Decline in Cargo Volume Since April

"Next Year's Summer Flight Slots... 265% Increase Compared to This Year"

[Asia Economy Reporter Yoo Hyun-seok] Cargo transportation, which has been responsible for the revenue of full-service carriers (FSC) during the COVID-19 period, is expected to enter a significant decline starting this year. This is because concerns over economic contraction are expected to lead to a substantial decrease in cargo volume from next year. However, as the easing of the COVID-19 pandemic has opened air routes faster than this year, it is anticipated that passenger traffic will support the decreasing cargo volume.

According to the aviation industry on the 24th, the third-quarter cargo sales of Korean Air and Asiana Airlines were 1.8564 trillion KRW and 680.2 billion KRW, respectively. Korean Air’s cargo sales increased by 12.5% compared to the same period last year, while Asiana Airlines saw a 10% decrease.

Although the year-on-year figures differ, compared to the previous quarter, cargo sales decreased by 14.50% and 16.88%, respectively. The industry analyzed that the decline in third-quarter cargo transportation revenue compared to the previous quarter was influenced by ongoing rises in exchange rates, oil prices, and interest rates, which led to economic slowdown and reduced demand for air cargo.

Air cargo was the business that sustained full-service carriers during the COVID-19 period. While low-cost carriers (LCCs) struggled in the passenger business due to COVID-19, full-service carriers converted passenger aircraft into cargo planes, resulting in soaring performance.

Korean Air recorded annual sales of 8.7534 trillion KRW last year, an 18.2% increase from the previous year. Operating profit surged by 514.4% to 1.4644 trillion KRW, surpassing the previous record high operating profit of 1.1589 trillion KRW set in 2010. Asiana Airlines also achieved consolidated sales of 4.3323 trillion KRW, a significant 11.2% (437 billion KRW) increase from the previous year. Operating profit reached 91.6 billion KRW, marking a return to profitability.

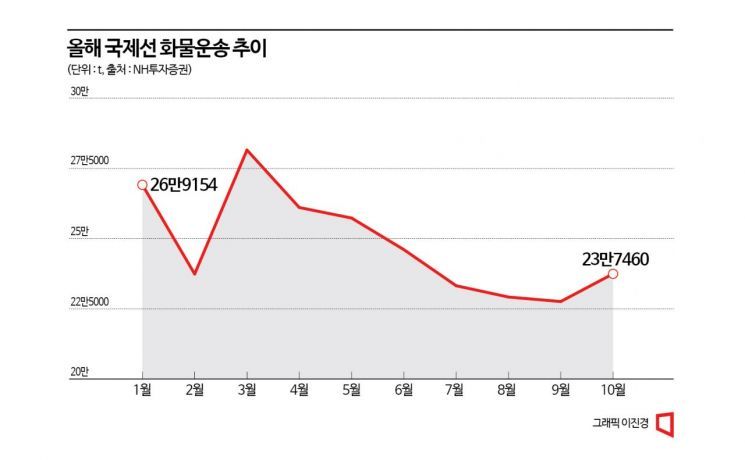

Cargo volume has already been on a declining trend. Domestic departing and arriving air cargo peaked at 281,551 tons in March, then steadily decreased from April. The figures dropped to 261,081 tons in April, 246,078 tons in June, and 227,589 tons in September. However, the fourth quarter is expected to see some rebound due to companies adjusting inventory and the traditional peak season for cargo transportation before Black Friday. In fact, October saw an upward shift to 237,460 tons.

However, from next year, cargo transportation is expected to decline significantly, raising concerns within the industry. Currently, Korean full-service carriers are benefiting from the reduced cargo supply from Chinese airlines due to China’s lockdowns. If Chinese airlines begin to resume operations next year and concerns over economic contraction persist, both cargo freight rates and volumes could rapidly decrease.

The reassuring factor is the expectation of increased passenger traffic next year. Incheon International Airport Corporation forecasts that the number of slot allocations at Incheon International Airport for the next summer season (late March to late October) will reach 263,004, a 265% increase compared to 99,077 slots during the same period this year. This also represents a 12.5% increase compared to 233,650 slots in the summer of 2019, before the pandemic. A full-service carrier official explained, "An increase in slot allocations means passenger flights are normalizing," but added, "As cargo unit prices decline, there could be impacts on related revenue and operating profit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.