Will the Santa Rally Come in December?

Need to Watch November Economic Indicators

December FOMC as a Gauge for Policy Shift

Timing of December Decline in Margin Balances

[Asia Economy Reporter Junho Hwang] Will Santa bring gifts to the Korean stock market?

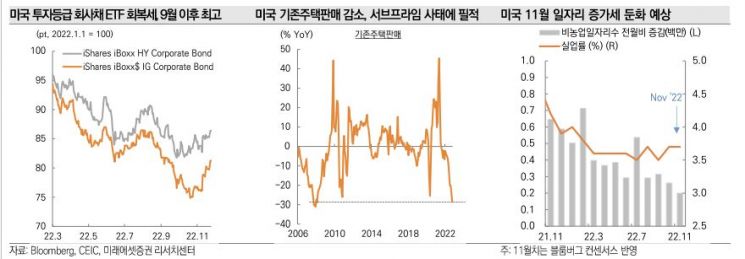

Expectations for a Santa rally, where stock prices show strength around the year-end and New Year period surrounding Christmas (December 25), have increased. Last month, news emerged that the intensity of U.S. monetary tightening might ease, and signals suggesting a recession due to high-intensity tightening are also being detected one after another. With this shift in sentiment, U.S. real interest rates are rising and the dollar's value is falling, prompting stock markets in Korea and other countries to attempt a rebound; however, it is still considered too early to predict a Santa rally.

Direction of November Economic Indicators

Hee-chan Park, a researcher at Mirae Asset Securities, advised on the 27th, "To see if the recent stock price rebound will lead to a Santa rally, we need to pay close attention to various indicators to be released next week."

Between the 28th of this month and the 2nd of next month, November U.S. employment data and November Consumer Price Index (CPI) will be released. Researcher Park said, "The market expects the pace of job growth to slow down and, given the risk of recession, it may be difficult to continue high-intensity tightening. However, considering recently released U.S. retail sales and durable goods orders exceeded expectations, caution is necessary."

Bullard's Voice

Besides the indicators, attention should also be paid to the remarks of Federal Reserve (Fed) officials who determine the direction of U.S. monetary policy. In particular, the statements of James Bullard, President of the Federal Reserve Bank and a leading hawk who has been advocating 'Giant Steps' throughout the year, are anticipated. Jerome Powell, Fed Chair, is also scheduled to give a speech.

Their remarks are expected to serve as a guide to gauge how much the Fed officials will tighten monetary policy at the FOMC meeting scheduled for the 14th of next month.

Jaeman Lee, a researcher at Hana Securities, analyzed, "It is most likely that the FOMC will proceed with a Big Step (a 50 basis point rate hike), but core inflation (5.2%) remains too high and the unemployment rate (3.7%) is too low. According to the Taylor rule, the appropriate U.S. interest rate is calculated at 9.4%, so concerns about a 75 basis point hike still persist."

Accordingly, he predicted, "Although the recent KOSPI PER peak reached 11.6 times (2483), the highest point of the year, debates over the magnitude of rate hikes and the final interest rate will continue until before next month's FOMC, causing increased volatility in the index."

The Season of Decreasing Loan Balances

This year, as the stock market plunged due to high-intensity tightening, cautious views on a sentiment turnaround have naturally emerged. However, the Santa rally is not necessarily far away.

It is important to note that December is seasonally a month when loan balances decrease. Just before the year-end dividend record date, there is a cycle of temporarily repaying borrowed stocks and then borrowing them again at the beginning of the year, known as the 'year-end decrease and early-year increase of loan balances.' This process ensures that dividend or voting rights belong to the original owners of the borrowed stocks by temporarily repaying the borrowed stocks before the record date.

Gyun Jeon, a researcher at Samsung Securities, analyzed, "From 2019 to 2021, the loan balances of KOSPI 200 constituent companies showed a more pronounced decrease in December compared to November," adding, "the decrease in loan balances in December compared to November was 3.2 times and 1.6 times in 2019 and 2020, respectively."

He further explained, "While large-cap stocks ranked 100th or higher in market capitalization experienced a sharp decrease in loan balances, mid-cap stocks ranked below 100 did not show a clear decrease or even increased compared to November. The year-end decrease in loan balances can actually occur through short covering, and short covering has been detected as a factor contributing to price increases in those stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.