Concerns Over Side Effects Like Inflation by People's Bank of China, Shift from LPR to RRR Cut

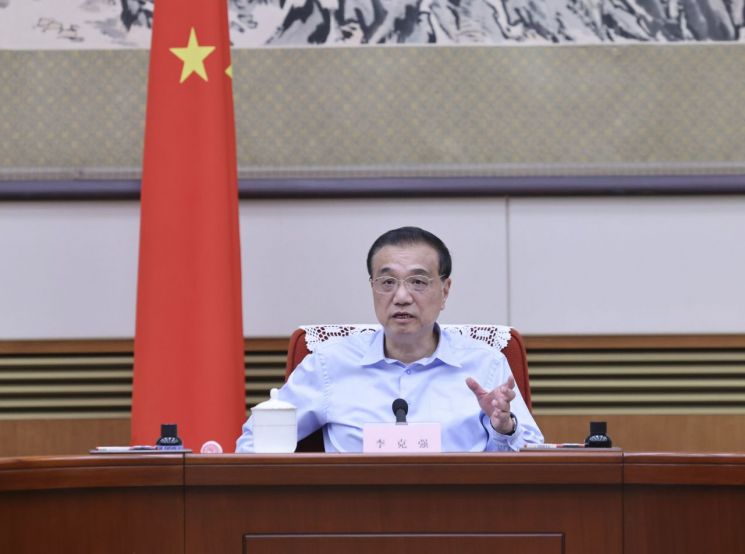

Premier Li Keqiang: "Fourth Quarter Is a Very Important Time, Appropriately Use Monetary Policies Such as Reserve Requirement Ratio Cut"

[Asia Economy Senior Reporter Cho Young-shin] Chinese Premier Li Keqiang mentioned lowering the reserve requirement ratio (RRR) as a measure to stimulate the economy. It appears that Chinese authorities, concerned about inflation and other factors, have opted to lower the RRR instead of cutting the benchmark interest rate.

Accordingly, the People's Bank of China, the central bank, is expected to lower the RRR as early as this week.

According to Chinese media including the Shanghai Securities News on the 24th, Premier Li said at the State Council executive meeting the day before that the fourth quarter is a very important period for the overall economy, and monetary policy tools such as lowering the RRR should be used timely and appropriately.

Premier Li called for more fiscal support for the real economy and emphasized the need for sufficient liquidity supply.

Concerns have arisen that the Chinese economy will continue to face difficulties in the fourth quarter due to lockdown policies following the resurgence of COVID-19, leading to expectations that the People's Bank of China might cut the loan prime rate (LPR), which serves as the benchmark interest rate.

However, on the 21st, the People's Bank of China kept both the one-year and five-year LPR rates unchanged. It appears that the rates were held steady due to concerns about side effects such as rising prices that could occur if interest rates were lowered.

Also, considering the uncertain economic situation next year, it was interpreted as a sign that monetary policy will be viewed from a more long-term perspective.

The RRR cut was also mentioned as a tool that Chinese financial authorities could use. The RRR is the cash reserve that commercial banks are required to hold at the central bank. Lowering the RRR increases the lending capacity of commercial banks. Since the RRR can be used to adjust the money supply in the market if necessary, it has a smaller overall economic impact than an interest rate cut. Currently, the weighted average RRR in the Chinese financial sector is 8.1%.

Mingming, chief analyst at Zhongxin Securities, said, "Downward pressure on the economy has become prominent since October," and evaluated that "this meeting, which considered lowering the RRR, was very timely." He also forecasted that lowering the RRR would have a positive effect on the real estate market.

Dong Simiao, chief researcher at Zhaolian Finance, argued, "Considering the current economic situation in China, lowering the RRR is urgent." He explained that as of October, China's consumer price index (CPI) rose only 2.1% year-on-year, indicating almost no inflationary pressure in China.

Chinese financial experts expect that lowering the RRR will lead to increased lending capacity for commercial banks. They also anticipate that the central bank may further cut the five-year LPR next month to revitalize the real estate market.

However, since there are limits to stimulating consumption through interest rate cuts and expanded lending, some point out that the central bank may use monetary policy gradually and moderately.

The extent of the RRR cut is also a matter of interest. The People's Bank of China lowered the RRR by 0.25 percentage points last April. Although the exact cut by Chinese authorities cannot be predicted, a large cut would be interpreted as indicating that the economic situation in China is not good. Within China, it is expected that the RRR will be lowered by 0.25 to 0.5 percentage points this time.

Meanwhile, the Organisation for Economic Co-operation and Development (OECD) forecasted China's growth rate at 3.3% this year. This falls significantly short of the Chinese government's initial target of around 5.5%. The OECD also projected China's economic growth rate at 4.6% next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.