Xiaomi Takes 1st Place in Indian Market in Q3

Samsung Electronics, Once Dropped to 3rd, Begins Push to Regain Top Spot

[Asia Economy Reporter Lim Hye-seon] Samsung Electronics is launching a chase against China's Xiaomi in the "largest battleground for smartphones," the Indian market. The gap in market share is rapidly narrowing, showing a back-and-forth battle for the top spot. Samsung aims to reclaim the number one position by securing the lead in the newly launched 5th generation (5G) mobile communication services this year and strengthening its online market presence.

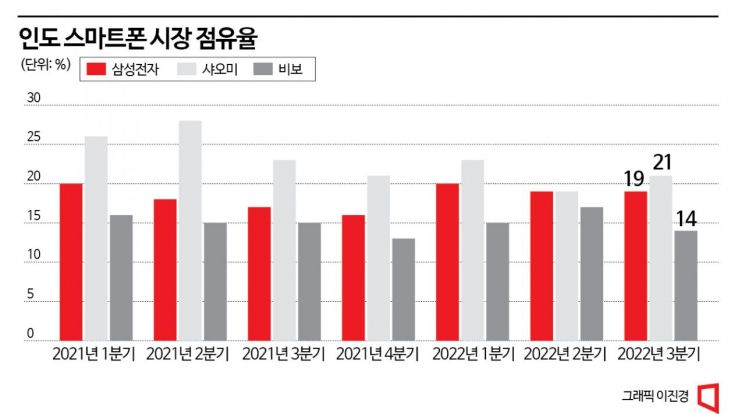

According to market research firm Counterpoint Research on the 29th, Xiaomi recorded a 21% market share in the Indian market in the third quarter, securing first place. Samsung Electronics ranked second with a 19% market share. In the second quarter, Samsung and Xiaomi each held a 19% market share, sharing the top spot for the first time since the third quarter of 2020. Samsung led the Indian market until 2017 but was pushed down to third place due to the offensive of Chinese smartphone companies such as Xiaomi, Vivo, and Realme, which emphasized price competitiveness.

The dispute between India and China has become an opportunity for Samsung. After the border conflict in 2020 near the northern Kashmir region, where 20 soldiers died in clashes with the Chinese army, India has continued to pressure the Chinese information technology (IT) industry. Last year, 168 million smartphones were sold in India, making it the second-largest market globally after China. The smartphone penetration rate in India is around 60%, indicating high growth potential. Especially with the recent launch of 5G mobile communication services, demand for smartphone replacements is also increasing.

Samsung has shown strength in the 5G market, becoming the best-selling 5G smartphone brand in India. Counterpoint Research explained, "Since the launch of 5G services, the number of consumers wanting to purchase 5G smartphones has increased," adding, "In the third quarter, 5G smartphones recorded a 31% growth compared to the previous year and accounted for 32% of total shipments."

According to foreign media, Samsung Electronics sold about $1.7 billion (approximately 2.4055 trillion KRW) worth of smartphones during the Diwali festival period. Sales of various models, including the Galaxy S22 and the foldable series, reportedly increased. The Diwali festival season is considered a representative demand indicator in India. During Diwali, 35% of consumer goods sales in India occur, making it a crucial period that determines annual performance.

Samsung is also performing well in the online market. A characteristic of the Indian smartphone market is that the sales proportion through online channels has been the highest. Samsung recorded its highest annual online market share at 17.2%. In the third quarter, Samsung strengthened indirect sales through major online sales channels Flipkart and Amazon. According to Counterpoint Research's India smartphone tracker, the sales proportion of online channels rose to about 50% compared to offline channels from the first to the third quarter of this year.

Park Jin-seok, an analyst at Counterpoint Research, said, "India, where online smartphone sales have been more active than other regions, has seen this trend strengthen through the COVID-19 pandemic, and this trend is expected to continue to some extent in the future," adding, "In an era of high inflation, dependence on relatively lower-priced online channels is expected to increase."

Samsung Electronics' smartphone sales in India from January to September increased by 178% compared to the same period last year. Sales of premium models priced over 500,000 KRW also increased by more than 99%. A telecommunications industry official said, "Samsung is targeting consumers with aggressive marketing," adding, "If Samsung continues its growth trend until the end of the year, it is highly likely to reclaim the number one spot in the Indian market this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.