Potential Growth Rate Below Expectations... Lowest Forecast Among Major Institutions

[Asia Economy Reporter Seo So-jeong] The Bank of Korea has sharply revised down its economic growth forecast for next year from the previous 2.1% to 1.7%, while maintaining this year's economic growth rate at 2.6%. The current account surplus is expected to record $25 billion and $28 billion for this year and next year, respectively. These figures represent a significant downward revision from the August projections of $37 billion and $34 billion. The consumer price inflation forecast for next year was slightly lowered from 3.7% in August to 3.6% on this occasion.

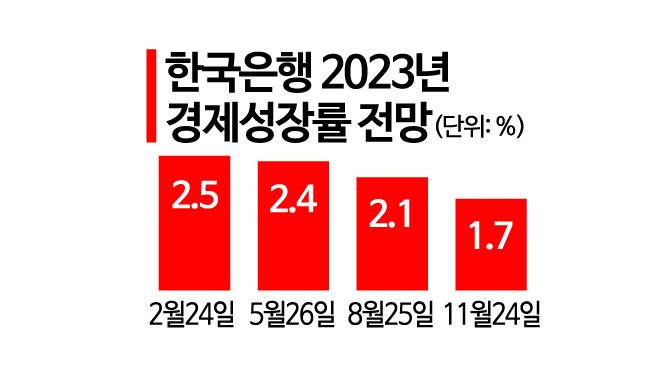

In the revised economic outlook announced on the 24th, the Bank of Korea projected next year's economic growth rate at 1.7%, 0.4 percentage points lower than in August. This is the first time in 12 years and 11 months, excluding the COVID-19 period, that the Bank has forecast growth below 2%, the last being 0.2% in December 2009. Specifically, growth is expected to fall to 1.3% in the first half of the year and then rise to 2.1% in the second half.

The Bank of Korea's growth forecast for next year (1.7%) is lower than most institutions, including the Asian Development Bank (ADB, 2.3%), International Monetary Fund (IMF, 2.0%), credit rating agency Fitch (1.9%), Organisation for Economic Co-operation and Development (OECD, 1.8%), and Korea Development Institute (KDI, 1.8%). It is the same as the Korea Institute of Finance (1.7%). The Bank lowered its growth forecast to the 1% range due to the global economic slowdown weakening exports, which are the engine of Korea's economy, and the series of interest rate hikes expected to slow the recovery in consumption.

Kim Woong, Director of the Bank of Korea's Research Department, stated, "Private consumption will continue its recovery momentum driven by pent-up demand, but the pace will gradually moderate due to rising interest rates and declining purchasing power." He added, "Goods exports will continue to slow due to global demand weakness but are expected to rebound in the second half of next year as China's economy and the IT sector improve."

Private consumption growth is estimated to fall from 4.7% this year to 2.7% next year. Goods export growth is expected to decline from 3.4% this year to 0.7% next year, while goods imports are projected to slow from a 5.8% increase this year to 0.4% next year. Accordingly, the net contribution of domestic demand to growth is forecast to shrink from 1.8 percentage points this year to 1.4 percentage points next year, and the net contribution of exports from 0.8 percentage points to 0.3 percentage points.

Facility investment is expected to contract further due to global demand slowdown and rising capital costs, with growth declining from -2.0% this year to -3.1% next year. The manufacturing sector is expected to perform poorly as both IT and non-IT sectors face weakening overseas demand and deteriorating capital conditions, reducing investment capacity. The service sector is expected to grow, led by information and communications and air transportation.

Construction investment is projected to continue its sluggish trend due to a slowdown in the housing market and cuts in social overhead capital (SOC) budgets. Construction investment growth is expected to narrow from -2.4% this year to -0.2%. Residential building construction is anticipated to see only a slight increase in construction volume due to a contraction in new housing sales despite strong order inflows, while non-residential building construction is expected to weaken due to the economic slowdown.

Director Kim explained, "The future growth path is highly uncertain with mixed upside and downside risks. Easing monetary tightening in major countries, early relaxation of China's zero-COVID policy, and sustained consumption recovery momentum are upside risks, while intensified domestic and international financial instability, persistently high energy prices, and escalating geopolitical tensions are downside risks."

The number of employed persons is expected to increase by 820,000 this year and 90,000 next year. Employment saw a significant rise this year due to the reopening effect but is expected to increase only slightly next year as this effect fades and the economic slowdown takes hold.

The consumer price inflation forecast has been revised down by 0.1 percentage points from the August projections to 5.1% this year and 3.6% next year. This reflects recent inflation data and a decline in agricultural product prices. Core inflation and consumer price inflation are expected to be 2.9% and 3.6%, respectively, next year, slightly below the August forecasts of 3.1% and 3.7%. Although the economic slowdown will act as a downward factor next year, accumulated cost pressures will exert upward pressure, resulting in inflation slightly below previous projections.

The current account surplus is projected at $25 billion this year and $28 billion next year, significantly down from the August forecasts of $37 billion and $34 billion. This is due to a sharp increase in imports, a steep decline in semiconductor prices?Korea's main export product?and a worse-than-expected deterioration in exports to China. The current account surplus as a percentage of GDP is expected to be in the mid-1% range for both years. Looking ahead, the Bank of Korea expects the trade balance to remain in deficit for some time, leading to a continued slowdown in the current account surplus, but anticipates improvements in both the Chinese economy and the semiconductor sector from the second half of next year.

The Bank of Korea has set the growth forecast for the Korean economy in 2024 at 2.3% and the inflation forecast at 2.5%. Director Kim said, "The domestic economy is expected to continue growing below its potential level due to synchronized downturns in major economies, but the slowdown is expected to gradually ease after the second half of next year as external uncertainties diminish."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.