Concerns Over 'Domino Insolvency' as Foreclosure Listings Surge Due to Unpaid Debts

Downward Pressure on Real Estate Market Feared

[Asia Economy Reporter Koo Chae-eun] As of September this year, the total number of real estate properties (collective buildings, land, buildings) nationwide with mortgage liens set due to loans and other reasons reached 2.06 million. There are concerns that if the burden of interest increases sharply due to rapid interest rate hikes and mortgage lien properties flood the market because debts cannot be repaid on time, downward pressure on real estate prices could intensify, potentially leading to a domino effect of defaults.

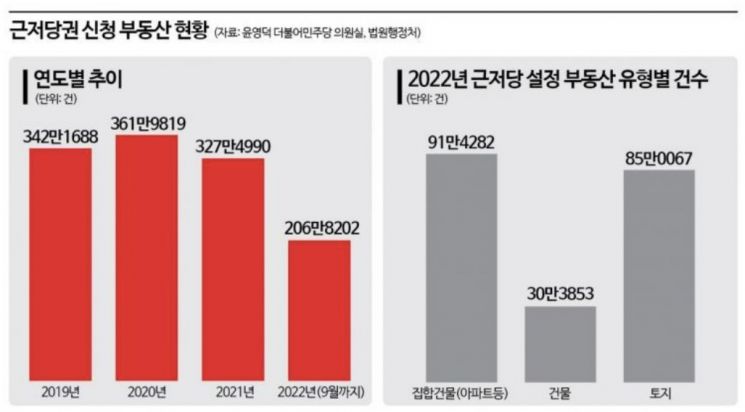

According to data titled ‘Status of Mortgage Lien Applications by 17 Cities and Provinces’ received on the 24th by the office of Yoon Young-duk, a member of the National Assembly’s Political Affairs Committee from the Democratic Party of Korea, from the Court Administration Office, the total number of real estate properties with mortgage liens set as of September this year was 2,068,202.

A mortgage lien refers to collateral set on real estate by creditors such as banks, individuals, or companies when lending money. If the loan is not repaid, the creditor can immediately auction the mortgaged property to recover the money with priority. It is also an indicator of real estate exposed to risk during economic downturns.

By type, collective buildings (such as apartments) accounted for the largest number at 914,282 cases, followed by land at 850,067 cases, and buildings at 303,853 cases. By region, Gyeonggi Province had the highest number at 658,205 cases, followed by Seoul with 226,312 cases, Gyeongnam 139,896 cases, Gyeongbuk 121,727 cases, Chungnam 119,056 cases, and Busan 109,943 cases.

The increase in mortgage liens is likely to become another trigger for defaults amid rising interest rates. If repayment burdens increase and loans cannot be repaid, properties will be auctioned. This can lead to a vicious cycle of ‘interest rate hikes → increased repayment burden → rising delinquency rates → more properties going to auction → higher auction failure rates → decline in real estate prices.’

In fact, due to the real estate market downturn, the number of auction bidders has sharply decreased, causing auction failure rates to rise and auction sale price ratios to plummet. According to Gigi Auction, a court auction specialist company, as of September, the average auction success rate for apartments in Seoul was 22.4%, down 14.1 percentage points from the previous month. This is the lowest figure since statistics began being compiled in May 2001.

Seo Jin-hyung, co-representative of the Apartment Forum and professor of MD Product Planning and Business at Gyeongin Women’s University, said, "Mortgage lien properties are a risk factor in the current situation where many borrowers feel the burden of interest due to rising rates. From an investment demand perspective, if the economy worsens, it becomes difficult to sell collateral, and if properties end up being auctioned at low prices, it could pose a macroeconomic risk."

Professor Sung Tae-yoon of Yonsei University’s Department of Economics stated, "Although the interest rate hikes were at expected levels, they could have adverse effects on the macroeconomy including real estate in the long term, so financial stability risks must be carefully examined."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.