[Asia Economy Sejong=Reporter Son Seon-hee] Even with the reduction of the corporate tax top rate and adjustment of the tax base brackets, about 70% of large corporations showed a cautious stance toward increasing investment and employment next year. It is interpreted that the domestic and international economic uncertainties, despite the lower corporate tax rate, acted as a burden factor.

The Korea Institute of Public Finance, a government-funded research institute, announced the results of a "Public Opinion Survey on the Improvement Plan for Corporate Tax Base Brackets and Tax Rate System" in the "Tax and Fiscal Brief" published on the 22nd. This survey was conducted with 70 experts (survey period: September 15?24) and 100 corporate officials (survey period: September 15?26).

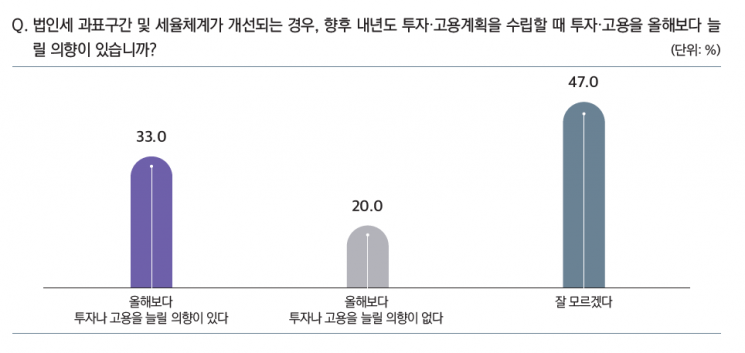

The survey asking whether there is an intention to expand investment or employment compared to this year if the corporate tax base brackets and tax rate system are improved was conducted with the 100 corporate officials. Among all corporate respondents, 47% answered "I don't know." The proportion who responded that they would increase investment or employment was 33%, while 20% answered that they had no intention to increase.

Looking at the responses by company size, 62.5% of large corporation officials answered "I don't know" regarding increasing investment or employment, and 8.3% answered "No." The proportion of large corporations that responded they would increase investment or employment was only 29.2%.

Similarly, for small and medium-sized enterprises (SMEs), 43.2% answered "I don't know" and 32.4% answered "No" to the question of whether they would increase investment or employment. The proportion who answered they would expand was only 24.3%.

Mid-sized companies were the only group with the highest proportion of respondents indicating an intention to increase investment or employment at 43.6%. "I don't know" was 41%, and "No" was 15.4%, respectively.

Regarding the government's plan to reduce the corporate tax top rate from 25% to 22%, 67.6% of respondents expressed support. In particular, the approval rate among large corporations was overwhelmingly high at 83.5%, followed by mid-sized companies at 71.8%, and SMEs at 51.4%.

The reason for supporting the reduction of the corporate tax top rate was most frequently cited as "It is necessary to improve the investment and employment environment of companies amid intensifying international tax competition," with 71.3% responding this way.

On the other hand, the reason for opposing the reduction of the corporate tax top rate was most commonly "The effect of the corporate tax rate reduction may only benefit large corporations," accounting for 74.5% of responses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.