10% Viewership Rating Surpassed in 3 Episodes

Strong Performance by Production Company RaemongRaein and Others

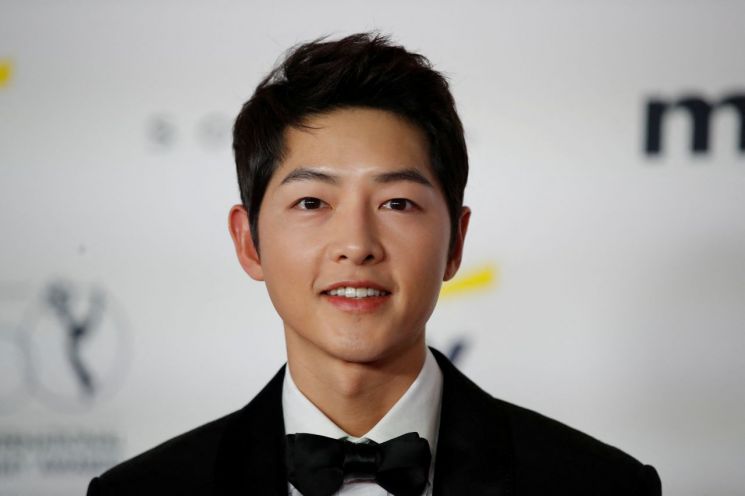

[Asia Economy Reporter Kwon Jae-hee] JTBC drama "The Youngest Son of a Conglomerate," starring Song Joong-ki, has sparked attention by surpassing a 10% viewership rating in just three episodes, and related stocks are also showing strong performance. Following the approximately 91% surge in related stocks within two weeks after the broadcast of "Extraordinary Attorney Woo," investors are increasingly hopeful that "The Youngest Son of a Conglomerate" could become the "second Woo Young-woo."

According to the Korea Exchange on the 25th, the production company of "The Youngest Son of a Conglomerate," RaemongRaein, closed at 37,950 KRW, up 29.97% from the previous day. RaemongRaein has been on a five-day consecutive rise since the 18th, driven by buying pressure from individuals and foreigners.

Nam Hyo-ji, a researcher at SK Securities, analyzed, "RaemongRaein’s performance will be reflected across the fourth quarter of this year and the first quarter of next year due to 'The Youngest Son of a Conglomerate,' and major productions such as 'Maestra' and 'Jikpil' are also in preparation. Even with conservative estimates, operating profit this year is expected to exceed 5 billion KRW, and balancing production with two to three major works annually will lead to stable performance growth."

Other related stocks include Mr. Blue, a webtoon, web novel platform, and game specialist company, which rose up to 10.59%, Corpus Korea, holding the Japanese distribution rights for "The Youngest Son of a Conglomerate," which rose up to 15.51%, and Wysiwyg Studios, which rose up to 18.01%. Wysiwyg Studios is the largest shareholder of RaemongRaein and a computer graphics company that also participated in the production of "The Youngest Son of a Conglomerate." Contentree Joongang, which holds the intellectual property (IP) rights of "The Youngest Son of a Conglomerate" along with RaemongRaein, also rose up to 10.79% on the same day.

The anticipation for the success of "The Youngest Son of a Conglomerate" is greatly influenced by the earlier hit "Extraordinary Attorney Woo." The expectation is similar to "Woo Young-woo," whose related stocks rose about 91% within two weeks of airing. "The Youngest Son of a Conglomerate" recorded a nationwide viewership rating of 10.8% after just three episodes. It also ranked first in more than 50 countries across five continents, including the United States, Brazil, Canada, the United Kingdom, Australia, and India, on global online video streaming services (OTT) such as Netflix.

Although content-related stocks have experienced a slump due to Netflix’s poor performance, there is advice to anticipate a 'year-end effect' in the media content market.

Kim Hoe-jae, a researcher at Daishin Securities, said, "In the remaining little over a month this year, the biggest anticipated works will be released on TV and OTT. Since there are many major year-end events in content, film, and advertising, it is a good time to increase exposure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.