Korean Banks' Fee Income Share Stands at 8.8% in Q3

Kakao Bank and Toss Bank Lead Domestically... Shinhan Bank Strong Among Traditional Banks

[Asia Economy Reporter Minwoo Lee] The top-tier banks in terms of 'digital banking' have a fee income ratio of 31%, which is more than three times the ratio of domestic banks.

On the 24th, Korea Deloitte Group published the '2022 Global Digital Banking Maturity Survey' report, which covers the results of a digital banking trend survey conducted by Deloitte Global in September across 304 banks in 41 countries worldwide. South Korean banks were not included in this survey.

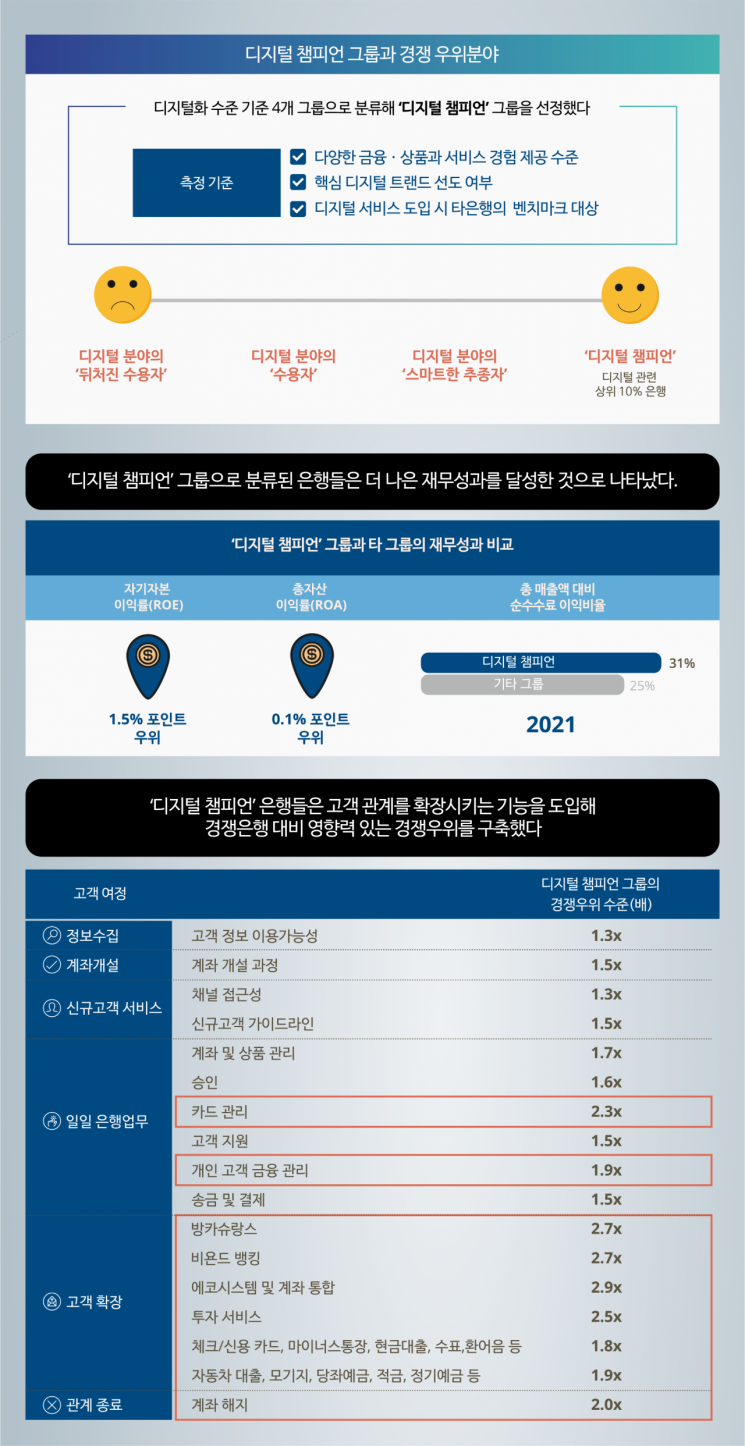

Deloitte classified the surveyed banks into four groups based on their level of digitalization: ▲'Digital latecomers' ▲'Digital adopters' ▲'Digital smart followers' ▲'Digital Champions.'

