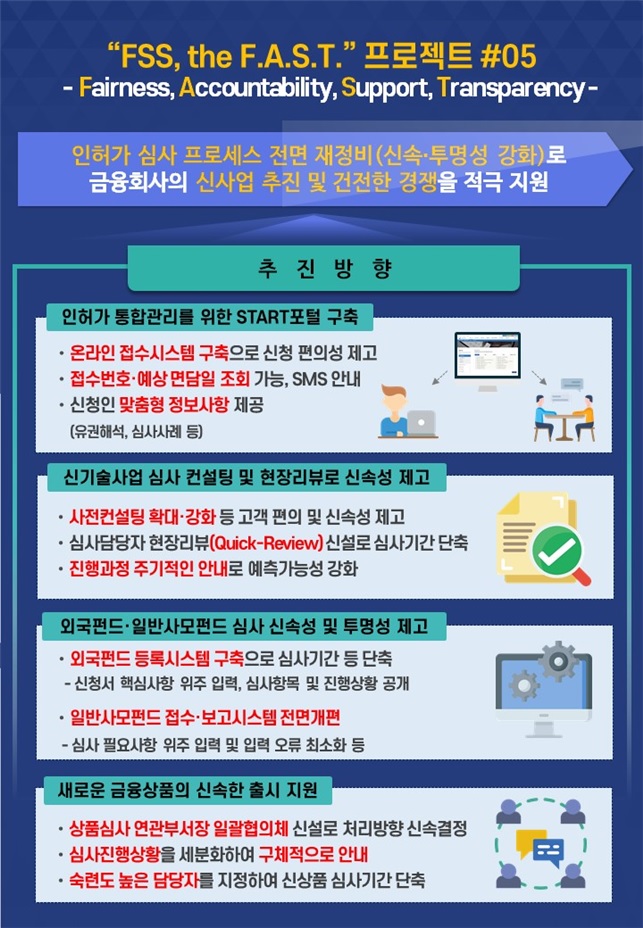

[Asia Economy Reporter Song Hwajeong] The Financial Supervisory Service (FSS) is completely overhauling its licensing review process to enhance speed and transparency. Through this, it plans to actively support financial companies in pursuing new business ventures and fostering healthy competition.

On the 27th, the FSS announced the 'FSS, the F.A.S.T. Project #05' containing these details.

First, to ensure a swift and transparent licensing review process, the FSS will establish the 'START Portal' system, which allows for online pre-consultation applications and management. Applicants can conveniently apply for pre-consultations through this portal system and receive notifications about the person in charge and progress status (waiting order, meeting schedule) via text messages (SMS), etc.

Regarding licensing, the FSS will also revise manuals tailored to applicants' needs, such as creating FAQs focused on frequently received inquiries and answers.

The FSS plans to build the portal system by the first half of next year and revise the licensing manuals by the first quarter of next year.

When applicants request to engage in new technology business finance, the FSS will promptly conduct pre-meetings. It will provide detailed guidance on required registration documents, registration requirements under relevant laws, and precautions during registration, along with thorough consulting.

A Quick-Review system will be newly introduced at the registration review stage. Review officers will conduct on-site reviews of documents upon receipt, and if registration preparation is complete, they will proceed with acceptance and registration.

The FSS will shorten review periods by improving the registration and reporting systems for foreign funds and general private equity funds. For foreign funds, it will develop a 'Foreign Fund Registration and Management System' (tentative name) to computerize the entire foreign fund registration review process, including application, review, and result notification. Review items and progress will be transparently disclosed to enhance predictability of review outcomes, while the computerized system will focus on key review items to enable swift reviews and minimize delays caused by frequent supplementary document requests. For general private equity funds, the reporting and reception system will also be completely revamped to enable faster review processing.

The FSS plans to build and revamp the computerized systems by the first half of next year and apply the changed systems in the second half of next year after pilot testing.

The FSS will shorten the pre-consultation period for financial products and enhance review transparency. It will support rapid resolution of difficulties in consultation applications and establish a 'Product Review Related Department Heads Joint Consultation Body' for matters involving multiple departments such as legal reviews, deciding on the review departments and processing directions within five business days from the date of receipt.

To enable financial companies to accurately grasp the progress of reviews during product reporting, the FSS will improve the terms and conditions review system by subdividing and specifically guiding the review progress. For new types of financial products, experienced officers will be assigned to enable prompt reviews. This measure will be implemented in the first quarter of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.