[Asia Economy Sejong=Reporter Kim Hyewon] The National Tax Service (NTS) has uncovered 53 offshore tax evaders who embezzled foreign currency funds and caused national wealth outflow.

The NTS announced on the 23rd that it has launched tax investigations into 53 suspects of offshore tax evasion who caused national wealth outflow while burdening the difficult economic conditions.

They are suspected of continuously transferring foreign currency funds abroad by fabricating business structures different from the actual ones, transferring funds or income of domestic corporations overseas, or embezzling income that should have been brought into the country locally.

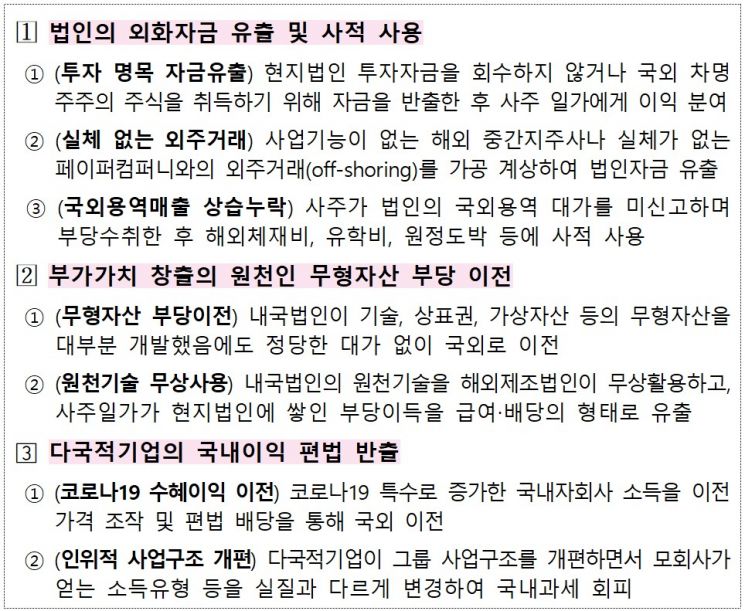

The types of subjects under tax investigation are threefold: ▲ corporate foreign currency fund outflow and private use (24 persons) ▲ improper transfer of intangible assets, the source of value added (16 persons) ▲ illicit repatriation of domestic profits by multinational corporations (13 persons).

The characteristic of this investigation’s subjects is that unlike previous tax evasion methods based simply on the secrecy of offshore transactions, they disguised tax evasion transactions as legitimate transactions, thereby entrenching the structure of national wealth outflow.

The first type abuses the fact that capital and service transactions have no export-import customs clearance records, illegally transferring foreign currency funds abroad under the name of overseas investment or outsourcing, or failing to report overseas sales.

The second type is suspected of providing ownership or usage rights of domestic intangible assets to foreign related parties without proper compensation, contrary to most companies’ efforts to protect intangible assets, which are the source of competitiveness and value added.

The third type involves some multinational corporations maximizing profits earned by selling to domestic consumers through market dominance, while not leaving appropriate profits to domestic subsidiaries according to tax laws and treaties, but instead repatriating them abroad.

The total taxes collected through offshore tax evasion investigations by the NTS over the past three years amount to 1.6559 trillion KRW. By tax category, corporate tax was the highest at 1.0736 trillion KRW, followed by value-added tax (445.8 billion KRW), income tax (69.7 billion KRW), and gift tax (49.4 billion KRW).

The NTS stated, "In this offshore tax evasion investigation, we will thoroughly verify remittance details, export-import customs clearance data, and overseas investment specifications, and according to tax laws and tax treaties, we will pursue taxation to the end through forensic analysis, financial transaction investigations, and information exchange among tax authorities, including targeting corporate owners and related parties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.