Among all surveyed banks, challenger banks, including internet-only banks, accounted for 19% of the Digital Champion group. They demonstrated differentiation from traditional banks by adopting innovative solutions. In South Korea, internet-only banks also surpassed traditional banks. In particular, KakaoBank and TossBank showed a strong presence, leading digital strategies.

Top 10% Digital Leading Banks Have Fee Income Ratio of 31%... Three Times That of Korean Banks

The 'Digital Champion' group, which leads the digital banking trend, refers to the top 10% of banks with solid digital infrastructure. According to Deloitte's survey, banks in the Digital Champion group had return on equity (ROE) and return on assets (ROA) 1.5 percentage points and 0.1 percentage points higher, respectively, than other banks. The pure fee income ratio also increased from 28% in 2019 to 31% last year. In contrast, other banks remained almost stagnant, moving from 24% to 25% during the same period.

There was a significant gap compared to domestic banks. According to the Financial Supervisory Service, the fee income ratio of domestic banks last year was only 10% (about 5.3 trillion KRW). As of the cumulative third quarter this year, it further dropped to 8.77% (about 3.7 trillion KRW).

The Digital Champion group also outperformed other banks in expanding customer relationships. They secured a competitive advantage 2.9 times higher than other banks in ecosystems and account aggregation. Their competitiveness in bancassurance and 'beyond banking' (services providing new value beyond traditional banking) was 2.7 times higher, and in investment services, the gap was 2.5 times.

Still 'Internet' Banks... "KakaoBank and TossBank Overwhelm Traditional Banks in Digital Banking"

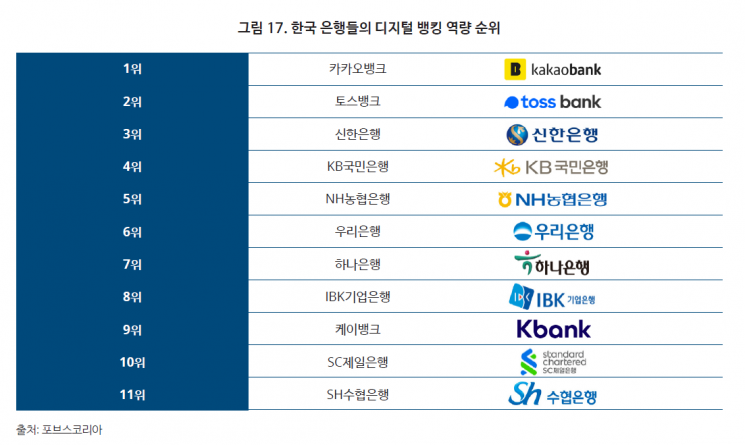

In South Korea, where the digital wave is strong, internet banks have shown significant presence. According to a survey conducted by Forbes Korea in March targeting 1,000 domestic consumers using digital banking, KakaoBank and TossBank ranked first and second in digital banking capabilities. Among traditional banks, Shinhan Bank showed strong performance, ranking third.

Challenger banks such as KakaoBank and TossBank have launched strong digital strategies, creating a favorable environment to become digital champions. Since younger generations, including those in their 20s and 30s, greatly value app launch speed and exemption from transfer fees in their digital banking satisfaction, KakaoBank and TossBank have emerged as the twin leaders of Korea's digital banking industry.

Jang Hyungsoo, Customer Industry Leader of the Financial Industry Integrated Services Group at Korea Deloitte Group, said, "The digital transformation of the banking industry has become a mission of the times, and challenger banks are leading the way. Depending on satisfaction with digital banking services, customers nowadays do not hesitate to leave their long-standing main banks and turn to new digital champions. Going forward, digital banking will establish itself as an important competitive advantage in terms of customer contact and profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.