KCCI Points Out in Report: "Must Lower to OECD Average Level"

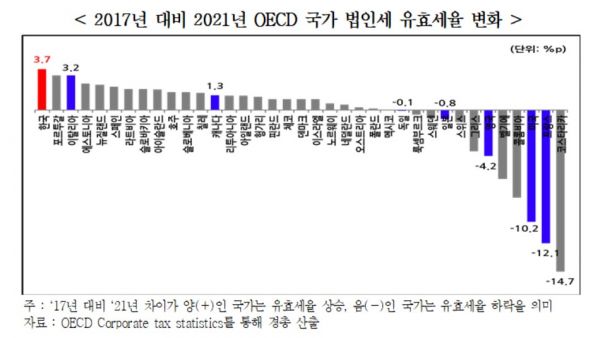

[Asia Economy Reporter Kiho Sung] South Korea's effective corporate tax rate showed the largest increase among OECD countries (compared to 2017), resulting in a significant rise in ranking from 18th to 9th among OECD countries during the same period.

The Korea Employers Federation announced this on the 27th through a report titled "International Comparison and Implications of Effective Corporate Tax Rates," which analyzed OECD data.

The effective corporate tax rate refers to the expected level of corporate tax burden that companies in a given country would face, considering the nominal top tax rate (including local taxes), various deduction systems, and macro indicators such as inflation and interest rates. While similar in concept to the effective tax rate, which reflects the actual tax burden, the effective rate is a prospective estimate based on the top nominal rate.

South Korea's nominal top corporate tax rate is 27.5% (including local taxes), ranking 10th highest among 38 OECD countries (as of 2022). In 2000, it was ranked 22nd, indicating tax competitiveness, but since then, the pace of reduction has lagged behind major countries, gradually moving up the ranks. In 2018, it was even increased, making it significantly higher than the OECD average by 4.4 percentage points.

In particular, when comparing changes in effective corporate tax rates among OECD countries from 2017 to last year, South Korea showed the largest increase. Due to this change, South Korea's effective corporate tax rate (25.5%) last year ranked 9th among 37 OECD countries and was 3.5 percentage points higher than the OECD average (22.0%).

Additionally, as of last year, South Korea's effective tax rate was analyzed to significantly exceed both the OECD average and the G7 average. This contrasts with 2017, when South Korea's effective corporate tax rate was lower than both averages.

This is mainly attributed to many OECD countries lowering or maintaining their nominal top corporate tax rates since 2017, while South Korea increased its top corporate tax rate (including local taxes) from 24.2% to 27.5% in 2018.

In this year's IMD World Competitiveness Ranking, South Korea's tax policy ranking fell sharply to 26th out of 63 countries, down from 15th in 2017. Notably, the ranking for 'top corporate tax rate' was 39th, and for 'corporate tax burden relative to GDP' was 47th, placing South Korea in the lower-middle tier and acting as a factor lowering tax competitiveness.

Ha Sang-woo, head of the Economic Research Department at the Korea Employers Federation, pointed out, "A corporate tax rate significantly higher than the OECD average acts as a factor that lowers our national competitiveness, potentially leading to reduced investment and employment capacity of our companies and intensified capital outflow abroad."

He added, "Lowering the top corporate tax rate to the OECD average level can contribute not only to revitalizing investment by our companies facing difficult conditions but also to enhancing shareholder value and creating jobs," emphasizing, "We hope the tax reform bill submitted by the government this year will be promptly passed in the current National Assembly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.