[Asia Economy Reporter Junho Hwang] "Starting January 1 next year, the U.S. Internal Revenue Service (IRS) will withhold a 10% tax on the sale proceeds of publicly traded partnership (PTP) stocks held by foreigners based on Section 1446(f), so please be cautious with your investments and trades."

This is a notice issued by a domestic securities firm following the emergence of a new tax obligation when investing in U.S.-listed companies related to crude oil and natural gas, pipelines, and certain real estate products in the form of PTPs. The main point is that if you hold these stocks, you will have to pay 10% of the sale proceeds as tax early next year, so you should liquidate by the 27th of next month. Although this has put pressure on overseas individual investors (known as Seohak Gaemi) who invested in related products, it is expected to trigger a 'money move' into the domestic commodity exchange-traded note (ETN) market.

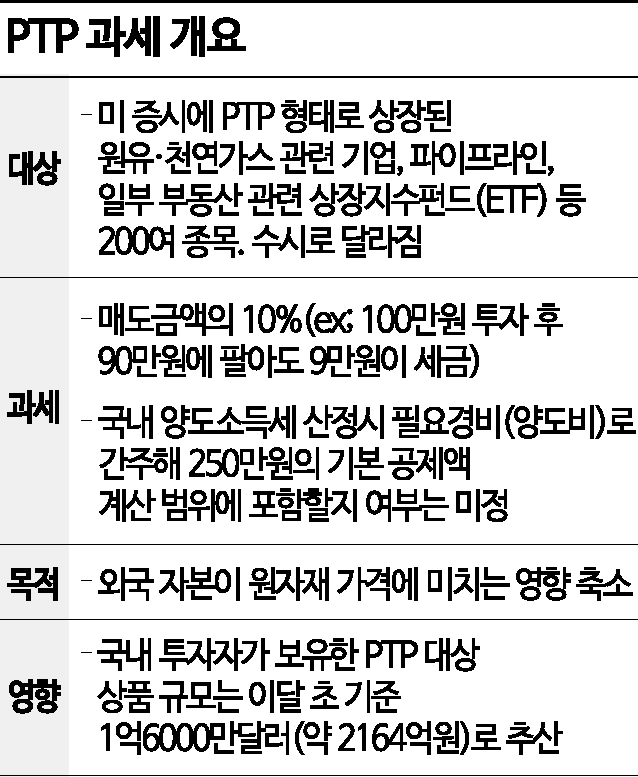

According to the financial investment industry on the 25th, starting next year, the U.S. IRS will withhold 10% tax on the amount when foreign investors sell their investments in publicly traded partnerships (PTPs), which are limited partnerships (MLPs) investing in commodities and real estate that are tradable on the stock market. This measure aims to prevent increased volatility in commodity prices caused by foreign investment.

About 200 stocks are subject to this, but the list can change frequently. Taxes may also vary by stock. Jun Kyun, a researcher at Samsung Securities, explained, "Commodity ETFs or ETNs are structured in various ways such as funds, trusts, or PTPs, so different tax systems are applied."

What is certain is that the tax is imposed on the sale amount, not on capital gains, so taxes must be paid even if there is a loss. From the perspective of Seohak Gaemi, as advised by Kyungjoo Jeong, a researcher at KB Securities, "unless you expect a return exceeding 13-15% from PTP-taxed ETFs, a conservative approach is necessary."

According to the financial investment industry, the scale of PTP products held by domestic investors is estimated at about $160 million (approximately 217 billion KRW). Representative products include 'ProShares Ultra Bloomberg Natural Gas (BOIL),' which Seohak Gaemi net purchased about $1.78 million (23.6 billion KRW) over the past month until the 24th (ranked 11th by settlement amount). Domestic-listed ETFs that include PTP-related ETFs cannot escape the tax burden. Researcher Jeong said, "Investors holding alternative asset ETFs need to check the constituent stocks within each ETF," adding, "If the holding amount is large, it is safer to look at ETFs to shift the weight to and sell in portions."

There is also a forecast that as Seohak Gaemi shows tax resistance to PTPs, capital may flow into the domestic commodity ETN market. Regarding currency exposure to dollar assets, one of the purposes of overseas investment, the same effect can be achieved through currency-exposed products among domestic ETNs. Also, exemption from ETN transaction tax and the presence of liquidity providers (LPs) are explained by the securities industry as very advantageous in terms of liquidity and convertibility compared to overseas products. Researcher Jeon analyzed, "Among U.S. PTP products, there are many domestic ETN-listed products that can substitute commodities and volatility underlying assets, and additional listings are planned."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)