[Asia Economy Reporter Lee Seon-ae] Even among the top 100 companies by market capitalization on the Korea Stock Exchange, the number of 'zombie companies' is increasing. Even large companies are transforming into potential marginal companies that cannot even cover their interest expenses with profits earned from operating activities.

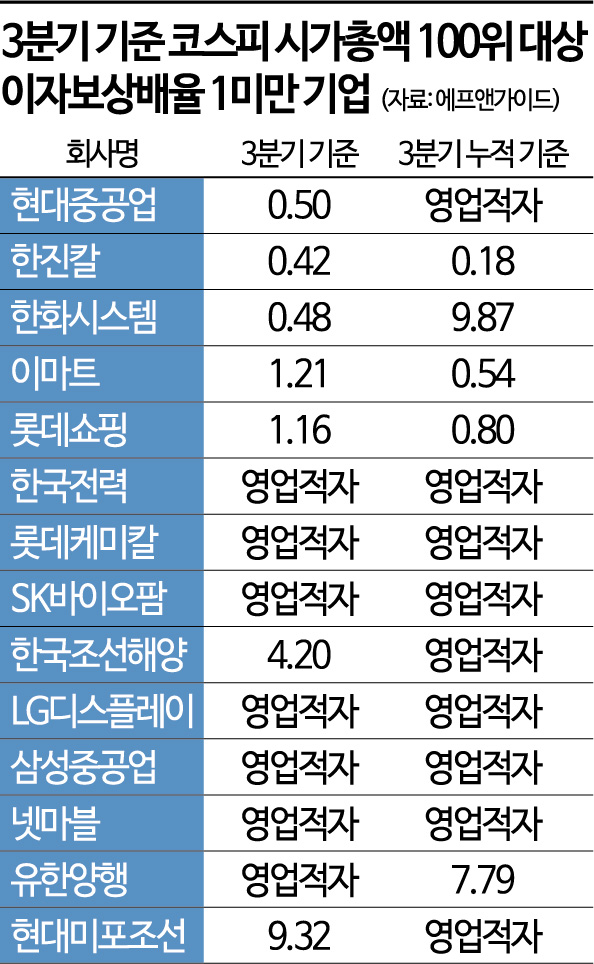

On the 28th, Asia Economy, commissioned by financial information firm FnGuide, analyzed the interest coverage ratio of the top 100 KOSPI companies by market capitalization as of the third quarter. The analysis found that 10 companies had an interest coverage ratio below 1 (including those with operating losses). On a cumulative basis for the third quarter, the number reached 12 companies.

The interest coverage ratio is an indicator showing how much a company's earnings (operating profit) cover the interest expenses it must pay in a given year. In other words, it is operating profit divided by interest expenses. An interest coverage ratio below 1 means the company cannot even pay its interest expenses with the money earned in that year. Generally, an interest coverage ratio of 1.5 or higher indicates sufficient ability to repay debt, while below 1 classifies the company as potentially insolvent. Moreover, if the ratio remains below 1 for three consecutive years, the company is considered marginal.

This year, the number of zombie companies is again on the rise. In the first quarter of 2019, companies with an interest coverage ratio of 1 or less accounted for 38% of all listed companies. The proportion expanded significantly to 42% during the COVID-19 crisis as companies struggled with interest burdens, but it decreased to 35% in the first quarter of last year. Based on last year's financial statements, it was 32%. However, due to prolonged inflation increasing corporate costs and rising interest rates increasing interest burdens, the situation worsened again this year. As of the first quarter, it reached 36%. In the second quarter, 479 companies had an interest coverage ratio below 1. Among them, 74 companies had a ratio between 0 and 1, and 405 companies were operating at a loss. These 479 companies represent 33% of the total 1,453 companies for which the interest coverage ratio is calculated. Although the third quarter's interest coverage ratio for all listed companies has not yet been compiled, experts expect it to have increased compared to the previous quarter and the same period last year, as it inevitably rises with the base interest rate hikes.

Lee Sang-ho, a research fellow at the Korea Capital Market Institute, pointed out, "With market interest rates rising sharply in the second half of the year, companies' debt repayment ability is likely to decline further until next year." The Korea Economic Research Institute under the Federation of Korean Industries forecasted, "Due to the impact of base rate hikes, the proportion of marginal companies unable to pay even interest despite earning operating income will increase by 0.33 percentage points this year." This corresponds to about 22 companies in number.

As of the third quarter, companies unable to pay interest included Hyundai Heavy Industries (0.50), Hanjin KAL (0.42), Hanwha Systems (0.48), Korea Electric Power Corporation (KEPCO), Lotte Chemical, SK Biopharm, LG Display, Samsung Heavy Industries, Netmarble, and Yuhan Corporation (operating losses). On a cumulative basis for the third quarter, the list included Hanjin KAL (0.18), Emart (0.54), Lotte Shopping (0.80), KEPCO, Hyundai Heavy Industries, Lotte Chemical, SK Biopharm, Korea Shipbuilding & Offshore Engineering, LG Display, Samsung Heavy Industries, Netmarble, and Hyundai Mipo Dockyard (operating losses). Notably, Lotte Shopping and Hanjin KAL have had interest coverage ratios below 1 for three consecutive years as of the second quarter this year among companies with market capitalizations exceeding 1 trillion won. The interest coverage ratios in the second quarter were 0.62 for Lotte Shopping and 0.07 for Hanjin KAL.

The liquidity crisis triggered by the 'Legoland incident' at Lotte Construction is showing signs of spreading to the entire group, raising market concerns about Lotte Chemical and Lotte Shopping. Lotte Chemical announced plans to conduct a paid-in capital increase of 8.5 million shares early next year to secure about 1.1 trillion won in funds. Although the group claims there is sufficient cash and no major problems, the market views this with concern given the global economic crisis. Lotte Shopping has been unable to cover interest expenses with operating profits since 2018. Although it has gradually recovered after the direct hit from COVID-19 and showed improvement in the third quarter, it still struggles to cover interest on a cumulative basis.

Hanjin KAL, the holding company of the Hanjin Group, has also been unable to cover interest expenses since 2020, and its interest coverage ratio worsened in the third quarter compared to the previous quarter. While expectations for the end of COVID-19 and recovery in travel demand are rising, attention is focused on whether future performance improvements can offset the impact of interest rate hikes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.