[Asia Economy Reporter Lee Seon-ae] As the Samsung Life Insurance Act once again becomes a hot topic, anxiety is growing among the 6 million individual investors of Samsung Electronics. If the amendment to the Insurance Business Act, known as the 'Samsung Life Insurance Act,' is passed, 19 trillion KRW worth of Samsung Electronics shares will be released. Individual investors fear that the Samsung Electronics stock price, which has barely escaped the '50,000 KRW mark,' could slide again.

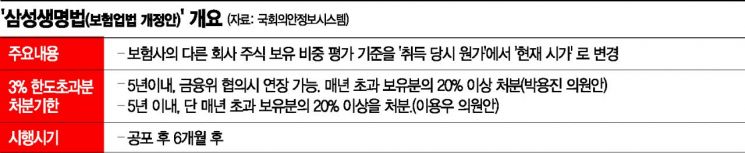

According to the financial investment industry on the 26th, as the amendment to the Insurance Business Act was submitted to the National Assembly's Political Affairs Committee bill subcommittee, Samsung Electronics individual investors have expressed concerns. The amendment, jointly proposed by Democratic Party lawmakers Park Yong-jin and Lee Yong-woo, is attracting attention because it could affect Samsung Group's governance structure.

The amendment mainly changes the 3% ownership limit on major shareholders and bonds issued by subsidiaries of insurance companies from acquisition cost to market value as the evaluation standard. Currently, acquisition cost is used as the standard. This has been criticized for favoring Samsung Group's maintenance of control. If the evaluation standard changes from cost to market value, Samsung Group's governance structure could be directly affected, which is why the amendment is also called the 'Samsung Life Insurance Act.'

Currently, Samsung has a governance structure that goes from Samsung C&T → Samsung Life Insurance → Samsung Electronics. If the standard changes, the value of Samsung Electronics shares held by Samsung Life Insurance will increase, exceeding the 3% limit, making changes to the governance structure inevitable.

Samsung Life Insurance holds 8.51% of Samsung Electronics common stock and 0.01% of preferred stock. Based on the stock price at the end of last September, this is valued at 26.99 trillion KRW. However, 3% of Samsung Life Insurance's total assets (excluding customer assets) is only 7.89 trillion KRW. If the amendment is implemented, Samsung Life Insurance will have to sell 19.1 trillion KRW worth of Samsung Electronics shares. The higher the Samsung Electronics stock price rises, the larger the amount Samsung Life Insurance must sell. Although the amendment allows a grace period of 5 to 7 years, once implemented, Samsung Electronics shares will eventually be released into the market.

As Samsung Electronics is the leading stock in the domestic market, if its stock price collapses, the impact on the market will inevitably be significant. This is why financial authorities have expressed the opinion to "consider the impact on the stock market and small shareholders."

An official from a securities firm said, "It is estimated that there are more than 6 million small shareholders of Samsung Electronics," adding, "Given the strong opposition from small shareholders and the potential market impact, the amendment to the Insurance Business Act should be handled with caution."

Another official stated, "A block deal will inevitably occur, and due to the sales release, the stock price is likely to experience a sharp drop and remain in a sideways range," adding, "Even if sales are divided, trillions of won worth of Samsung Electronics shares will be released into the market annually, so shareholders will naturally be concerned about a decline in stock price."

However, there are also opinions that it could act as a positive factor in terms of resolving uncertainties regarding governance improvement. Furthermore, if Samsung Electronics shares are transferred to leading overseas institutional investors through a block deal, this is also expected to be a positive factor for the stock price.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)