[At-Risk Korean Companies]②

Companies Hit by a Perfect Storm...An Unprecedented Time of Trials

Sixth Consecutive Rate Hike at the Monetary Policy Committee on the 24th

Wailing Over Rising Financial Costs Amid Deteriorating Earnings

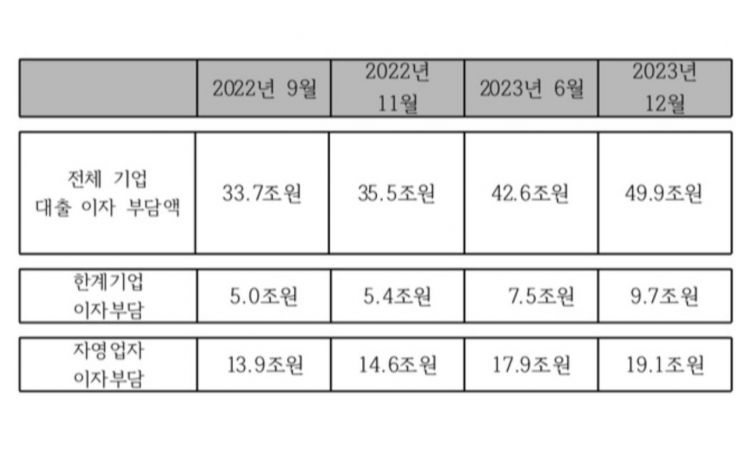

[Asia Economy Reporters Sunmi Park, Seoyoon Choi] Over the course of about 1 year and 3 months, the benchmark interest rate jumped from 0.5% to 3.25%, an increase of 2.75 percentage points, triggering a 'red light' for corporate debt. It is projected that corporate interest burdens will increase by more than 14 trillion won from the current level by the end of next year, approaching 50 trillion won.

According to the Korea Economic Research Institute on the 25th, assuming that the U.S. does not significantly change its current rate hike stance and the benchmark interest rate gap between Korea and the U.S. does not exceed 1.25 percentage points, the interest burden on corporate loans is expected to surge from about 35.5 trillion won as of November to 42.6 trillion won by June next year. By December next year, it is estimated to reach 49.9 trillion won, nearing 50 trillion won. Among this, the interest burden on marginal companies is also predicted to sharply increase from about 5.4 trillion won in November to 7.5 trillion won in June next year, and 9.7 trillion won by the end of next year.

The day before, the Bank of Korea set the benchmark interest rate at 3.25%. If the U.S. Federal Reserve decides on a big step next month, the upper limit of the interest rate gap between Korea and the U.S. will expand to 1.25 percentage points. Currently, the U.S. benchmark interest rate is between 3.75% and 4.00%.

Continued benchmark rate hikes are putting pressure on corporate debt burdens. According to the Bank of Korea's Economic Statistics System, as of the end of September, 61.2% of new bank loans to large corporations had an annual interest rate of 4% or higher. A year ago, only 5.8% of companies borrowed under conditions of 4% or higher annual interest rates, but as the Bank of Korea sharply raised rates, this proportion rose to about 24.7% in June this year and exceeded 50% in August. The proportion of large corporations bearing interest rates of 5% or higher also reached 16.5%.

For small and medium-sized enterprises (SMEs), currently 8 out of 10 companies are borrowing under conditions of 4% or higher annual interest rates, and 40% are borrowing at interest rates of 5% or higher.

As interest payments increase, corporate borrowings are also rapidly rising. According to the Financial Supervisory Service, the cumulative financial costs of the top 30 listed companies in the third quarter reached 45.7775 trillion won, a 131.2% surge compared to the previous year. The total borrowings of the top 10 large corporations increased by more than 20 trillion won in one year, exceeding 147 trillion won.

A representative from a large corporation said, "When companies announce investments worth several trillion won, they do not borrow the funds all at once but in several installments. In a situation where interest rates continue to rise, there is inevitably an impact, especially for companies that have set their loans with variable interest rates rather than fixed rates, which will suffer more."

Companies are reducing investments and securing cash. As of the end of September, the cash and cash equivalents of the top 10 large corporations reached 97.7 trillion won, nearly 18 trillion won more than at the end of last year. Since major companies announced plans to reduce investments during their third-quarter earnings reports, the trend of cash hoarding among companies is expected to strengthen for the time being.

The situation is more severe for SMEs and marginal companies. According to a recent analysis by the Korea Chamber of Commerce and Industry, when the benchmark interest rate rises by 1 percentage point, the interest burden increases by 2.3 trillion won for large corporations, while SMEs face a higher risk with an increase of 5.5 trillion won. The Bank of Korea also projected in its 'Financial Stability Report' that corporate debt will rapidly increase this year, and with worsening business conditions due to domestic and international economic slowdowns, loan rate hikes, and rising exchange rates and raw material prices, the number of marginal companies (those unable to cover interest payments with profits for three consecutive years) and their share of borrowings (excluding financial and insurance industries among all externally audited companies) will grow from 14.9% and 14.8% last year to 18.6% and 19.5% this year, respectively.

Lee Seung-seok, a senior researcher at the Korea Economic Research Institute, pointed out, "With the business environment deteriorating due to economic slowdown, soaring raw material prices, and rising exchange rates, the burden of principal and interest repayments due to interest rate hikes will significantly worsen corporate financial conditions." He expressed concern, saying, "Especially marginal companies vulnerable to changes in the financial environment will face great difficulties as they suffer from the interest burden following the impact of COVID-19."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)