[Asia Economy Reporter Minji Lee] [Asia Economy Reporter Minji Lee] The stock price of JD.com, which had been rising on expectations of a slowdown in interest rate hikes and strong earnings, is now declining as the spread of COVID-19 in China intensifies. Experts advise cautious buying as demand is expected to remain sluggish due to the continued zero-COVID policy.

On the 25th (local time), JD.com ADR (JD.com) on the US Nasdaq market fell 5.32% to $49.48. Over the past month, the stock had risen more than 30% supported by expectations of a slowdown in US interest rate hikes and strong third-quarter earnings, but ended the session lower due to concerns over the spread of COVID-19 in China.

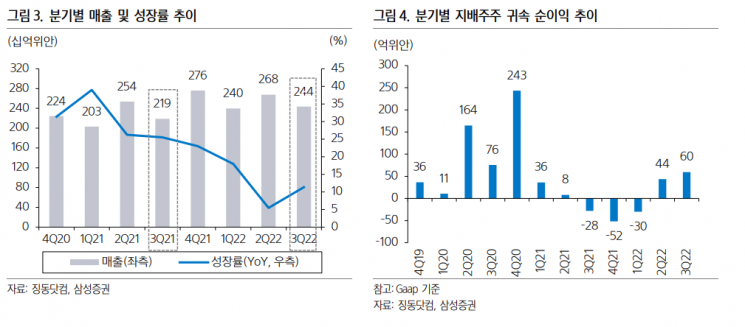

JD.com's third-quarter revenue was 243.5 billion yuan, up 11.4% year-on-year. Net profit attributable to controlling shareholders was 6 billion yuan, an increase of 800 million yuan compared to the same period last year. Non-GAAP net profit reached 10 billion yuan, exceeding market expectations by 41%. Profitability across all business segments and improvements in logistics cost ratio were key factors. The logistics cost ratio fell by 0.6 percentage points year-on-year, and the company's Non-GAAP net profit margin improved by 1.8 percentage points from a year ago to a record high of 4.1%. The core business segment, JD Retail, posted an operating margin exceeding 5% for the first time, while JD Logistics and new business segments turned profitable.

By platform, e-commerce direct sales revenue was sluggish. Related revenue was 197 billion yuan, growing only 6% year-on-year, and did not significantly improve from the previous quarter, which was the worst period due to the Shanghai lockdown. Baek Seung-hye, a researcher at Hana Securities, analyzed, "The demand for consumer discretionary goods such as cosmetics and alcoholic beverages was most noticeably weakened due to sluggish domestic consumption."

Service revenue, which includes third-party commission fees, advertising, and logistics business revenue, has largely recovered to pre-COVID-19 resurgence levels. Accordingly, the service revenue ratio increased to 19% of total revenue. Service revenue grew 42% year-on-year to 46.5 billion yuan, with third-party sales commissions and advertising revenue reaching 19 billion yuan, up 13%, showing a slight rebound compared to the second quarter. Logistics revenue grew 73% during the same period due to the consolidated results of Deppon, a logistics company merged since July this year, and increased demand from external clients.

Experts evaluated the improved profitability in the third-quarter earnings as favorable but maintained a cautious outlook on the stock price going forward. Hwang Sun-myung, a researcher at Samsung Securities, said, "Although the third-quarter results slightly exceeded the average for Chinese e-commerce, the ongoing adverse external environment is negative," adding, "With prolonged government regulations and growing concerns over economic slowdown, a conservative approach is necessary."

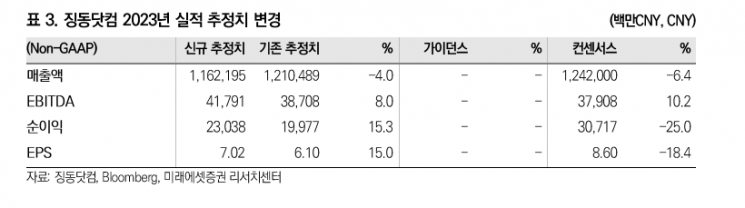

Due to the negative impact of zero-COVID on demand and logistics, earnings are also estimated to be lower than previously expected. Mirae Asset Securities estimates JD.com's revenue next year at 1.16 trillion yuan and operating profit at 33 billion yuan, revising revenue down by 4% from previous estimates. Jung Yong-je, a researcher at Mirae Asset Securities, explained, "While demand for some electronics such as new smartphone launches is positive, logistics issues caused by lockdown measures will continue."

However, since Chinese platform stocks have recently been on an upward trend, a stock price rise driven by improved investor sentiment is expected in the near term. Researcher Baek Seung-hye said, "With the risk of delisting from the US greatly eased and expectations of a slowdown in US interest rate hikes, investor sentiment toward Chinese stocks has recovered," adding, "The rebound from an excessive decline could drive a favorable stock price trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.