Domestic Bread Retail Sales Reach 303.2 Billion KRW in First Half of Year, Up 14.1% YoY

Increased Bread Consumption as Meal Replacement Since COVID-19

Expansion of Kitchen Appliance Adoption... Growing Demand for Convenient Frozen Bread

[Asia Economy Reporter Eunmo Koo] Since the spread of COVID-19, the number of consumers turning to bread as a meal substitute at home has increased, accelerating the growth of the bread market. In particular, with the expansion of kitchen appliances such as air fryers and the release of products that enhance cooking and storage convenience, demand for frozen bread is also rising.

According to the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 28th, last year, the domestic bread market reached 3.91 trillion KRW, showing an average annual growth rate of about 1.1% over the past five years. The industry expects the domestic bread market to grow to around 4.5 trillion KRW by 2026.

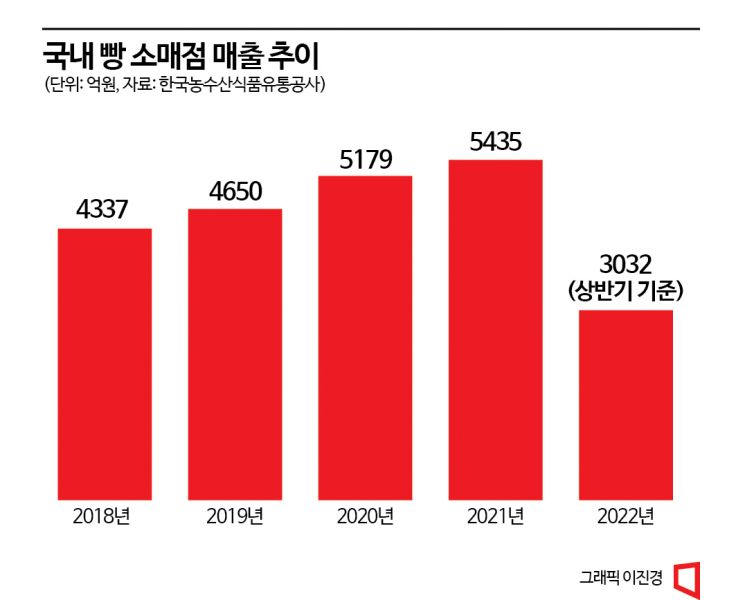

Sales at bread retail stores are also on the rise. According to market research firm Nielsen Korea, last year, domestic bread retail sales amounted to 543.5 billion KRW, marking a 4.9% increase compared to the same period the previous year. The domestic bread market has steadily grown over recent years, with sales reaching 433.7 billion KRW in 2018, surpassing 500 billion KRW to 517.9 billion KRW in 2020, and continuing its growth trend with 303.2 billion KRW in the first half of this year, a 14.1% increase compared to the same period last year.

By manufacturer, Samlip recorded an overwhelming market share of 73.1% with sales of 221.6 billion KRW in the first half of this year, a 25.4% increase compared to the same period last year, followed by Lotte (7.9%) and Shinsegae Food (3.0%). By market segment, general bread (113.9 billion KRW) and cakes (98.9 billion KRW) divided the market with shares of 37.6% and 32.6%, respectively, followed by hotteok (8.9%), hobang (8.4%), and pastries (4.9%).

The growth trend of the bread market is also strong in overseas markets. Last year, the global bread market size was 41.6 billion USD (approximately 55.66 trillion KRW), growing 4.5% compared to the previous year, and is expected to grow to 59.1 billion USD (approximately 79 trillion KRW) by 2028.

As more consumers enjoy bread at home, the industry is making efforts to supply fresh bread. Recently released products adopt a strategy to maintain the freshness of the product itself by using new packaging materials rather than methods that increase freshness through preservatives or additional processing. Additionally, preference for frozen bread products that can be stored and eaten is also increasing. With the higher penetration of kitchen appliances such as ovens and air fryers in households, the popularity of frozen bread, which was previously low, is steadily rising.

In particular, bread products released recently in the form of frozen raw dough, such as croissants and tarts that were previously sold only at specialty bakeries, are gaining attention. Frozen raw dough is a product made by shaping fermented flour dough into bread shapes and then rapidly freezing it. Frozen raw dough products are highly preferred because they allow consumers to simply thaw at room temperature and bake in an air fryer or oven without the cumbersome processes of kneading, fermenting, or shaping, resulting in freshly baked bread.

Shinsegae Food reported that sales of frozen raw dough increased by 29% in the third quarter compared to the second quarter this year. A Shinsegae Food representative said, "Due to recent increases in raw material and labor costs, consumers feeling the burden of bread prices are steadily showing interest in home bakery products. We are actively expanding sales channels and introducing various home bakery products to capture consumers who want to enjoy bakery-level bread conveniently and at reasonable prices at home." Homeplus also began importing and selling two types of frozen croissant raw dough from the UK’s representative bakery brand ‘Pret a Manger’ earlier this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.