TrendForce Announces Q3 NAND Market Statistics

Samsung, SK and Other Operators Continue to See Revenue Decline

[Asia Economy Reporter Kim Pyeonghwa] As the semiconductor industry downturn intensifies, the NAND flash market in the third quarter was directly affected. Following a 24.3% decrease in market size, major players such as Samsung Electronics and SK Hynix also experienced declines in sales and market share. The market expects the cold spell in the NAND market to last longer than that of DRAM.

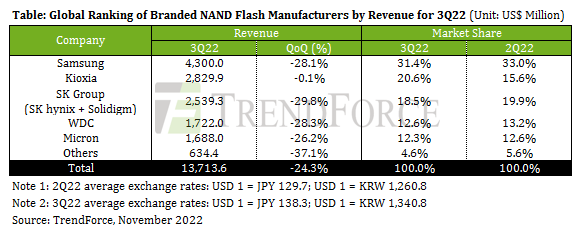

According to market research firm TrendForce on the 24th, the global NAND market's third-quarter sales amounted to $13.7136 billion, down 24.3% from the previous quarter. Multiple negative factors such as inflation, interest rate hikes, economic recession, and the Russia-Ukraine war overlapped, leading to a full-scale downturn centered on memory semiconductors.

The average selling price (ASP) of NAND in the third quarter fell 18.3% compared to the previous quarter, and NAND bit shipments also decreased by 6.7%. TrendForce pointed out that front-end demand from appliances and servers fell short of expectations, causing an oversupply inventory issue across NAND suppliers, which led to market contraction.

Major market players also saw declines in sales and market share. Samsung Electronics recorded $4.3 billion in NAND sales in the third quarter, down 28.1% from the previous quarter. It maintained its position as the market leader with a 31.4% share, but this was a 1.6 percentage point decrease from the previous quarter. TrendForce noted that Samsung's enterprise solid-state drive (SSD) shipments declined due to weakening server demand.

SK Hynix, which was the second-largest player in the previous quarter, dropped to third place this quarter. Including its subsidiary Solidigm, SK Hynix's third-quarter market share was 18.5%, down 1.4 percentage points. Sales also fell 29.8% from the previous quarter to $2.5393 billion. TrendForce attributed this result to deteriorating front-end demand for PCs and smartphones, as well as a contraction in the server market.

The company that took second place was Japan's Kioxia, which was third in the previous quarter. Kioxia posted $2.8299 billion in sales in the third quarter, a slight 0.1% decline from the previous quarter. Its market share rose from 15.6% to 20.6%, an increase of 5 percentage points. This was due to gradual recovery from a factory contamination incident earlier this year and increased bit shipments driven by stockpiling activities from smartphone industry customers.

TrendForce forecasts that the global NAND market downturn will continue into the fourth quarter. They added that with significant inventory accumulation and continued NAND price declines, total market sales could decrease by nearly 20% compared to the previous quarter.

TrendForce stated, "Except for Samsung Electronics, most suppliers are expected to be more cautious in setting production plans following third-quarter earnings announcements," and predicted, "Measures such as reducing wafer input and slowing technology migration will be taken to restore supply-demand balance."

The semiconductor industry and securities analysts expect the NAND market downturn to persist for an extended period. Due to the nature of memory being vulnerable to economic conditions and intensified competition, the situation is considered worse than that of DRAM. Han Jinman, Vice President of Samsung Electronics Memory Business Division, said during a conference call after the third-quarter earnings announcement last month, 'Unlike DRAM, NAND is expected to have a low outlook for overcoming market conditions next year.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.