taxation. This means that income earned outside the country is effectively not taxed.

As of now, the countries still applying the residence-based system among OECD members are only six: Korea, Ireland, Mexico, Chile, Colombia, and Israel. Twenty countries, including the United States and Japan, have adopted the source-based system.

The tax amendment allows domestic parent companies holding at least 10% (5% for overseas subsidiaries in overseas resource development projects) of the shares of foreign subsidiaries for more than six months as of the dividend record date to exclude 95% of dividends paid by the foreign subsidiaries from taxable income. This exclusion means that although the dividends clearly increase the corporation's net assets in accounting terms, they are not included in taxable income under the Corporate Tax Act.

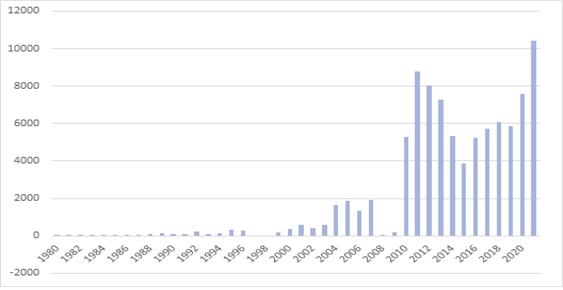

Trends of retained earnings abroad in the balance of international payments. (Source: Korea Economic Research Institute)

Trends of retained earnings abroad in the balance of international payments. (Source: Korea Economic Research Institute)

According to the Korea Economic Research Institute, Korean multinational corporations' overseas retained earnings reached 90.2 billion USD (approximately 121 trillion KRW) as of last year. The retained earnings of foreign subsidiaries increased by 10.43 billion USD (about 14 trillion KRW) in just one year. The residence-based system not only forces companies to spend additional costs on tax-saving strategies but also traps funds overseas to be invested only abroad, causing distorted investment decisions and inefficient management, which is a problematic vicious cycle.

Researcher Lim Dongwon of the Korea Economic Research Institute said, "The main reason for the increase in overseas retained earnings is the residence-based system, which requires taxation again in the home country when income earned abroad is remitted back. Residence-based taxation creates a 'lock-in effect' that prevents repatriation of foreign-sourced income, but switching to a source-based taxation system would promote the repatriation of overseas retained earnings."

Japan and the United States have seen significant benefits from switching from residence-based to source-based taxation. According to the Korea Economic Research Institute, Japan's repatriation rate of overseas retained earnings rose to 95.4% in the year following the introduction of source-based taxation in 2009. The United States also repatriated about 77% of its overseas retained earnings after adopting the source-based system.

Switching to source-based taxation is expected to positively impact not only Korean companies' overseas retained earnings but also attract foreign companies' investments into Korea. Since most multinational corporations have their headquarters acting as holding companies and establish subsidiaries worldwide, they are sensitive to additional taxation depending on each country's tax system. In the current environment of global supply chain restructuring and rapid de-Chinaization, source-based taxation could serve as a solution for attracting investment.

According to the Korea Economic Research Institute, Korean companies' outward direct investment (ODI) amounts to 60.82 billion USD (about 81.5 trillion KRW), while foreign direct investment (FDI) into Korea is only 16.82 billion USD (about 22.5 trillion KRW). The scale of ODI is 3.6 times that of FDI. Researcher Lim said, "Even if only half of the 90.2 billion USD in overseas retained earnings is repatriated, the effect would be substantial."

Insisting on the residence-based system is also out of step with international trends. Since 2011, only six countries including Korea have raised their corporate tax top rates. During this period, Korea increased its rate from 22% to 25%, a 3 percentage point rise. As a result, Korea's international tax competitiveness ranking among 37 OECD countries dropped nine places from 17th in 2017 to 26th this year. Researcher Lim emphasized, "To enhance the tax competitiveness of domestic investment companies, the taxation system should be changed to source-based taxation that exempts foreign income from taxation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.