Dexter, Corpus Korea, and Others Surge on Riverside Hotel's China OTT Supply News

Previous Day's Gains in Middle East Beneficiary Stocks like CJ ENM and SM

[Asia Economy Reporter Ji Yeon-jin] Entertainment stocks are stirring. Following the rise of Middle Eastern 'oil money' as major investors in K-content, expectations for the lifting of China's ban on Korean content (Hanhanryeong) have also been reflected, making related stocks beneficiaries.

According to the Korea Exchange on the 24th, Dexter started trading on the KOSDAQ market with a surge of over 10% from the early session. The company provides visual effects for films, advertisements, and music videos, with domestic and international film and drama production companies as its main clients. On the same day, Corpus Korea, which processes video, audio, subtitles, and supplies them to over-the-top (OTT) streaming services, also recorded a rise of over 7% from the early session. CarrieSoft, a company specializing in children's content, also rose more than 10%.

The Presidential Office announced the day before that through the Korea-China summit, the service of the Korean film "Gangbyeon Hotel" would resume on a Chinese representative OTT platform, which is interpreted as having raised the corporate value of these stocks. China imposed the 'Hanhanryeong' in 2006, suspending the import of Korean content due to the Korea-China THAAD missile defense system issue, but expectations have grown that it will resume after six years. The news that the drama "Hyena," produced by KeyEast, was sold for remake rights in China also acted as a positive factor.

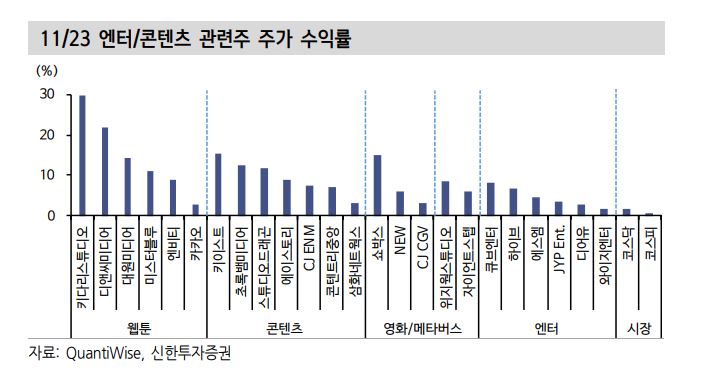

Earlier the day before, media stocks expected to benefit from Middle Eastern oil money surged. Studio Dragon closed up 11.77%, and CJ ENM (7.41%) and SM Entertainment (4.50%) also rose sharply. Expectations were reflected that investments in domestic content companies would expand following an 800 billion KRW investment in Kakao Entertainment by the world's largest sovereign wealth funds, Saudi Arabia and the Singapore Investment Corporation.

Saudi Arabia signed business agreements earlier this year with SM Entertainment and CJ ENM, and invested 3 trillion KRW in Nexon and NCSoft, becoming the second-largest shareholder. Thanks to this Saudi investment, Kakao Entertainment is expected to aggressively expand its business through mergers and acquisitions (M&A) in various fields such as web novels, webtoons, videos, and music. Shin Ji-in, a researcher at Shinhan Financial Investment, said, "There is also a possibility that Kakao's acquisition of SM Entertainment will gain momentum," adding, "Such large-scale global investment inflows or the opening of new large markets are always positive."

However, it is pointed out that whether China's Hanhanryeong will actually be lifted remains to be seen. Researcher Ji said, "In recent years, old Korean dramas have often been broadcast in China," adding, "simultaneous broadcasting of new works, allowing offline 'performance hall rentals for Korean singers' with a capacity of over ten thousand people, and Korean 'game companies receiving foreign game licenses in China' are the key points," he explained.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)