Narrowing Procurement Channels Threaten Funding Intermediation Ability

Support with Potential Impact on Net Interest Margin Soundness May Increase

[Asia Economy Reporter Minwoo Lee] It is expected that banks will face increased burdens due to financial authorities' requests to restrain deposit interest rate competition and the launch of a 'refinancing loan platform' that allows borrowers to switch loans. Analysts suggest that if issuing bank bonds becomes difficult amid record-high outflows of low-cost deposits, banks' ability to intermediate funds could be significantly threatened.

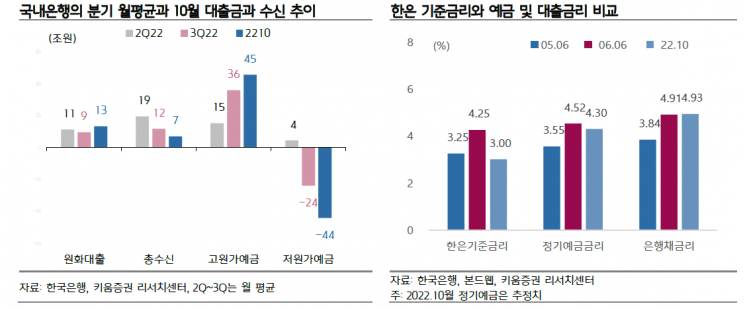

According to the industry on the 26th, the Financial Services Commission requested through a meeting with heads of fund management departments at commercial banks on the 24th to minimize interest rate competition among financial companies, including raising deposit interest rates. Despite the Bank of Korea raising the base rate by 0.25 percentage points that day, commercial banks did not increase interest rates on deposit and savings products. This contrasts with previous instances when the Bank of Korea implemented 'big steps' (raising the base rate by 0.5 percentage points at once), and banks immediately raised deposit rates.

Prior to this, authorities also requested restraint in issuing bank bonds. This was due to concerns that bank bonds, along with Korea Electric Power Corporation bonds, were absorbing funds in the bond market and causing market tightening. Financial authorities appear to be actively intervening in the market to maintain financial stability. Corporate bond spreads, including card bonds, have been rising daily, and liquidity risks at major financial institutions such as savings banks, mutual finance, and Saemaeul Geumgo have not significantly improved, prompting proactive measures.

Low-cost deposits, which have been a major funding source, are experiencing record-scale outflows. According to the Bank of Korea, low-cost deposits at deposit banks decreased by 44.2 trillion KRW compared to the previous month. Meanwhile, time deposits increased by 56.2 trillion KRW during the same period, marking the largest scale since related totals were first compiled in 2002.

The upcoming refinancing loan platform is also expected to put pressure on banks. As competition among financial companies for loan interest rates becomes inevitable, it will be difficult to avoid lowering loan rates. Banks are facing a 'triple hardship' situation where low-cost deposits are leaving at record levels, issuance of bank bonds is restrained, and loan interest rates cannot be easily raised.

Youngsoo Seo, a researcher at Kiwoom Securities, said, "Despite the already record-level outflow of low-cost deposits likely to worsen further, the government has requested restraint in issuing bank bonds to reduce the burden on the bond market. If securing sufficient deposits becomes difficult due to government regulations, banks' ability to intermediate funds will inevitably be significantly threatened," adding, "As government policy responses intensify, banks will increasingly have to provide direct support that can affect net interest margins and soundness, beyond indirect impacts such as liquidity support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.