[Asia Economy Reporter Ji Yeon-jin] Foreign investors have switched to net buying in the domestic stock market after a week. There is an expectation that the easing of the high exchange rate due to hopes for a slowdown in the US tightening pace will have a positive impact on foreign demand.

According to the Korea Exchange on the 27th, foreign investors net purchased domestic stocks worth 468.3 billion won from the 21st to the 25th. They net bought 379.5 billion won in the KOSPI market and 88.8 billion won in KOSDAQ.

Foreign investors had recorded six consecutive weeks of net buying since switching to buying in October, but showed a selling preference in the second week of November, before switching back to buying after a week.

The stock most purchased by foreigners last week was Korea Zinc (226.8 billion won). This was followed by LG Energy Solution (125.5 billion won), Samsung SDI (101.1 billion won), Hanwha Solutions (64.7 billion won), and KakaoBank (63.1 billion won) in order of net buying.

On the other hand, SK Hynix was the most sold stock with net sales of 72.8 billion won. LG Chem (-64.3 billion won), Kia (-44.4 billion won), L&F (-36.5 billion won), and POSCO Holdings (-35.4 billion won) were also heavily net sold.

The expectation that the Federal Reserve (Fed) will slow the pace of interest rate hikes due to concerns about an economic downturn, as revealed in the November Federal Open Market Committee (FOMC) Beige Book (minutes), appears to have fueled foreign investors' buying momentum.

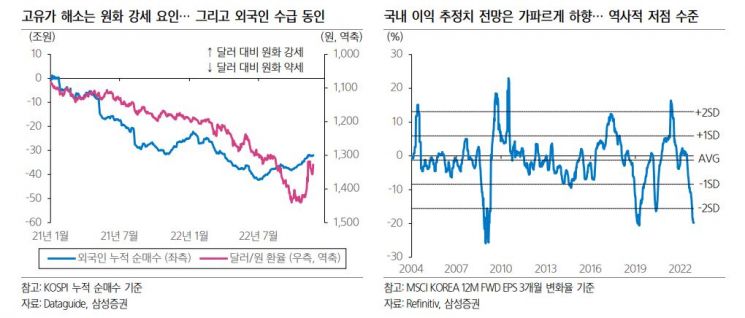

The slowdown in the pace of rate hikes and the recent decline in oil prices can also help ease the domestic trade deficit. This leads to a drop in the won-dollar exchange rate, which can increase the attractiveness of the domestic market from the perspective of foreign investors.

Seojeong Hoon, a researcher at Samsung Securities, said, "Foreign investors have purchased 6 trillion won in the KOSPI since October, but compared to the cumulative net selling amount of 38 trillion won since 2021, it is still insignificant," adding, "Since the domestic stock market was particularly vulnerable to high inflation, high interest rates, and high oil prices, this reversal signal will provide sufficient buying incentives for foreigners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)