Nationwide Officetel Jeonse Rate at 84.91%

Steady Increase Since December Last Year

Higher Risk for Young People and Single-Person Households

Rising Jeonse Rates for Row Houses and Multi-Family Homes Too

[Asia Economy Reporter Seoyul Hwang] "There are too many newly built officetel listings, making it difficult to judge whether the properties are safe, and even when sales prices are available, the jeonse prices are almost at the same level, limiting the range of choices" (Kim Iyung, 26, who is recently looking for jeonse properties)

The jeonse price ratio of officetels, which have high demand from young single-person households, has reached an all-time high. As the gap between sales prices and jeonse prices narrows, the risk of encountering the ‘empty jeonse’ problem has increased.

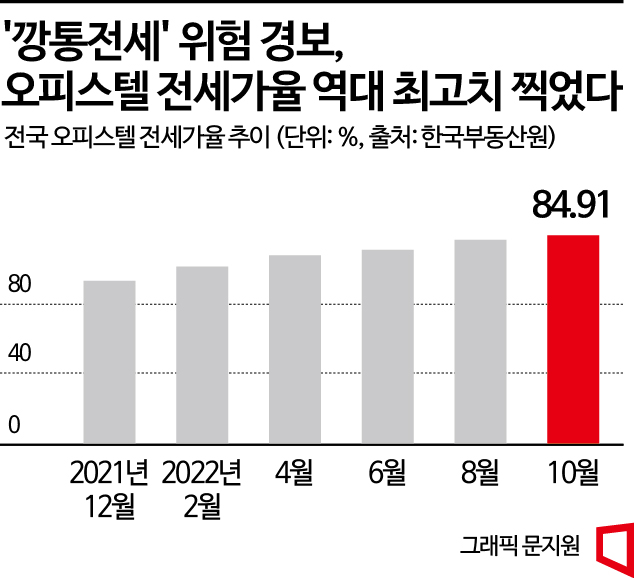

According to the Korea Real Estate Board on the 22nd, the nationwide officetel jeonse price ratio (jeonse price compared to sales price) recorded 84.91% last month. Generally, a high jeonse price ratio indicates a higher possibility of ‘empty jeonse,’ where tenants risk losing their deposit from landlords. This figure has steadily increased since December last year (84.5%) and peaked since the related statistics began in July 2020.

Both jeonse and sales prices are declining, but the jeonse price ratio rises as transaction volume decreases more sharply due to weakened buying sentiment. Last month, the officetel sales index fell by 0.18 points from the previous month to 102.43, while the jeonse price index dropped by 0.16 points during the same period.

As the officetel jeonse price ratio steadily rises, the risk burden on young single-person households with insufficient funds is expected to grow. According to the ‘Officetel 1 Million Units Era, Achievements and Challenges’ report released in March by the Korea Construction Industry Research Institute, which analyzed microdata from the Ministry of Land, Infrastructure and Transport’s 2020 Housing Survey, single-person households and those under 40 accounted for 73.4% and 77.4%, respectively, of all officetel residents.

The jeonse price ratio in the metropolitan area in October was higher than the nationwide figure, indicating greater risk. Gyeonggi Province recorded 86.92%, Incheon 86.83%, and Seoul 84.22%. Particularly, the southwestern area of Seoul (Gangseo-gu, Guro-gu, Geumcheon-gu, Gwanak-gu), where there is high demand from single-person households, showed a jeonse price ratio of 87.12%.

The jeonse price ratio of multi-family and row houses, which have many one-room units, is also on the rise, deepening concerns for those seeking rental properties. The average jeonse price compared to sales price for nationwide multi-family and row houses was 67.7%, showing an upward trend with alternating monthly increases and stability since the same month last year (67.3%).

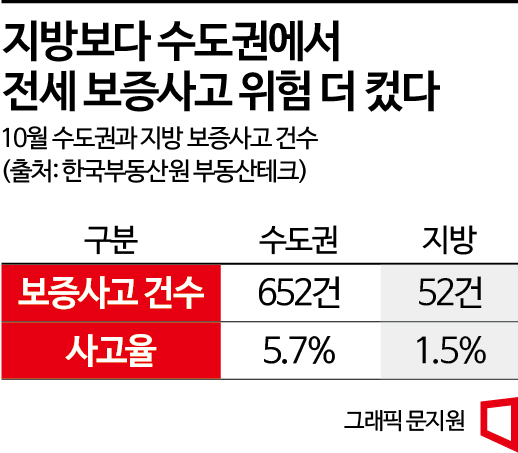

Meanwhile, according to the Korea Real Estate Board’s Real Estate Tech, the number of cases last month in the metropolitan area where tenants did not receive their jeonse deposit back was 652, about 12 times higher than the 52 cases in provincial areas. The incident rate, which represents the amount of deposits involved in incidents compared to the amount of deposits with expired guarantee periods, was 5.7% in the metropolitan area, more than three times higher than the 1.5% in provincial areas.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.