Fair Market Value Ratio for Single-Homeowners Next Year '45% or Less'

Payment Deferral for Elderly and Long-Term Holders...Single-Homeowner Fair Market Value Ratio Range Reduced by 10%p to 30~70%

Expansion of Inherited Housing Scope and Single-Homeowner Tax Rate Special Cases Eligibility Increased

[Asia Economy Reporter Lim Cheol-young] The government will reduce the property tax for single-homeowners facing difficulties due to recent housing price declines, high interest rates, and high inflation to the levels before 2020. Additionally, considering the high uncertainty in tax burden situations, it will introduce a tax base cap system to limit the increase in taxable value, and also implement a payment deferral system for elderly and long-term holders to alleviate the tax burden on retirees.

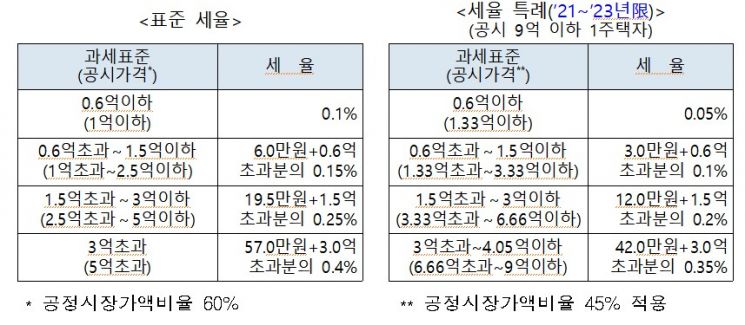

On the 23rd, the Ministry of the Interior and Safety announced that it had prepared such institutional improvement measures. The ministry will first restore the 2023 property tax for single-homeowners, who are actual housing users, to the levels before 2020. Next year, reflecting the housing market situation, it plans to lower the fair market value ratio for single-homeowners to 45% or less. Earlier, the government revised the enforcement decree in June to temporarily reduce the fair market value ratio for single-homeowners from 60% to 45% this year, thereby lowering the property tax burden to pre-2020 levels.

The fair market value ratio for multi-homeowners and corporations will be maintained at 60% next year, but some minor adjustments will be made considering the recent housing price decline. The Ministry of the Interior and Safety explained, "Next year, to ease the property tax burden on low-income households, we will maintain the policy of lowering the fair market value ratio for single-homeowners," adding, "We plan to further reduce it to a level lower than 45%, reflecting the effect of the decline in official property prices due to falling housing prices."

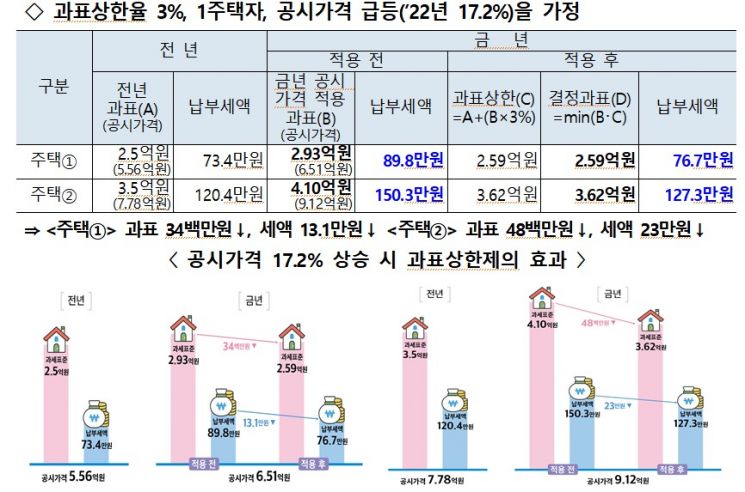

Furthermore, institutional improvements will be pursued to stably manage tax burdens and reduce taxpayer burdens. The government plans to introduce a 'tax base cap system' to stably manage taxable values even if official property prices surge. Since a rapid increase in official property prices leads to a sharp rise in property tax bases, the government intends to improve this unreasonable aspect.

Accordingly, the government announced it will introduce a tax base cap system that sets an annual limit on the increase in taxable value within the range of 0 to 5%. This figure considers consumer price inflation and local fiscal conditions. The government aims to implement this in 2024 and plans to revise the law in the second half of this year.

The Ministry of the Interior and Safety emphasized, "With the introduction of the tax base cap system, property tax burdens can be stably managed even amid surging official property prices," adding, "Even if the official property price rises significantly in a given year, the taxable value will increase within 5% of the taxable value calculated using that year's official property price, making it predictable and manageable at an appropriate level."

The previously implemented tax burden cap system will be abolished. There was confusion in having to consider both the calculated tax amount based on taxable value and tax rate and the payment amount calculated by the tax burden cap simultaneously, and with the introduction of the tax base cap system, the effect of the tax burden cap disappears. However, the government plans to abolish the tax burden cap system five years after the introduction of the tax base cap system, considering that immediate abolition could cause a sudden increase in tax amounts for taxpayers who had previously benefited from the cap.

Following the tax base cap system, payment deferrals will be allowed for elderly and long-term holders. Due to the recent surge in official property prices increasing property tax burdens, taxpayers aged 60 or older and those who have held their homes for more than five years, meeting certain conditions, will be allowed to defer property tax payments until the time of inheritance, gift, or transfer of the property. The introduction of the payment deferral system is expected to significantly reduce the property tax payment burden for retired elderly and long-term holders.

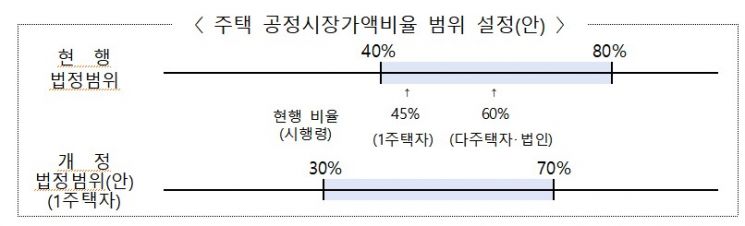

Reflecting the real estate market situation, the fair market value ratio range for single-homeowners will be lowered by 10 percentage points from 40-80% to 30-70%, limiting the increase in tax burden, while expanding the scope of those eligible for special tax rate benefits.

The government will include housing acquired within five years by inheriting cooperative membership rights or pre-sale rights as inherited housing, excluding them from the housing count for special tax rate benefits. It will also exclude accessory land of unauthorized houses built without the consent of landowners from the housing count.

Minister of the Interior and Safety Lee Sang-min said, "We hope that the 2023 property tax imposition plan and institutional improvements announced this time will contribute to housing stability for low-income households and help households struggling with recent high inflation and high interest rates," adding, "We will continue to discover and promote improvement tasks to support the low-income economy at the local tax level in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.