[At-Risk Korean Companies]③

Companies Hit by a Perfect Storm... Unprecedented Times of Crisis

Semiconductor Export Value Plummets, Trade Balance Wobbles

Semiconductor Inventory Surges Due to Declining Front-End Demand

[Asia Economy Reporter Kim Pyeonghwa] The semiconductor inventory, the flagship export item of South Korea, has surged sharply due to the global economic recession and sluggish business conditions, causing headaches for the related industries. As the domestic memory semiconductor market, a key sector, is expected to remain frozen until the first half of next year, there are evaluations that a shadow of low growth has been cast over the overall economy, including domestic exports.

According to the Korea Customs Service on the 25th, export value (provisional customs clearance basis) from the 1st to the 20th of this month was 33.16 billion USD, down 16.7% compared to the same period last year. The export value of semiconductors, the largest export item, recorded 5.281 billion USD due to the worsening external economic conditions, a sharp decline of 29.4% year-on-year. As the decrease in export value became prominent, the trade deficit widened. The cumulative deficit up to the 20th of this month reached 39.968 billion USD, doubling the record largest deficit in 1996 (20.6 billion USD).

The problem is that the sluggish business conditions in the memory sector, which the domestic semiconductor industry focuses on, are prominent, and future export prospects are not bright. In fact, looking at last month's semiconductor export figures, the decline in memory exports (35.7%) was greater than the overall export decline (17.4%) compared to the same month last year. Factors such as inflation and interest rate hikes have caused difficulties in the global economy, and external factors such as the Russia-Ukraine war and China's lockdown measures due to the spread of COVID-19 have also influenced, leading to a full-fledged down cycle in the semiconductor market.

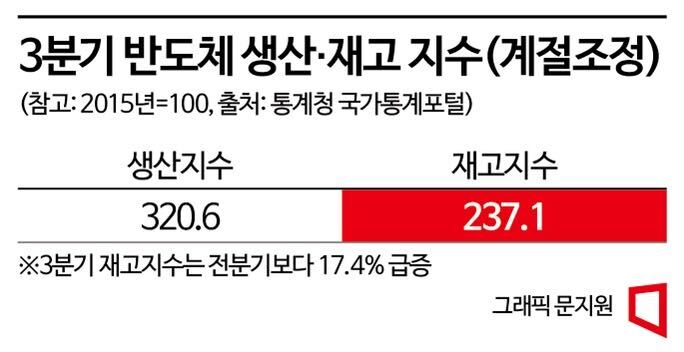

As a result, a vicious cycle of inventory increases and production decreases due to weak demand in front-end markets such as IT devices and servers continues. According to the National Statistical Portal (KOSIS) of Statistics Korea, the semiconductor inventory index (seasonally adjusted) was 237.1 (2015=100) in the third quarter of this year, a sharp increase of 17.4% from the previous quarter. It has been rising for four consecutive months since June. As inventory increased, production decreased. The semiconductor production index (seasonally adjusted) in the third quarter of this year recorded 320.6 (2015=100), down 11% from the previous quarter, marking the largest decline in 14 years since the fourth quarter of 2008, right after the global financial crisis.

Prices of major memory products such as DRAM and NAND flash are also falling consecutively. According to market research firm DRAMeXchange, as of the end of last month, the fixed transaction price of PC DRAM (DDR4 8Gb) averaged 2.21 USD, a sharp drop of 22.46% from the previous month. NAND for memory and USB (128Gb 16Gx8) also decreased by 3.73% to 4.14 USD based on the same criteria. Market research firm TrendForce expects the fixed transaction price of DRAM to fall by 18-23% in the fourth quarter of this year. The NAND price in the fourth quarter is forecasted to decrease by 15-20% compared to the previous quarter.

The market is closely watching the sharply increased inventory levels in the memory industry. According to the quarterly reports of South Korea's two major semiconductor companies, Samsung Electronics and SK Hynix, the total inventory assets of the two companies as of the end of the third quarter this year were 26.3652 trillion KRW (semiconductor division) and 14.665 trillion KRW, respectively. Compared to the first half of the year, these increased sharply by 22.6% and 23.5%, respectively. Since the memory business downturn is expected to continue until the first half of next year, the industry must endure a prolonged cold spell. This inevitably affects domestic exports and the overall economy.

Professor Kim Young-ik of Sogang University Graduate School of Economics said, "With exports having decreased once last month and the decline expanding this month, along with poor consumption and investment, which make up GDP (Gross Domestic Product), I expect our economy to show negative growth from this quarter." He added, "Next year, negative growth will become visible globally, including in the U.S., and the domestic economic growth rate will likely be around 1.2% at best."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.